Answered step by step

Verified Expert Solution

Question

1 Approved Answer

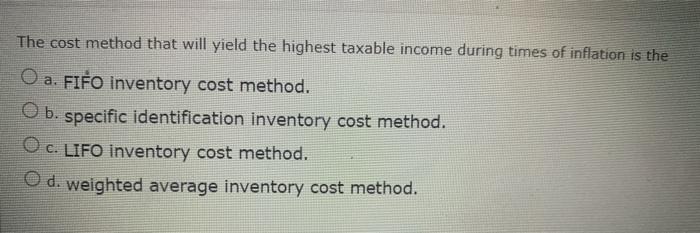

The cost method that will yield the highest taxable income during times of inflation is the O a. FIFO inventory cost method. O b.

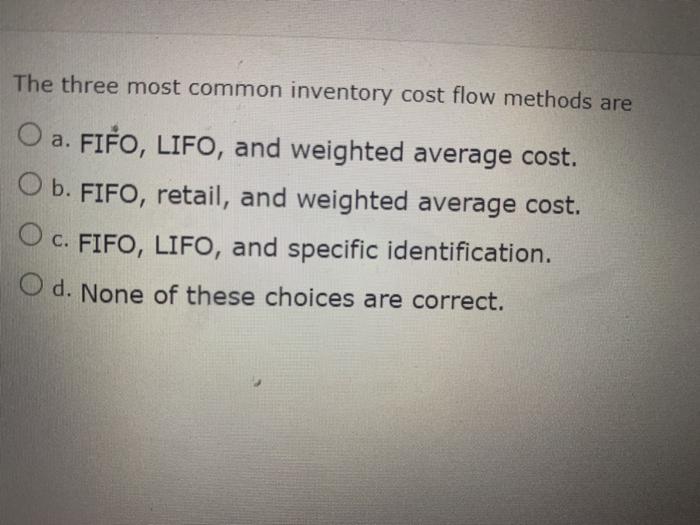

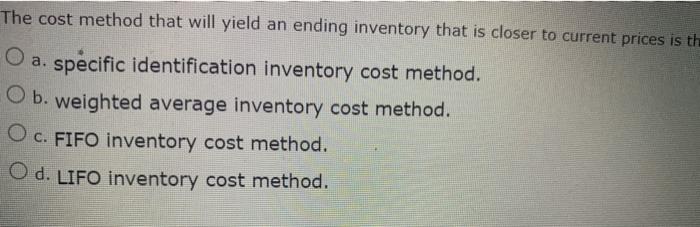

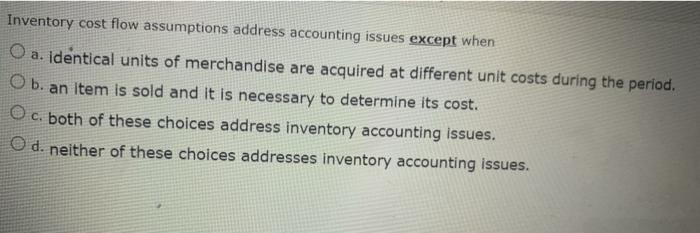

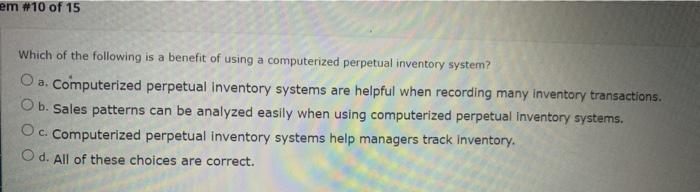

The cost method that will yield the highest taxable income during times of inflation is the O a. FIFO inventory cost method. O b. specific identification inventory cost method. O c. LIFO inventory cost method. O d. weighted average inventory cost method. The three most common inventory cost flow methods are O a. FIFO, LIFO, and weighted average cost. O b. FIFO, retail, and weighted average cost. O c. FIFO, LIFO, and specific identification. O d. None of these choices are correct. The cost method that will yield an ending inventory that is closer to current prices is the O a. specific identification inventory cost method. O b. weighted average inventory cost method. O c. FIFO inventory cost method. O d. LIFO inventory cost method. Inventory cost flow assumptions address accounting issues except when O a. identical units of merchandise are acquired at different unit costs during the period. O b. an item is sold and it is necessary to determine its cost. O.C. c. both of these choices address inventory accounting issues. O d. neither of these choices addresses inventory accounting issues. em #10 of 15 Which of the following is a benefit of using a computerized perpetual inventory system? O a. Computerized perpetual inventory systems are helpful when recording many inventory transactions. O b. Sales patterns can be analyzed easily when using computerized perpetual inventory systems. O c. Computerized perpetual inventory systems help managers track inventory. O d. All of these choices are correct.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Question The cost method that will yield the highest taxable income during times of inflation is the Answer FIFO inventory cost method FIFO stands for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started