Answered step by step

Verified Expert Solution

Question

1 Approved Answer

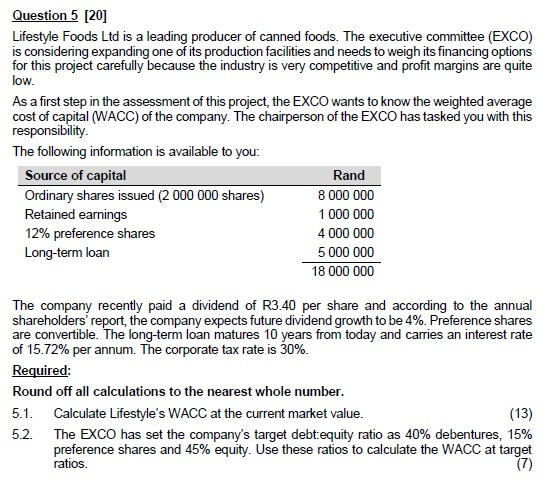

The cost of capital for ordinary shares is 22%. This percentage was omitted in the question. Question 5 [20] Lifestyle Foods Ltd is a leading

The cost of capital for ordinary shares is 22%. This percentage was omitted in the question.

Question 5 [20] Lifestyle Foods Ltd is a leading producer of canned foods. The executive committee (EXCO) is considering expanding one of its production facilities and needs to weigh its financing options for this project carefully because the industry is very competitive and profit margins are quite low. As a first step in the assessment of this project, the EXCO wants to know the weighted average cost of capital (WACC) of the company. The chairperson of the EXCO has tasked you with this responsibility The following information is available to you: Source of capital Rand Ordinary shares issued (2 000 000 shares) 8 000 000 Retained earnings 1 000 000 12% preference shares 4 000 000 Long-term loan 5 000 000 18 000 000 The company recently paid a dividend of R3.40 per share and according to the annual shareholders' report, the company expects future dividend growth to be 4%. Preference shares are convertible. The long-term loan matures 10 years from today and carries an interest rate of 15.72% per annum. The corporate tax rate is 30%. Required: Round off all calculations to the nearest whole number. 5.1. Calculate Lifestyle's WACC at the current market value. (13) 5.2. The EXCO has set the company's target debt equity ratio as 40% debentures, 15% preference shares and 45% equity. Use these ratios to calculate the WACC at target ratios. Question 5 [20] Lifestyle Foods Ltd is a leading producer of canned foods. The executive committee (EXCO) is considering expanding one of its production facilities and needs to weigh its financing options for this project carefully because the industry is very competitive and profit margins are quite low. As a first step in the assessment of this project, the EXCO wants to know the weighted average cost of capital (WACC) of the company. The chairperson of the EXCO has tasked you with this responsibility The following information is available to you: Source of capital Rand Ordinary shares issued (2 000 000 shares) 8 000 000 Retained earnings 1 000 000 12% preference shares 4 000 000 Long-term loan 5 000 000 18 000 000 The company recently paid a dividend of R3.40 per share and according to the annual shareholders' report, the company expects future dividend growth to be 4%. Preference shares are convertible. The long-term loan matures 10 years from today and carries an interest rate of 15.72% per annum. The corporate tax rate is 30%. Required: Round off all calculations to the nearest whole number. 5.1. Calculate Lifestyle's WACC at the current market value. (13) 5.2. The EXCO has set the company's target debt equity ratio as 40% debentures, 15% preference shares and 45% equity. Use these ratios to calculate the WACC at target ratiosStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started