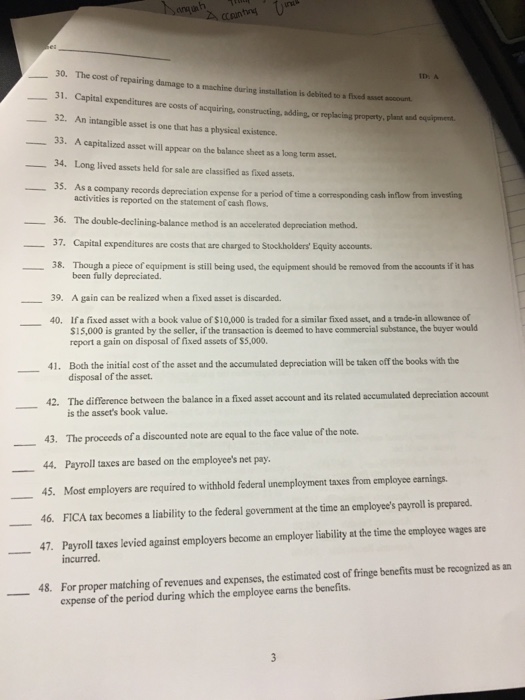

The cost of repairing damage to a machinre during installations is debited to a fixed asset acc ount. 31. Capital expenditures are costs of acquiring constructing, adding or replacing property, plant and equipment. 32. An intangible asset is one that has a physical existence. 33. A capitalized asset will appear on the balance sheet as a long termm asset. 34. Long lived assets held for sale are classified as fixed assets. 35. As a company records depreciation expense for a peroid of time a corresponding cash inflow from investing activities is reported on the statement of cash flosw. 36. The double-declining-balance method is an accelerated depreciation method. 37. Capital expenditures are costs that are charged to Stockholders' Equity accounts. 38. Though a piece of equipment is still being used, the equipment should be removed from the accounts if it has been fully depreciated. 39. A gain can be realized when a fixed asset is discarded. 40. If a fixed asset with a book value of $10,000 is traded for a similar fixed asser, and a trade-in allowance of $15,000 is granted by the seller, if the transaction is deemed to have commercial substance the buyer would report a gain on disposal of fixed assets of $5,000. 41. Both the initial cost of the asset and the accumulated depreciation will be taken off the books with the disposal of the asset. 42. The difference between the balance in a fixed asset account and its related accumulated depreciation account is the asset's book value. 43. The procceds of a discounted note are equal to the face value of the note. 44. Payroll taxes are based on the employee's net pay. 45. Mot employers are required to withhold federal unemployment taxes from employee earnings. 46. FICA tax becomes a liability to the federal government at the time an employee's payroll is prepared. 47. Payroll taxes levied against employers become an employer liability at the time the employee wages are incurred. 48. For proper mathcing of revenues and expenses, the estimated cost of fringe benefits must be recognized as an expense of the period during which the employee earns the benefits