Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Core Ltd. provides accounting services. The company's year-end is June 30 and adjusting entries are only prepared at year-end, on June 30. For

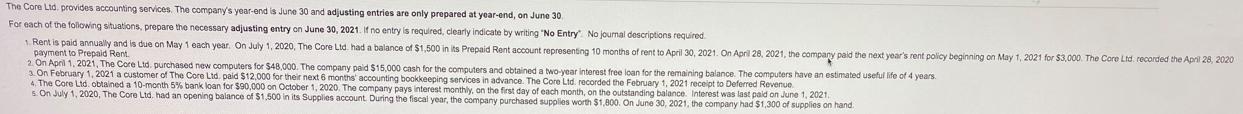

The Core Ltd. provides accounting services. The company's year-end is June 30 and adjusting entries are only prepared at year-end, on June 30. For each of the folowing situations, prepare the necessary adjusting entry on June 30, 2021. If no entry is required, clearly indicate by writing "No Entry. No journal descriptions required. 1. Rent is paid annually and is due on May 1 each year. On July 1, 2020, The Core Ltd. had a balance of $1,500 in its Prepaid Rent account representing 10 months of rent to April 30, 2021. On April 28, 2021, the company paid the next year's rent policy beginning on May 1, 2021 for $3,000. The Core Ltd. recorded the April 28, 2020 payment to Prepaid Rent. 2. On April 1, 2021, The Core Ltd. purchased new computers for $48,000. The company paid $15,000 cash for the computers and obtained a two-year interest free loan for the remaining balance. The computers have an estimated useful life of 4 years. 3. On February 1, 2021 a customer of The Core Ltd. paid $12,000 for their next 6 months' accounting bookkeeping services in advance. The Core Ltd. recorded the February 1, 2021 receipt to Deferred Revenue 4. The Core Ltd. obtained a 10-month 5% bank loan for $90,000 on October 1, 2020. The company pays interest monthly, an the first day of each month, on the outstanding balance. Interest was last paid on June 1, 2021. 5. On July 1, 2020, The Core Ltd, had an opening balance of $1,500 in its Supplies account. During the fiscal year, the company purchased supplies worth $1,800. On June 30, 2021, the company had $1,300 of supplies on hand.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

April 1 Dr prepaid rent 1500 cr rent 150...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

618b745f91624_851051.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started