Answered step by step

Verified Expert Solution

Question

1 Approved Answer

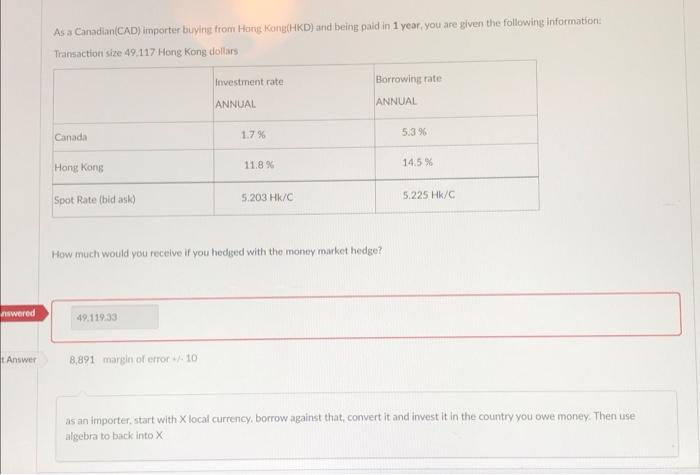

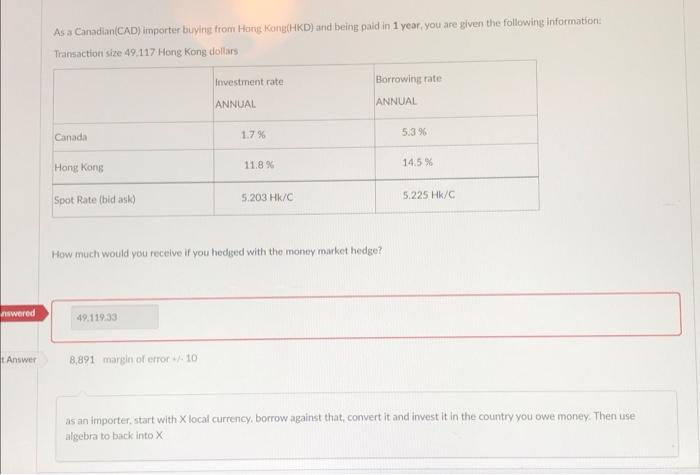

the correct answer is included! trying to figure out how to arrive at that answer! nswered t Answer As a Canadian (CAD) importer buying from

the correct answer is included! trying to figure out how to arrive at that answer!

nswered t Answer As a Canadian (CAD) importer buying from Hong Kong (HKD) and being paid in 1 year, you are given the following information: Transaction size 49,117 Hong Kong dollars Investment rate Borrowing rate ANNUAL ANNUAL Canada 5.3 % Hong Kong 11.8% 14.5% Spot Rate (bid ask) 5.203 Hk/C 5.225 HK/C How much would you receive if you hedged with the money market hedge? 49.119.33 8,891 margin of error +/- 10 as an importer, start with X local currency, borrow against that, convert it and invest it in the country you owe money. Then use algebra to back into X 1.7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started