Question

The Course Project consists of 10 Requirements for you to complete. Part 1 of the Course Project is due at the end of Week 4

The Course Project consists of 10 Requirements for you to complete. Part 1 of the Course Project is due at the end of Week 4 and Part 2 at the end of Week 6. See the Syllabus section Due Dates for Assignments & Exams for due date information. All of the information you need to complete the Course Project is located in this Workbook. There are eight worksheets in the workbook you will need to complete. A list of July transactions A Chart of Accounts reference sheet A Grading Rubric to help explain what is expected. Each worksheet has the Check Figures embedded as a comment.

I have 1,2 and 3 done. I Need to make sure 4&5, 6 and 7 are right.

Requirement #2

Requirement #4/5

#6

#7

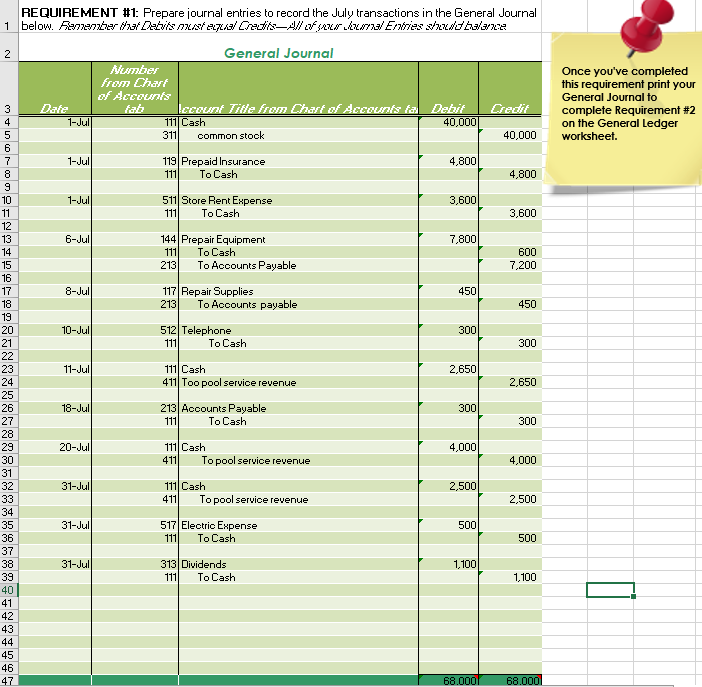

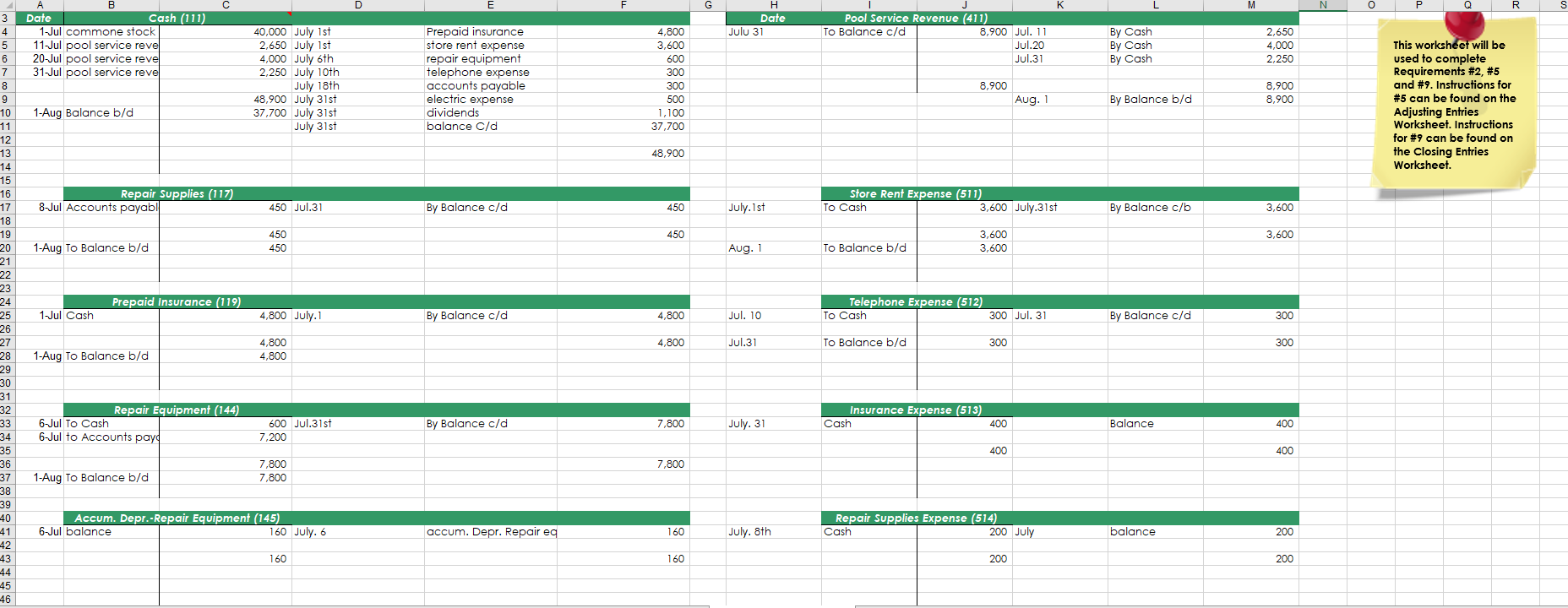

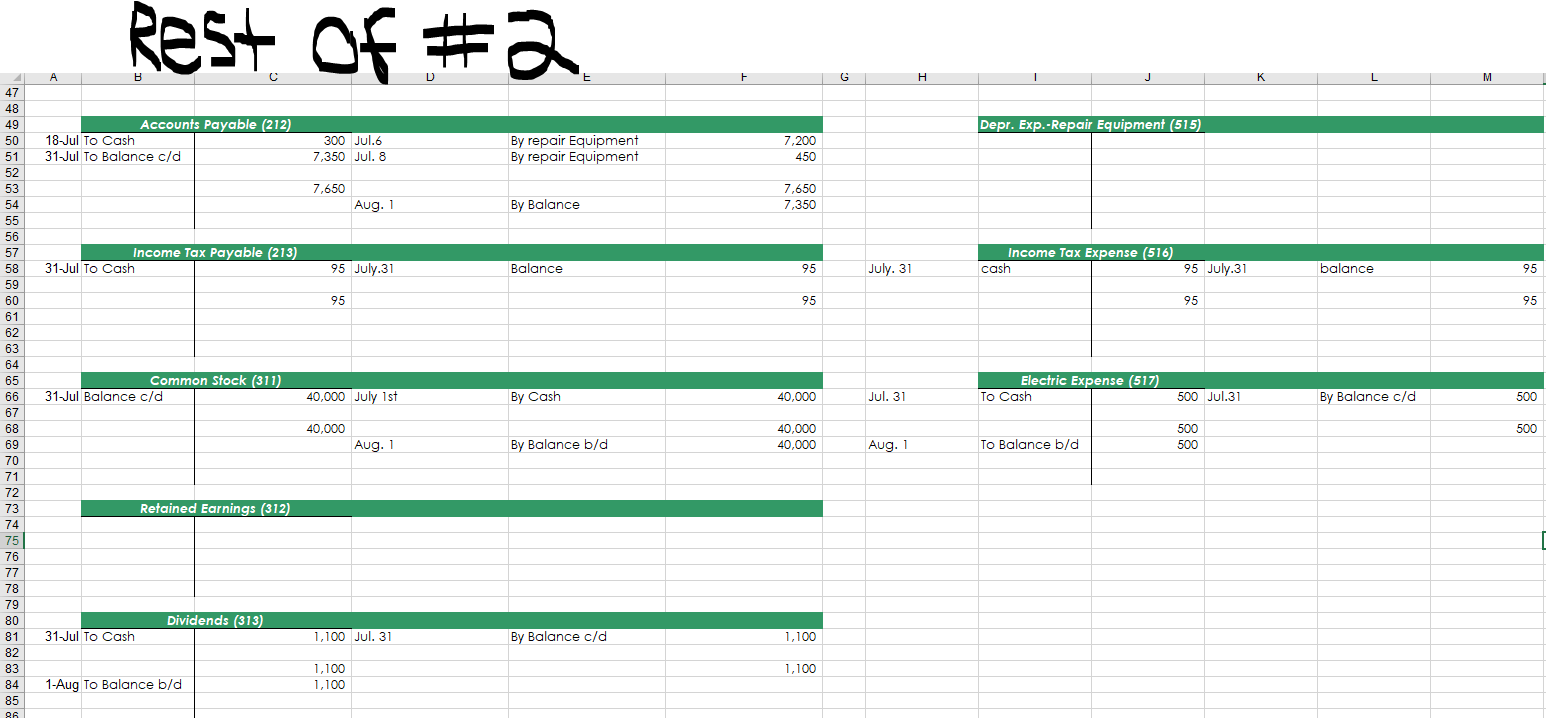

1 2 REQUIREMENT #1: Prepare journal entries to record the July transactions in the General Journal below. A7776er i Davis NXAI AJA/ Cat4//2XSAYA AKAN/Erwues s/w/th/3712 General Journal Number fron Chart of Accounts Date fab lecount Title from Chart of Accounts la Debit Credit 1-Jul 111 Cash 40,000 311 common stock 40,000 Once you've completed this requirement print your General Journal to complete Requirement #2 on the General Ledger worksheet. 3 4 5 6 7 8 9 10 1-Jul 119 Prepaid Insurance 111 To Cash 4,800 4,800 1-Jul 511 Store Rent Expense 111 To Cash 3,600 11 3,600 6-Jul 7,800 144 Prepair Equipment 111 To Cash 213 To Accounts Payable 600 7,200 8-Jul 450 12 13 14 15 16 17 18 19 20 21 22 23 117 Repair Supplies 213 To Accounts payable 450 10-Jul 300 512 Telephone 111 To Cash 300 11-Jul 2,650 111 Cash 411 Too pool service revenue 24 2,650 18-Jul 300 213 Accounts Payable 111 To Cash 300 20-Jul 4,000 111 Cash 411 To pool service revenue 4,000 31-Jull 2,500 111 Cash 411 To pool service revenue 2,500 31-Jul 500 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 517 Electric Expense 111 To Cash 500 31-Jul 313 Dividends 111 To Cash 1,100 1,100 68.0001 68.000 D E F G M N 0 R S . Date July 31 B Date Cash (111) 1-Jul commone stock 11-Jul pool service revel 20-Jul pool service reve 31-Jul pool service reve 40,000 July 1st 2,650 July 1st 4,000 July 6th 2,250 July 10th Pool Service Revenue (411) To Balance c/d 8,900 Jul. 11 Jul.20 Jul.31 By Cash By Cash By Cash 2,650 4,000 2,250 Prepaid insurance store rent expense repair equipment telephone expense accounts payable electric expense dividends balance cld 4,800 3,600 600 300 300 500 1,100 37,700 July 18th 8,900 8,900 8,900 Aug. 1 By Balance b/d This worksheet will be used to complete Requirements #2, #5 and #9. Instructions for #5 can be found on the Adjusting Entries Worksheet. Instructions for #9 can be found on the Closing Entries Worksheet 48,900 July 31st 37,700 July 31st July 31st 1-Aug Balance b/d 48,900 Repair Supplies (117) 8-Jul Accounts payabl Store Rent Expense (511) To Cash 3,600 July 31st 450 Jul.31 By Balance c/d 450 July. 1st By Balance c/b 3,600 450 3,600 1-Aug To Balance b/d 450 450 3,600 3,600 Aug. 1 To Balance b/d 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 . 22 23 24 . 25 26 27 28 29 30 24 31 20 32 33 34 34 35 36 37 38 20 39 40 40 41 40 42 12 43 44 45 46 Prepaid Insurance (119) 1 Jul Cash 4,800 July. 1 Telephone Expense (512) To Cash 300 Jul. 31 By Balance c/d 4,800 Jul. 10 By Balance c/d 300 4,800 Jul.31 To Balance b/d 300 300 1-Aug To Balance b/d 4,800 4,800 Repair Equipment (144) 6-Jul To Cash 6-Jul to Accounts payd Insurance Expense (513) Cash By Balance c/d 7,800 July. 31 400 Balance 600 Jul 31st 7,200 400 400 400 7,800 7.800 7,800 1-Aug To Balance b/d Accum. Depr.-Repair Equipment (145) 6-Jul balance 160 July. 6 Repair Supplies Expense (514) Cash 200 July accum. Depr. Repair eq 160 July. 8th balance 200 160 160 200 200 Rest of 2 A G H 47 48 49 Depr. Exp.-Repair Equipment (515) Accounts Payable (212) 18 Jul To Cash 31-Jul To Balance c/d 300 Jul.6 7,350 Jul. 8 By repair Equipment By repair Equipment 7,200 450 7,650 7,650 7,350 Aug. 1 By Balance Income Tax Payable (213) 31-Jul To Cash 95 July 31 Income Tax Expense (516) cash Balance 95 July. 31 95 July.31 balance 95 95 95 95 95 Common Stock (311) 31 Jul Balance c/d Electric Expense (517) To Cash 40,000 July 1st By Cash 40,000 Jul. 31 500 Jul.31 By Balance c/d 500 40,000 500 40,000 40,000 Aug. 1 By Balance b/d 500 500 Aug. 1 To Balance b/d Retained Earnings (312) I 70 71 72 12 72 74 14 75 19 76 76 77 78 To 79 19 on 80 01 81 92 82 83 83 84 85 86 Dividends (313) 31 Jul To Cash 1,100 Jul. 31 By Balance c/d 1,100 1,100 1-Aug To Balance b/d 1,100 1,100 A E F B REQUIREMENT #3: Prepare a trial balance for July in the space below. 1 Only enter accounts that have a balance. 2 3 Account 4 Number 5 111 6 311 7 119 8 511 9 144 10 213 11 117 12 512 13 411 14 517 15 313 16 17 total 18 Peter's Pool Corporation Trial Balance July 31 Account Title Cash Common stock Prepaid Insurance Store Rent Repair equipment Accounts payable repair supplies telephone expense pool serivse revenue electric expense dividends Balance Debit Credit 37,700 40,000 4,800 3,600 7,800 7,350 450 300 8,900 500 1,100 56,250 56,250 10 B D E F Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $250. c) The estimated depreciation on repair equipment is $160. d) The estimated income taxes are $95. 1 Requirement #5: Post the adjusting entries on July 31 below to the General Ledger T-accounts (Step 2) and compute adjusted balances. Just add to the balances that are already listed. 2 Requirement #4 3 Account Number from Chart of Accounts tab Date Account Title from Chart of Accounts tab Debit Credit 4 5 6 7 8 9 10 11 12 13 A D E F G B REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. 1 Peter's Pool Corporation Adjusted Trial Balance July 31 Account Title Only enter accounts that have a balance. 2 3 Account Number Balance Debit Credit 4 5 6. 7 8 9 10 11 12 13 14 15 16 17 18 19 20 D H B E F G Requirement #7: Prepare the financial statements for Peter's Pool Corporation as of July 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earnings, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project. 1 Peter's Pool Corporation Statement of Retained Earnings For the Month Ending July 31 Peter's Pool Corporation Balance Sheet July 31 Retained Earnings, July 1 Add: Net Income Subtotal Less : Dividends Retained Earnings, July 31 Assets: Cash Repair Supplies Prepaid Insurance Repair Equipment Less: Accum. Dep - Repair Equipment. Total Assets 2 3 4 Peter's Pool Corporation 5 Income Statement 6 For the Month Ending July 31 7 8 Revenues: 9 Pool Repair Revenue 10 Total Revenue 11 12 Expenses: 13 Store Rent Expense 14 Telephone Expense 15 Insurance Expense 16 Repair Supplies Exp. 17 Depreciation Exp. 18 Income Tax Expense 19 Electric Expense 20 Total Expenses 21 22 Net Income 23 24 25 26 27 Liabilities and Stockholders' Equity Liabilities: Accounts Payable Income Taxes Payable Total Liabilities Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started