Answered step by step

Verified Expert Solution

Question

1 Approved Answer

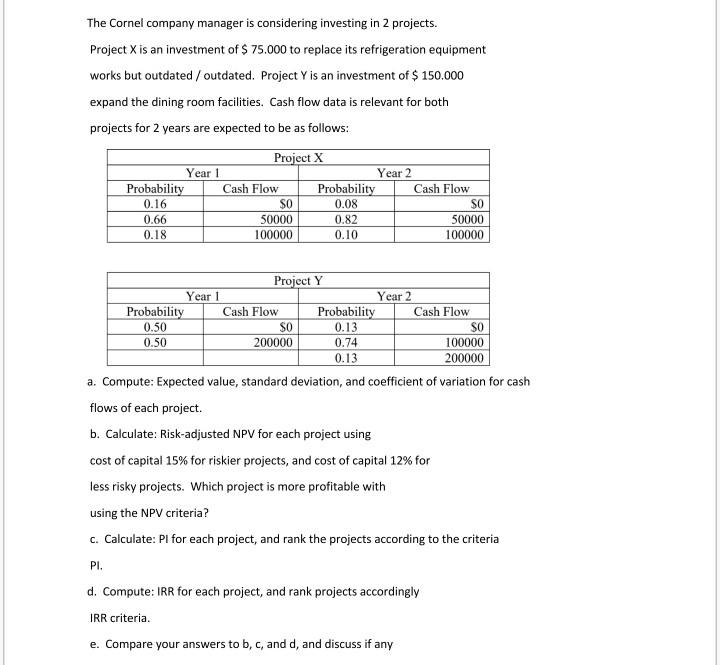

The Cornel company manager is considering investing in 2 projects. Project X is an investment of $ 75.000 to replace its refrigeration equipment works but

The Cornel company manager is considering investing in 2 projects. Project X is an investment of $ 75.000 to replace its refrigeration equipment works but outdated / outdated. Project is an investment of $ 150.000 expand the dining room facilities. Cash flow data is relevant for both projects for 2 years are expected to be as follows: Project X Year 1 Year 2 Probability Cash Flow Probability Cash Flow 0.16 SO 0.08 SO 0.66 50000 0.82 50000 0.18 100000 0.10 100000 Project Y Year 1 Year 2 Probability Cash Flow Probability Cash Flow 0.50 SO 0.13 SO 0.50 200000 0.74 100000 0.13 200000 a. Compute: Expected value, standard deviation, and coefficient of variation for cash flows of each project. b. Calculate: Risk-adjusted NPV for each project using cost of capital 15% for riskier projects, and cost of capital 12% for less risky projects. Which project is more profitable with using the NPV criteria? C. Calculate: Pl for each project, and rank the projects according to the criteria PI. d. Compute: IRR for each project, and rank projects accordingly IRR criteria. e. Compare your answers to b, c, and d, and discuss if any

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started