Answered step by step

Verified Expert Solution

Question

1 Approved Answer

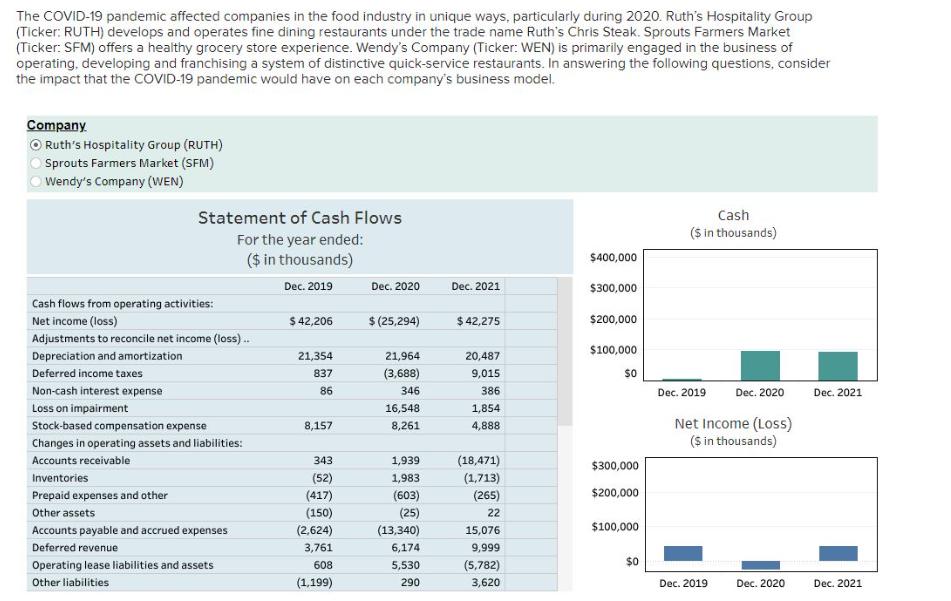

The COVID-19 pandemic affected companies in the food industry in unique ways, particularly during 2020. Ruth's Hospitality Group (Ticker: RUTH) develops and operates fine

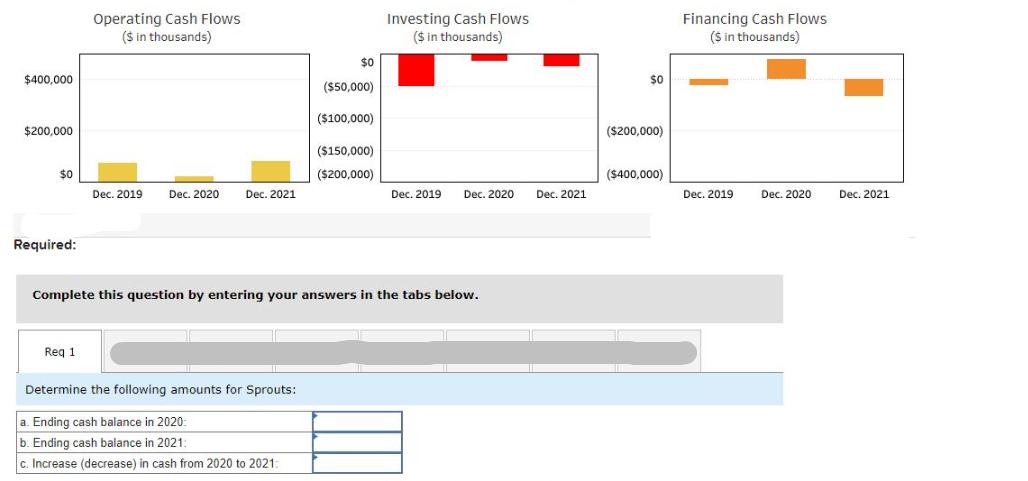

The COVID-19 pandemic affected companies in the food industry in unique ways, particularly during 2020. Ruth's Hospitality Group (Ticker: RUTH) develops and operates fine dining restaurants under the trade name Ruth's Chris Steak. Sprouts Farmers Market (Ticker: SFM) offers a healthy grocery store experience. Wendy's Company (Ticker: WEN) is primarily engaged in the business of operating, developing and franchising a system of distinctive quick-service restaurants. In answering the following questions, consider the impact that the COVID-19 pandemic would have on each company's business model. Company Ruth's Hospitality Group (RUTH) Sprouts Farmers Market (SFM) Wendy's Company (WEN) Statement of Cash Flows For the year ended: ($ in thousands) Cash ($ in thousands) $400,000 Dec. 2019 Dec. 2020 Dec. 2021 $300,000 Cash flows from operating activities: Net income (loss) $42,206 $(25,294) $42,275 $200,000 Adjustments to reconcile net income (loss).. $100,000 Depreciation and amortization 21,354 21,964 20,487 Deferred income taxes 837 (3,688) Non-cash interest expense 86 346 9,015 386 Dec. 2019 Dec. 2020 Dec. 2021 Loss on impairment 16,548 1,854 Stock-based compensation expense 8,157 8,261 4,888 Changes in operating assets and liabilities: Net Income (Loss) ($ in thousands) Accounts receivable 343 1,939 (18,471) $300,000 Inventories (52) 1,983 (1,713) Prepaid expenses and other (417) (603) (265) $200,000 Other assets (150) (25) 22 Accounts payable and accrued expenses (2,624) (13,340) 15,076 $100,000 Deferred revenue 3,761 6,174 9,999 Operating lease liabilities and assets 608 5,530 (5,782) Other liabilities (1,199) 290 3,620 $0 Dec. 2019 Dec. 2020 Dec. 2021 $400,000 Operating Cash Flows ($ in thousands) $0 ($50,000) Investing Cash Flows ($ in thousands) $0 Financing Cash Flows ($ in thousands) ($100,000) $200,000 ($200,000) ($150,000) $0 ($200,000) ($400,000) Dec. 2019 Dec. 2020 Dec. 2021 Dec. 2019 Dec. 2020 Dec. 2021 Dec. 2019 Dec. 2020 Dec. 2021 Required: Complete this question by entering your answers in the tabs below. Req 1 Determine the following amounts for Sprouts: a. Ending cash balance in 2020: b. Ending cash balance in 2021: c. Increase (decrease) in cash from 2020 to 2021

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Sprouts Farmers Market Cash Flow Analysis a Ending cash balance in 2020 Cash flows from operating ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started