Answered step by step

Verified Expert Solution

Question

1 Approved Answer

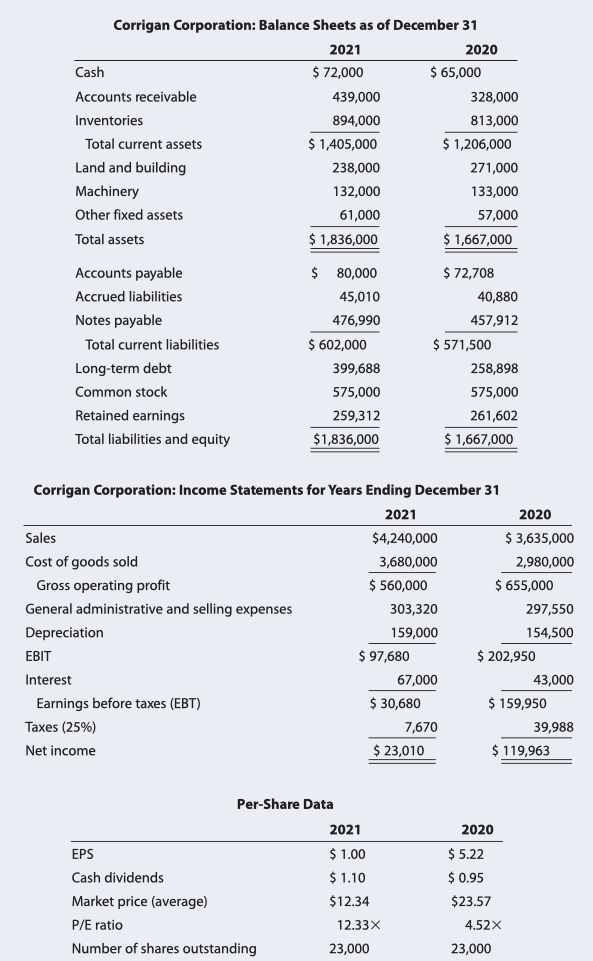

The Corrigan Corporation s 2 0 1 8 and 2 0 1 9 financial statements follow, along with some industry average ratios. Corrigan is exempt

The Corrigan Corporations and financial statements follow, along with some industry average ratios. Corrigan is exempt from the interest deduction limitation because its average gross revenues for the prior years was less than $ million. So of its interest expense is deductible. Industry Financial Ratios

Industry average ratios have been constant for the past years.

bBased on yearend balance sheet figures.

Calculation is based on a day year.

Measured as Shortterm debt Longterm debtShortterm debt Longterm debt

Common equity

a Assess Corrigans liquidity position, and determine how it compares with peers and how the liquidity position has changed over time.

b Assess Corrigans asset management position, and determine how it compares with peers and how its asset management efficiency has changed over time.

c Assess Corrigans debt management position, and determine how it compares with peers and how its debt management has changed over time.

d Assess Corrigans profitability ratios, and determine how they compare with peers and how its profitability position has changed over time.

e Assess Corrigans market value ratios, and determine how its valuation compares with peers and how it has changed over time. Assume the firms debt is priced at par, so the market value of its debt equals its book value.

f Calculate Corrigans ROE as well as the industry average ROE, using the DuPont equation. From this analysis, how does Corrigans financial position compare with the industry average numbers?

g What do you think would happen to its ratios if the company initiated costcutting measures that allowed it to hold lower levels of inventory and substantially decreased the cost of goods sold? No calculations are necessary. Think about which ratios would be affected by changes in these two accounts.

Corrigan Corporation: Balance Sheets as of December

Corrigan Corporation: Income Statements for Years Ending December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started