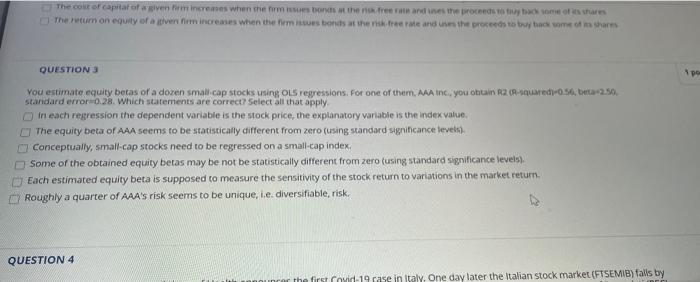

The cost of capital of assiven increases when the formes Dost the streets and in the proceeds to be shares The retum on equity of a ven increases when the westond the street and use the proceed to take on shares QUESTION 3 You estimate equity betas of a dozen small cap stocks using ous regressions. For one of them, AAA Inc. you obtain R2.0-1.056, beta2.50 standard error 0.28. Which statements are correct? Select all that apply In each regression the dependent variable is the stock price, the explanatory variable is the index value. The equity beta of AAA seems to be statistically different from zero (using standard significance level) Conceptually, small-cap stocks need to be regressed on a small-cap index, Some of the obtained equity betas may be not be statistically different from zero (using standard significance levels). Each estimated equity beta is supposed to measure the sensitivity of the stock return to variations in the market return Roughly a quarter of AAA's risk seems to be unique, i.e. diversifiable, risk. QUESTION 4 the first rovid 19 rase in italy. One day later the Italian stock market (FTSEMIB) falls by The cost of capital of assiven increases when the formes Dost the streets and in the proceeds to be shares The retum on equity of a ven increases when the westond the street and use the proceed to take on shares QUESTION 3 You estimate equity betas of a dozen small cap stocks using ous regressions. For one of them, AAA Inc. you obtain R2.0-1.056, beta2.50 standard error 0.28. Which statements are correct? Select all that apply In each regression the dependent variable is the stock price, the explanatory variable is the index value. The equity beta of AAA seems to be statistically different from zero (using standard significance level) Conceptually, small-cap stocks need to be regressed on a small-cap index, Some of the obtained equity betas may be not be statistically different from zero (using standard significance levels). Each estimated equity beta is supposed to measure the sensitivity of the stock return to variations in the market return Roughly a quarter of AAA's risk seems to be unique, i.e. diversifiable, risk. QUESTION 4 the first rovid 19 rase in italy. One day later the Italian stock market (FTSEMIB) falls by