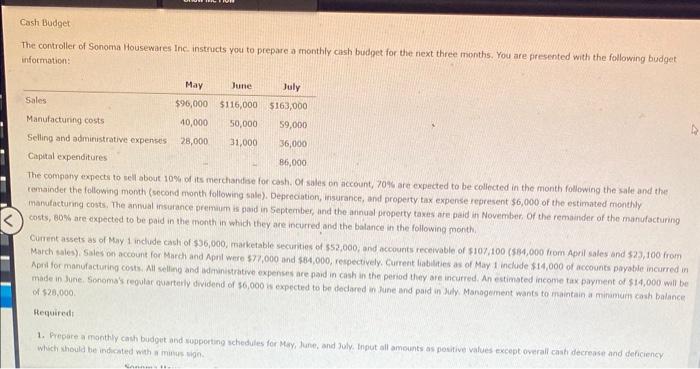

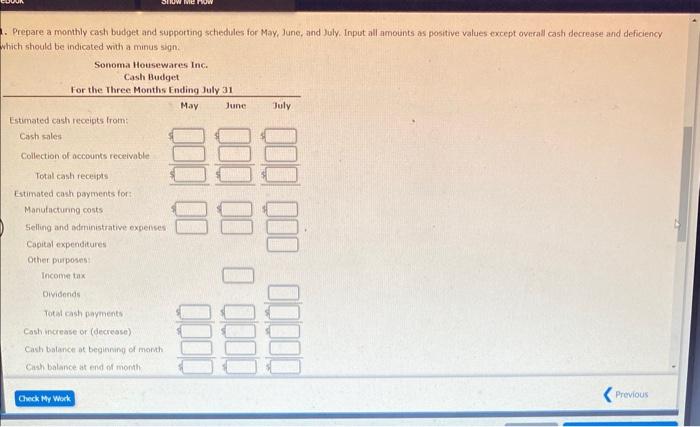

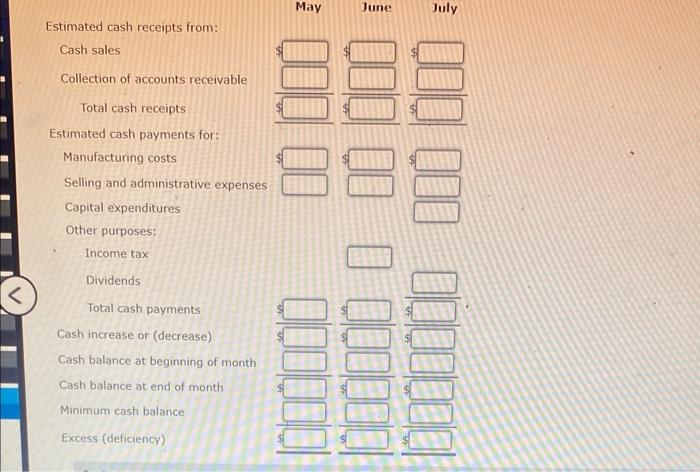

The controller of Sonoma Housewares Inc instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget. infocmation: The company expecte to sell about 10\% of its merchanifose for cash. Ol sales on account, 709 are expected to be coliected in the month following the sale and the remainder the following momth (sccond month following sale). Depceciation, insurance, and property tax expense represent $6,000 of the estimated monthly manufacturing costs. The anmwal insurance premaum is gaid in September, lind the aninual property taxes are paid int Novemiter. Of the remaander of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Cument assets as of May 1 indude cashi of $36,000, maaketable secuntios of \$52,000, and accounti, receivable of $107,100 (\$84,000 from A4pil sales and $23,100 from March sales), Sales on account for Mardh and Apnl were 577,000 and \$84,000, respectively, Current liabilities as of May 1 include $14,000 of accounts payoble incurred if Aprif for manufacturing costs. All selling and bdministrative expenses are paid in cash in the period thiey are incurred. An estimsted income tixx payment of 514,000 will be made in June. Sonoma's regular quarterly dividend of $6,000k expected to be dedared in June and paid in July Management wants to maintain a miramurts cash balance of 120,000 Hequiredt 1. hepare a monthly cash budgut and sopporting schedules for Moy, lune, and Joly. trput all amounts as positive values except overall castr decrease and deficiency which xhould bie indrated wath a minus sige. Prepare a monthly cash bubget and supporting schedules for May, June, and July. Input all amounts as positive values except overall cash decrease and deficiency hich should be indicated with a minus sign. Estimated cash receipts from: Cash sales Collection of accounts receivable Total cash receipts Estimated cash payments for: Manufacturing costs Selling and administrative expenses Capital expenditures Other purposes: Income tax Dividends Total cash payments Cash increase or (decrease) Cash balance at beginning of month Cash balance at end of month Minimum cash balance Excess (deficiency)