Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The correct final answers are provided below, please show your work on how to get the answers. Thanks! 35. $31,000 36. Higher $31,000 Use the

The correct final answers are provided below, please show your work on how to get the answers. Thanks!

The correct final answers are provided below, please show your work on how to get the answers. Thanks!

35. $31,000

36. Higher $31,000

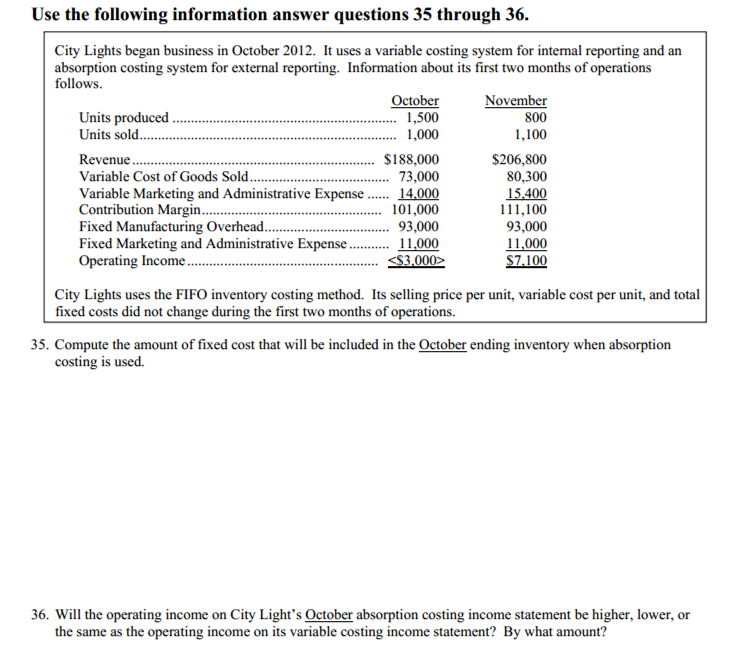

Use the following information answer questions 35 through 36. City Lights began business in October 2012. It uses a variable costing system for internal reporting and an absorption costing system for external reporting. Information about its first two months of operations follows October 1,500 1,000 $188,000 73,000 November 800 1,100 Units produced Units sold Revenue Variable Cost of Goods Sold Variable Marketing and Administrative Expense... 14,000 Contribution Margin Fixed Manufacturing Overhead Fixed Marketing and Administrative Expense Operating Income 101,000 93,000 rative Expense1.000 ES3.0002 $206,800 80,300 15400 11,100 93,000 11.000 S7.100 City Lights uses the FIFO inventory costing method. Its selling price per unit, variable cost per unit, and total fixed costs did not change during the first two months of operations. 35. Compute the amount of fixed cost that will be included in the October ending inventory when absorption costing is used. 36. Will the operating income on City Light's October absorption costing income statement be higher, lower, or the same as the operating income on its variable costing income statement? By what amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started