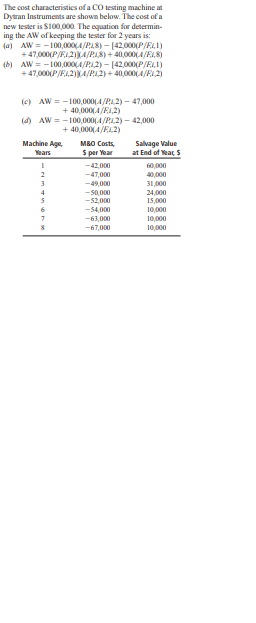

The cost characteristics of a CO testing machine at Dytran Instruments are shown below. The cost of a new fester is $100,000. The equation for determin- ing the AW of keeping the tester for 2 years is: (a] AW = -100,1004/PAS) - [42,010(P/F,1) + 4700(P/F31 4/PS) +40,000(4/F,5) (8) AW = -100,000(4/P12) - [42000(P/F,1) + 47000(P/F12)](4/P13) + 4000(4/F 2) (C) AW = -100,000(4/242) - 47,000 () AW = -100,000(4/243) - 42,000 Machine Age, MBO Costs, Salvage Value Years $ per Year at End of Wear, $ -42,000 -47.0DO -49.000 31,000 -90,000 24,030 -52,000 15 030 -54,000 -63,000 -67,000In a replacement study, what is meant by "taking the nonowner's viewpoint"? An asset that was purchased 3 years ago for $100,000 is becoming obsolete faster than ex- pected. The company thought the asset would last 3 years and that its book value would decrease by $20,000 each year and, therefore, be worthless at the end of year 3. In considering a more versatile, more reliable high-tech replacement, the company discovered that the presently owned asset has a market value of only $15,000. If the replacement is purchased immediately at a first cost of $75,000 and if it will have a lower annual worth, what is the amount of the sunk cost?' Assume the company's MARR is 15% per year. As a muscle car aficionado, a friend of yours likes to restore cars of the 60s and 70s and sell them for a poofit. He started his latest project (a 1965 Shelby GT350) four months ago and has a total of $126,000 invested so far. Another opportunity has come up (a 1969 Dodge Charger) that he is think- ing of buying because he believes he could sell it for a profit of $60,000 after it is completely re- stored. To do so, however, he would have to sell the unfinished Shelby first. He thought that the completely restored Shelby would be worth $195,000, resulting in a tidy profit of $22,000, but in its half-restored condition, the most he could get now is $115,000. In discussing the situation with you, he stated that if he could sell the Shelby now and buy the Charger at a reduced price, he would make up for the money he will lose in selling the Shelby at a lower-than-desired price. (a) What is wrong with this thinking? (b) What is his sunk cost in the Shelby?\f\f\f