The controller of ABC Inc., a nonissuer, prepared the 5 exhibits relating to ABC 's cash position at year-end. A new staff auditor with your CPA firm has begun to audit cash and has a number of points he suggests should be forwarded to the engagement partner. Your job as senior on the engagement is to review the various points made by the staff auditor. The materiality for the audit has, at this point, been set at $50,000. To revise the memo, click on each segment of underlined text below and select the needed correction, if any, from the list provided. the underlined text is already correct in the context of the document, select [Original Text] from the list. If

The controller of ABC Inc., a nonissuer, prepared the 5 exhibits relating to ABC 's cash position at year-end. A new staff auditor with your CPA firm has begun to audit cash and has a number of points he suggests should be forwarded to the engagement partner. Your job as senior on the engagement is to review the various points made by the staff auditor. The materiality for the audit has, at this point, been set at $50,000. To revise the memo, click on each segment of underlined text below and select the needed correction, if any, from the list provided. the underlined text is already correct in the context of the document, select [Original Text] from the list. If

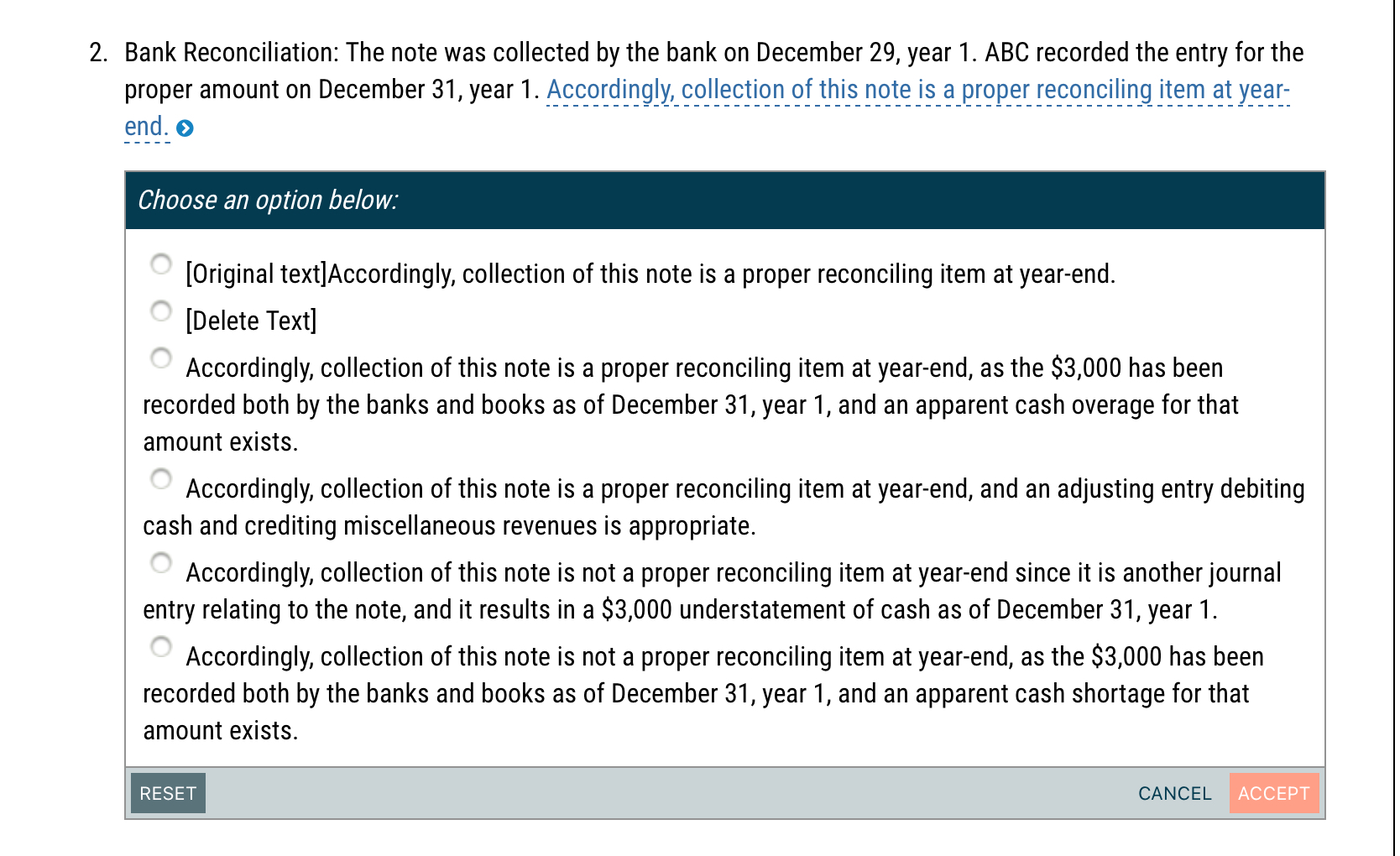

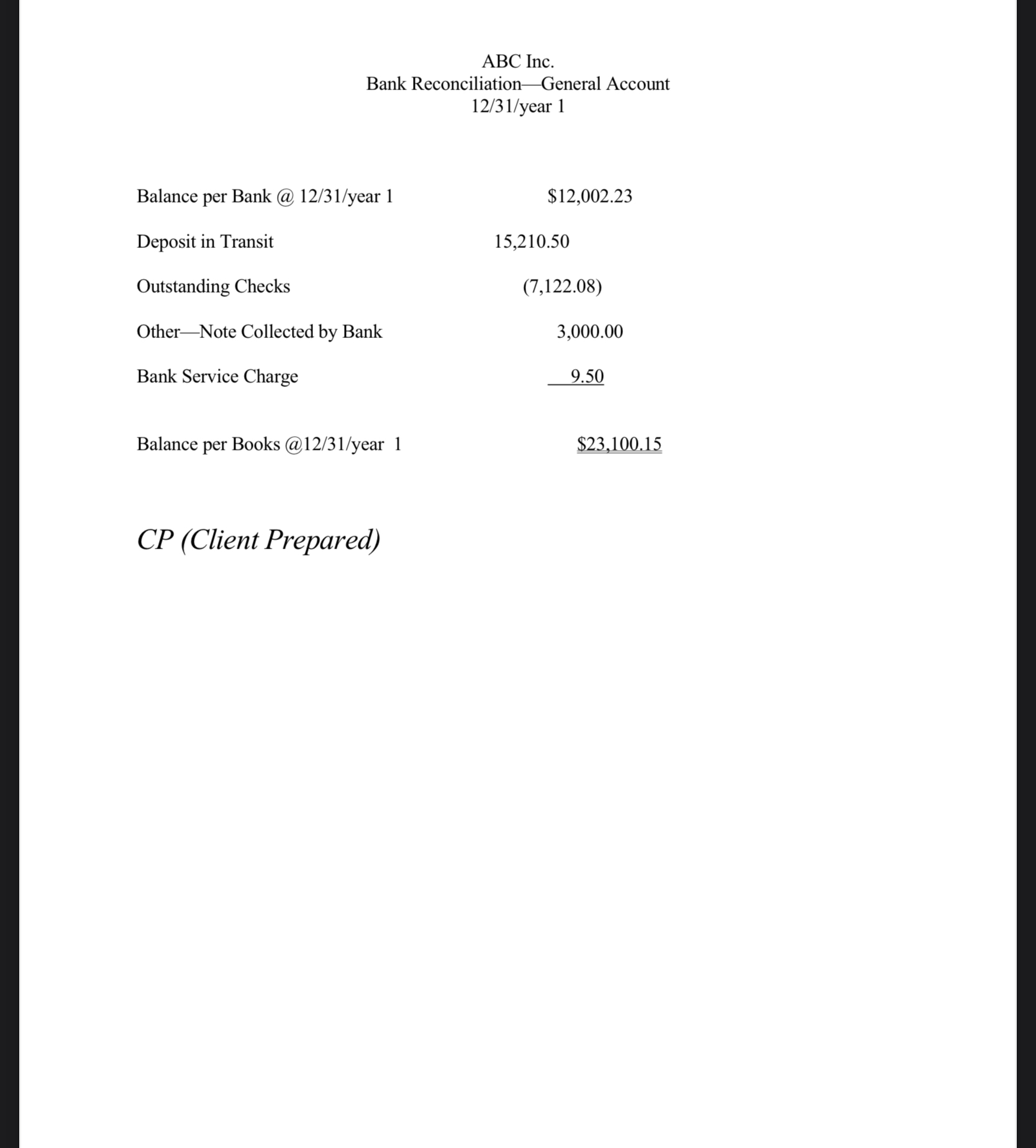

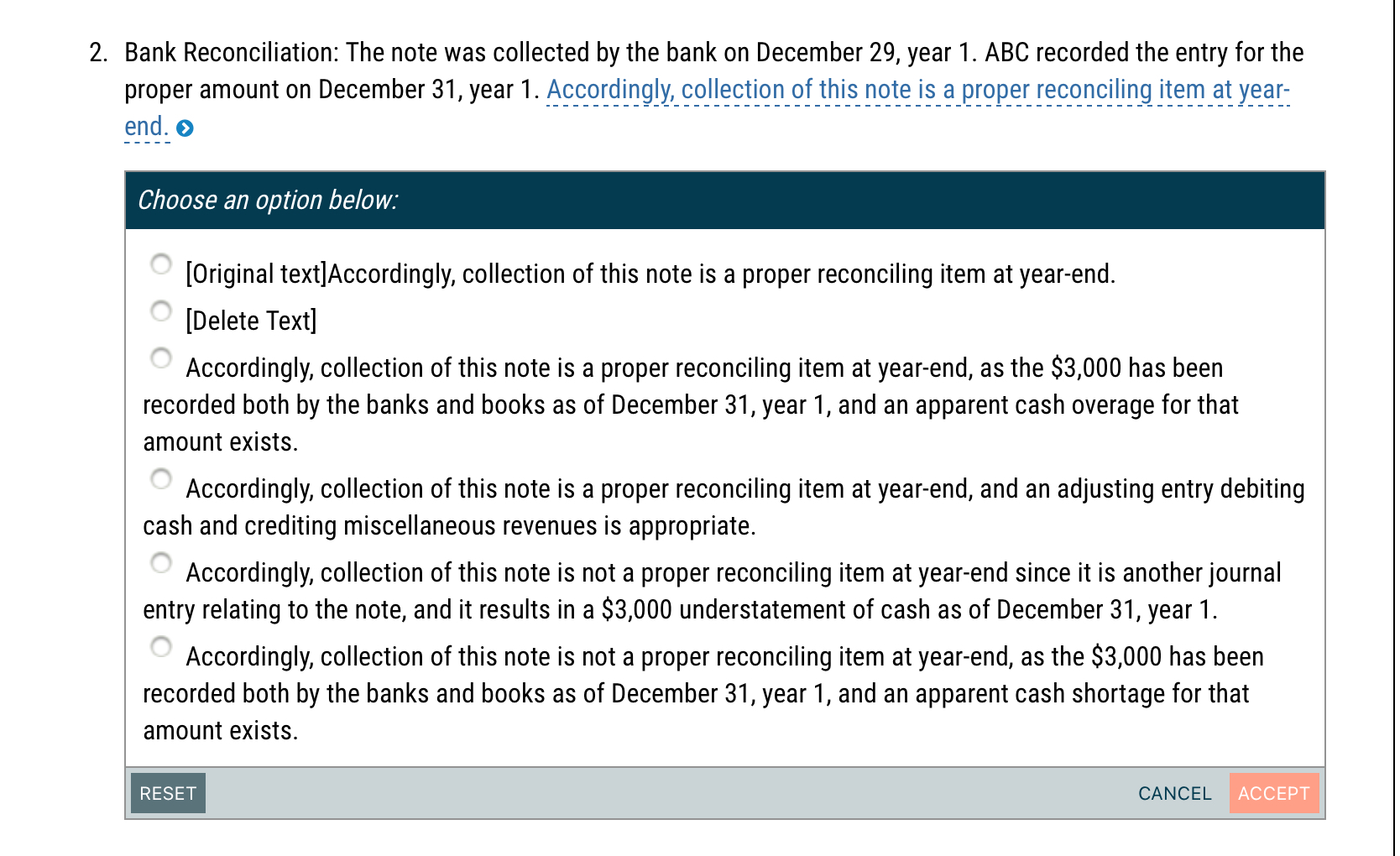

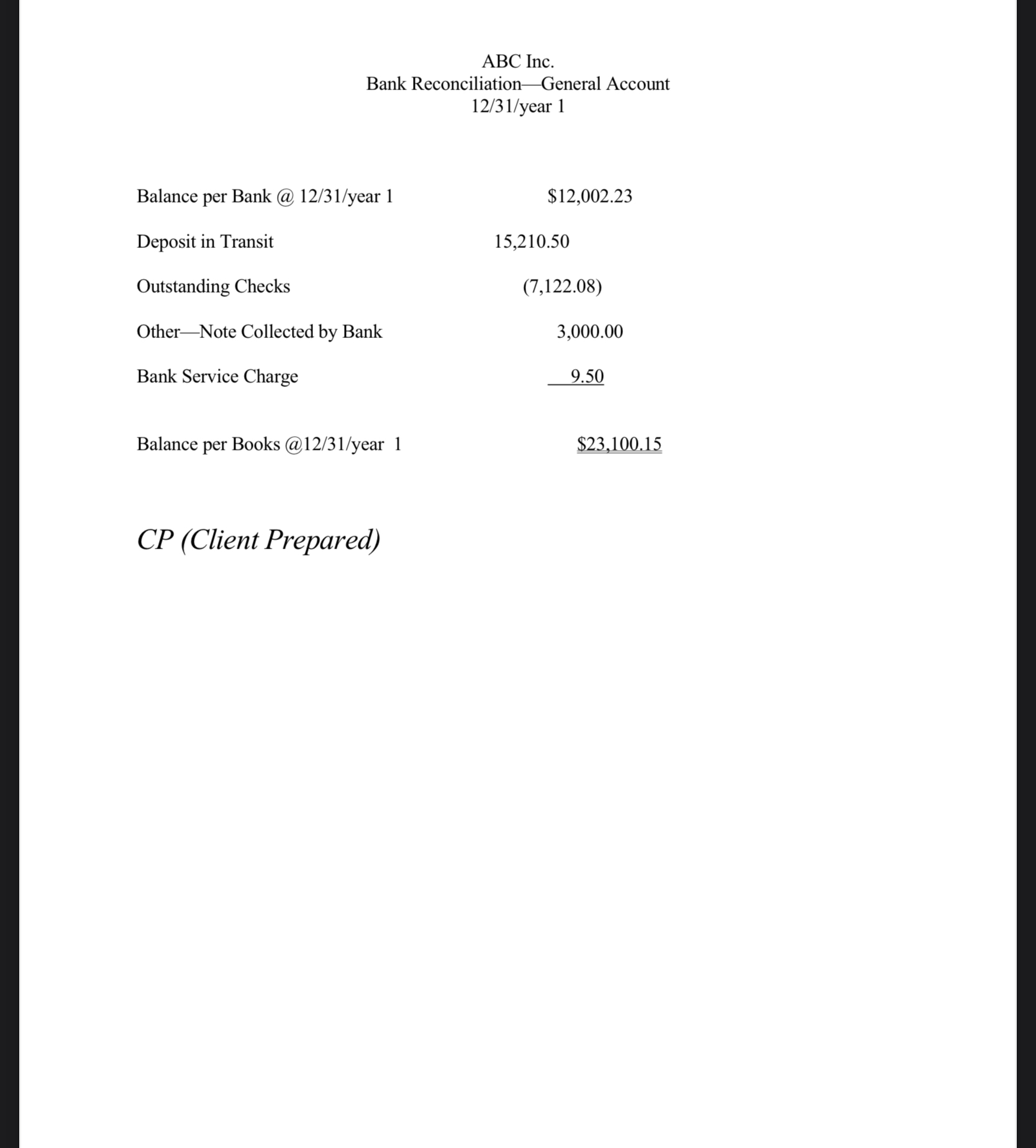

The controller of ABC Inc., a nonissuer, prepared the 5 exhibits relating to ABC 's cash position at year-end. A new staff auditor with your CPA firm has begun to audit cash and has a number of points he suggests should be forwarded to the engagement partner. Your job as senior on the engagement is to review the various points made by the staff auditor. The materiality for the audit has, at this point, been set at $50,000. To revise the memo, click on each segment of underlined text below and select the needed correction, if any, from the list provided. the underlined text is already correct in the context of the document, select [Original Text] from the list. If removal of the entire underlined text is the best revision to the document as a whole, select [Delete Text] from the list when that option is available. To: Audit Senior From: Staff Auditor Re: ABC Cash Work Date: January 11 , year 2 I have a number of findings we should forward to the engagement partner related to the auditing procedures I applied to ABC's cash accounts: Bank Reconciliation: The note was collected by the bank on December 29, year 1. ABC recorded the entry for the proper amount on December 31, year 1. Accordingly, collection of this note is a proper reconciling item at yearend. 0 Choose an option below: [Original text]Accordingly, collection of this note is a proper reconciling item at year-end. [Delete Text] Accordingly, collection of this note is a proper reconciling item at year-end, as the $3,000 has been recorded both by the banks and books as of December 31 , year 1 , and an apparent cash overage for that amount exists. Accordingly, collection of this note is a proper reconciling item at year-end, and an adjusting entry debiting cash and crediting miscellaneous revenues is appropriate. Accordingly, collection of this note is not a proper reconciling item at year-end since it is another journal entry relating to the note, and it results in a $3,000 understatement of cash as of December 31 , year 1 . Accordingly, collection of this note is not a proper reconciling item at year-end, as the $3,000 has been recorded both by the banks and books as of December 31 , year 1 , and an apparent cash shortage for that amount exists. ABC Inc. Bank Reconciliation-General Account 12/31/year 1

The controller of ABC Inc., a nonissuer, prepared the 5 exhibits relating to ABC 's cash position at year-end. A new staff auditor with your CPA firm has begun to audit cash and has a number of points he suggests should be forwarded to the engagement partner. Your job as senior on the engagement is to review the various points made by the staff auditor. The materiality for the audit has, at this point, been set at $50,000. To revise the memo, click on each segment of underlined text below and select the needed correction, if any, from the list provided. the underlined text is already correct in the context of the document, select [Original Text] from the list. If

The controller of ABC Inc., a nonissuer, prepared the 5 exhibits relating to ABC 's cash position at year-end. A new staff auditor with your CPA firm has begun to audit cash and has a number of points he suggests should be forwarded to the engagement partner. Your job as senior on the engagement is to review the various points made by the staff auditor. The materiality for the audit has, at this point, been set at $50,000. To revise the memo, click on each segment of underlined text below and select the needed correction, if any, from the list provided. the underlined text is already correct in the context of the document, select [Original Text] from the list. If