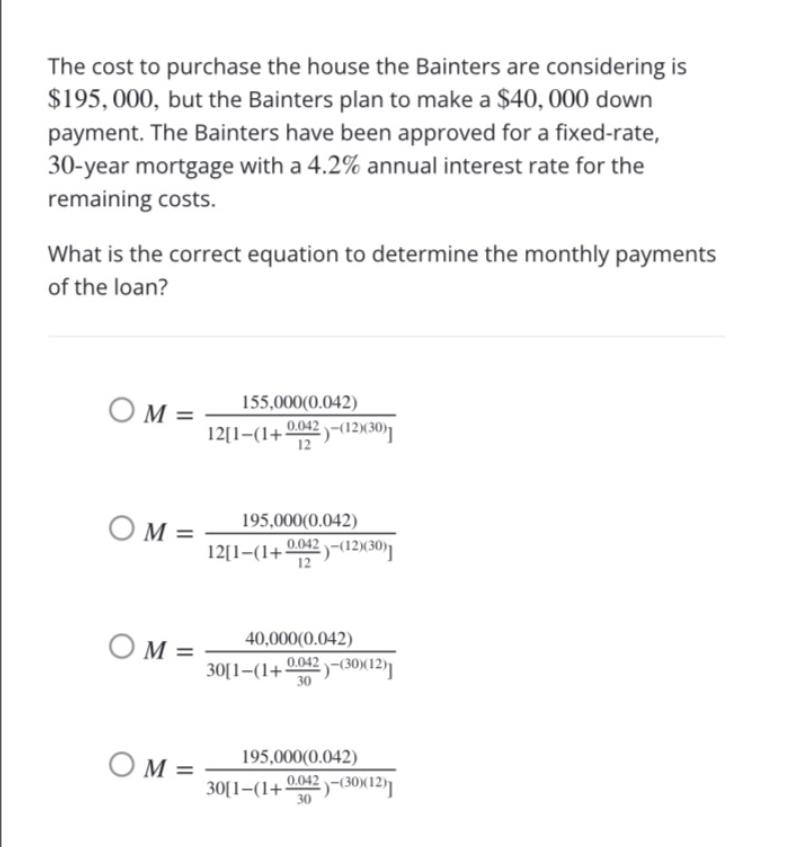

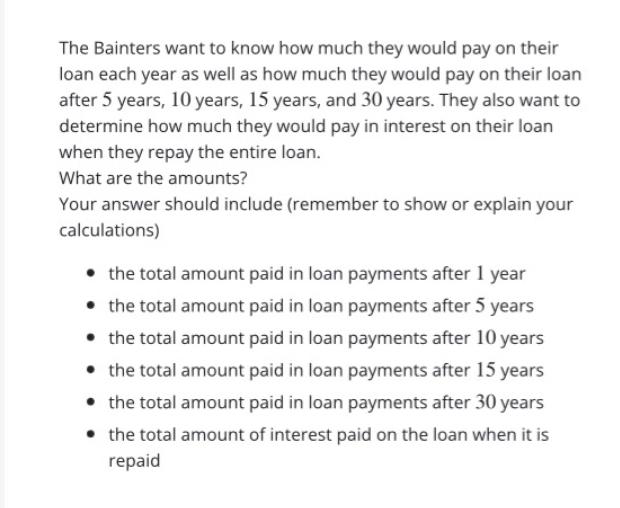

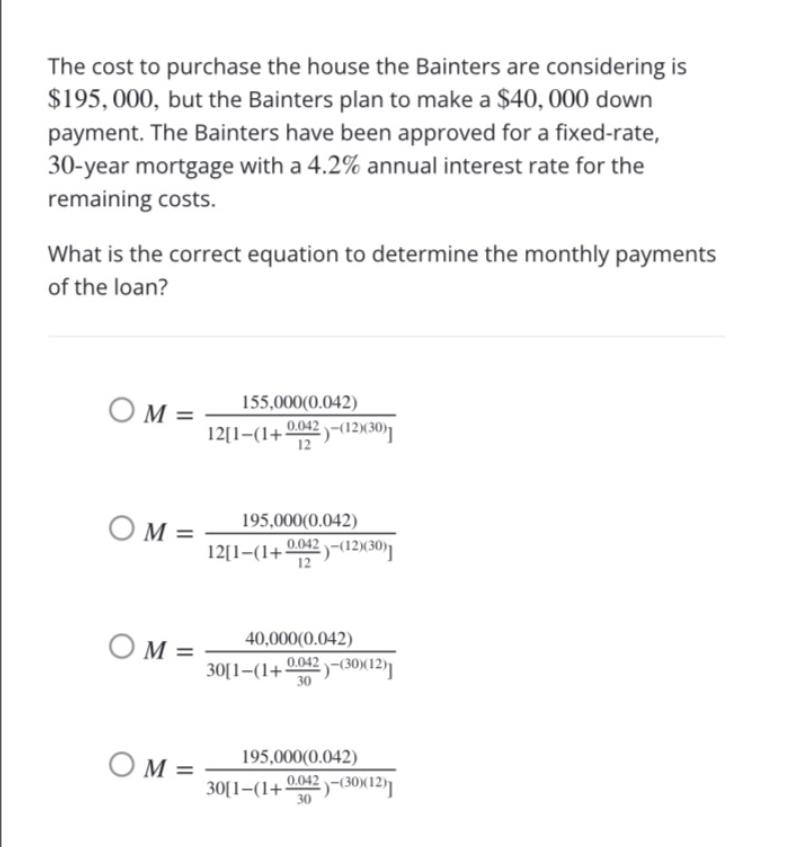

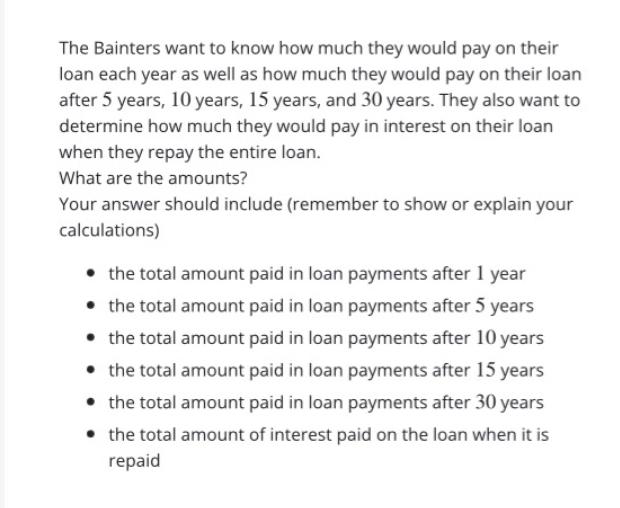

The cost to purchase the house the Bainters are considering is $195,000, but the Bainters plan to make a $40,000 down payment. The Bainters have been approved for a fixed-rate, 30-year mortgage with a 4.2% annual interest rate for the remaining costs. What is the correct equation to determine the monthly payments of the loan? OM= 155.000(0.042) 2)-(12(30) 12 12[1-(1+0.042 OM = 195,000(0.042) 12[1-(1+ 12 0.042 ) -(12)(30) OM= 40.000(0.042) 30[1-(1+ 30 0.042 ) -(30)(12) OM= 195,000(0.042) 30[1-(1+0.042)-(30)(12) 30 The Bainters want to know how much they would pay on their loan each year as well as how much they would pay on their loan after 5 years, 10 years, 15 years, and 30 years. They also want to determine how much they would pay in interest on their loan when they repay the entire loan. What are the amounts? Your answer should include (remember to show or explain your calculations) the total amount paid in loan payments after 1 year the total amount paid in loan payments after 5 years the total amount paid in loan payments after 10 years the total amount paid in loan payments after 15 years the total amount paid in loan payments after 30 years the total amount of interest paid on the loan when it is repaid The cost to purchase the house the Bainters are considering is $195,000, but the Bainters plan to make a $40,000 down payment. The Bainters have been approved for a fixed-rate, 30-year mortgage with a 4.2% annual interest rate for the remaining costs. What is the correct equation to determine the monthly payments of the loan? OM= 155.000(0.042) 2)-(12(30) 12 12[1-(1+0.042 OM = 195,000(0.042) 12[1-(1+ 12 0.042 ) -(12)(30) OM= 40.000(0.042) 30[1-(1+ 30 0.042 ) -(30)(12) OM= 195,000(0.042) 30[1-(1+0.042)-(30)(12) 30 The Bainters want to know how much they would pay on their loan each year as well as how much they would pay on their loan after 5 years, 10 years, 15 years, and 30 years. They also want to determine how much they would pay in interest on their loan when they repay the entire loan. What are the amounts? Your answer should include (remember to show or explain your calculations) the total amount paid in loan payments after 1 year the total amount paid in loan payments after 5 years the total amount paid in loan payments after 10 years the total amount paid in loan payments after 15 years the total amount paid in loan payments after 30 years the total amount of interest paid on the loan when it is repaid