Answered step by step

Verified Expert Solution

Question

1 Approved Answer

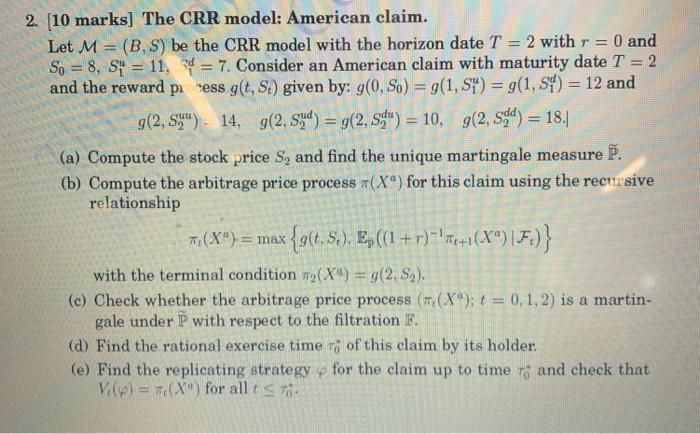

2. [10 marks] The CRR model: American claim. Let M - = (B, S) be the CRR model with the horizon date T 2

2. [10 marks] The CRR model: American claim. Let M - = (B, S) be the CRR model with the horizon date T 2 with r = 0 and So 8, ST 11, d= 7. Consider an American claim with maturity date T = 2 and the reward pi ess g(t, S) given by: g(0, So) = g(1, St) = g(1, St) = 12 and g(2, S) 14, g(2, Syd) = g(2, Sa") = 10, g(2, Sad) = 18.| (a) Compute the stock price S, and find the unique martingale measure P. (b) Compute the arbitrage price process (X) for this claim using the recursive relationship 7. (X) = max {g(t. S.). Ep((1+r)+1(X) |F)} with the terminal condition #(X) = g(2, S). (c) Check whether the arbitrage price process (T(X); t = 0.1, 2) is a martin- gale under P with respect to the filtration F. (d) Find the rational exercise time of this claim by its holder. (e) Find the replicating strategy for the claim up to timer and check that Vi (p), (X) for all to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

WORK ING a We have S 2 S 0 e r 0 5 2 t e r 0 5 2 W t where W t N 0 t Using the formula for the stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started