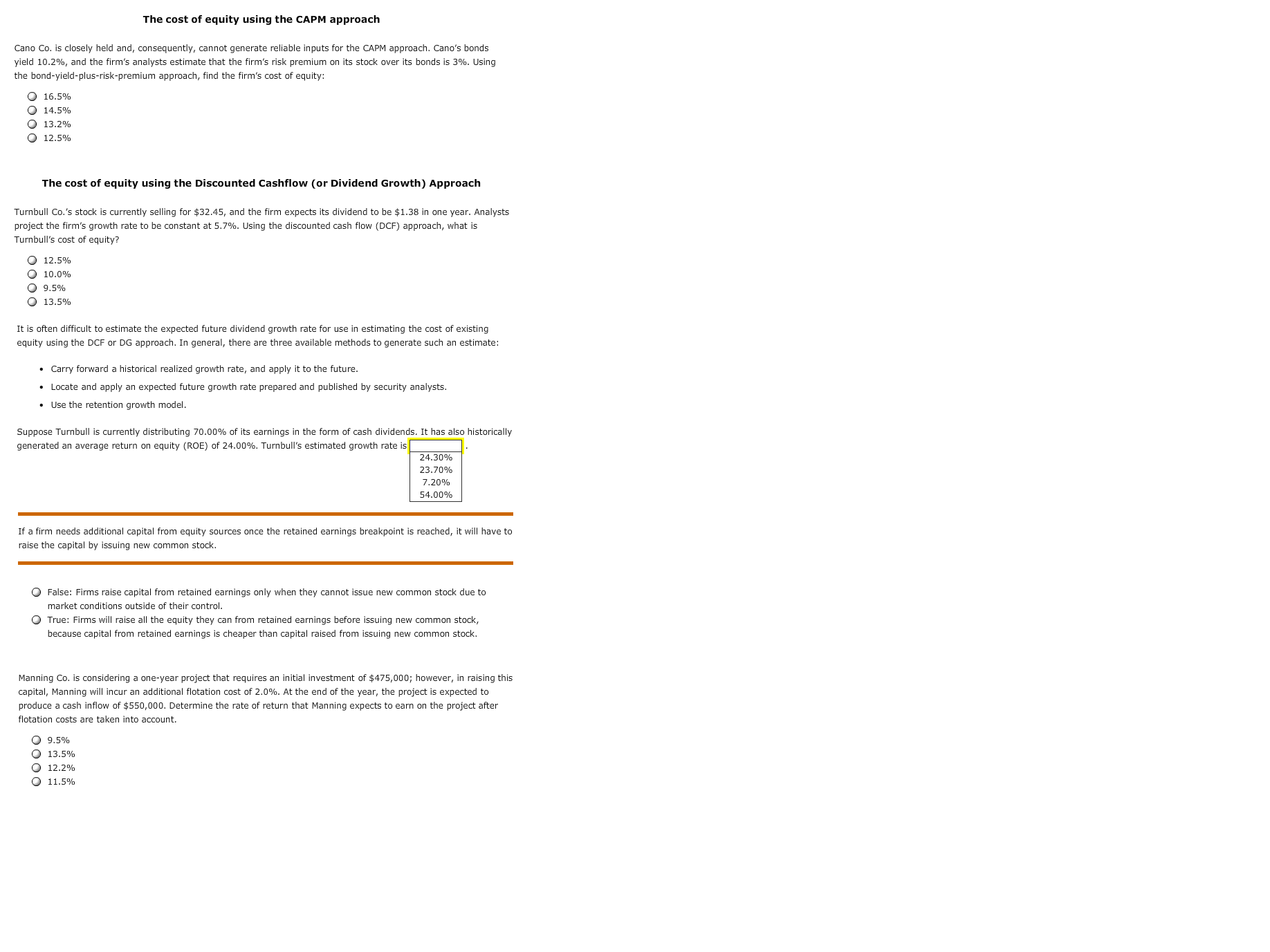

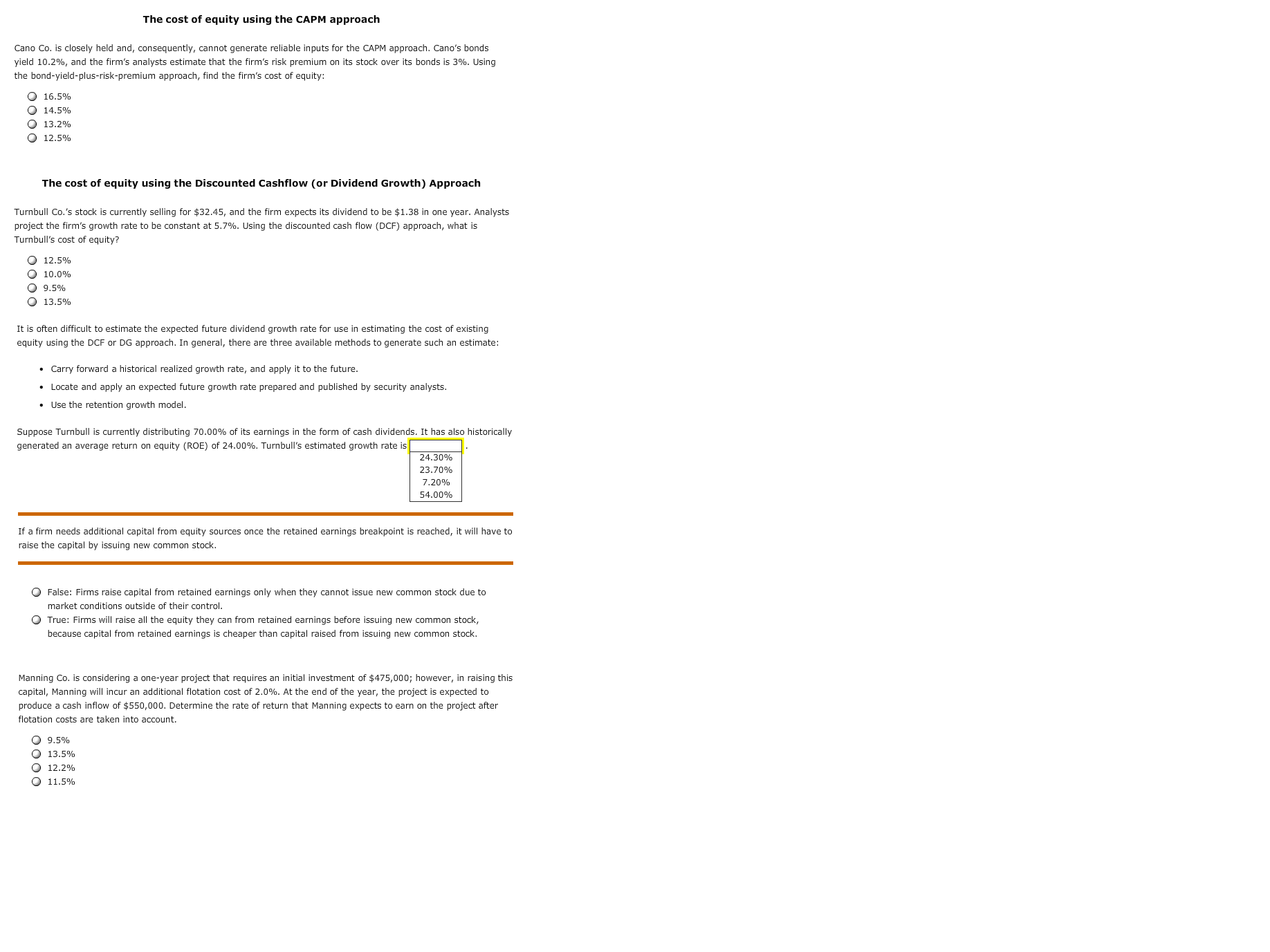

The cost of equity using the CAPM approach Cano Co. is closely held and, consequently, cannot generate reliable inputs for the CAPM approach. Cano's bonds yield 10.2%, and the firm's analysts estimate that the firm's risk premium on its stock over its bonds is 3%. Using the bond-yield-plus-risk-premium approach, find the firm's cost of equity: The cost of equity using the Discounted Cashflow (or Dividend Growth) Approach Turnbull Co.'s stock is currently selling for $32.45, and the firm expects its dividend to be $1.38 in one year. Analysts project the firm's growth rate to be constant at 5.7%. Using the discounted cash flow (DCF) approach, what is Turnbull's cost of equity? It is often difficult to estimate the expected future dividend growth rate for use in estimating the cost of existing equity using the DCF or DG approach. In general, there are three available methods to generate such an estimate: . Carry forward a historical realized growth rate, and apply it to the future. . Locate and apply an expected future growth rate prepared and published by security analysts. . Use the retention growth model. Suppose Turnbull is currently distributing 70.00% of its earnings in the form of cash dividends. It has also historically generated an average return on equity (ROE) of 24.00%. Turnbull's estimated growth rate is ___________ . If a firm needs additional capital from equity sources once the retained earnings breakpoint is reached, it will have to raise the capital by issuing new common stock. False: Firms raise capital from retained earnings only when they cannot issue new common stock due to market conditions outside of their control. True: Firms will raise all the equity they can from retained earnings before issuing new common stock, because capital from retained earnings is cheaper than capital raised from issuing new common stock. Manning Co. is considering a one-year project that requires an initial investment of $475,000; however, in raising this capital, Manning will incur an additional flotation cost of 2.0%. At the end of the year, the project is expected to produce a cash inflow of $550,000. Determine the rate of return that Manning expects to earn on the project after flotation costs are taken into account