Question

The CSI 300 Index is currently trading at 4,150. The continu- ously compounded risk-free rate is r = 0.06. The price of a European

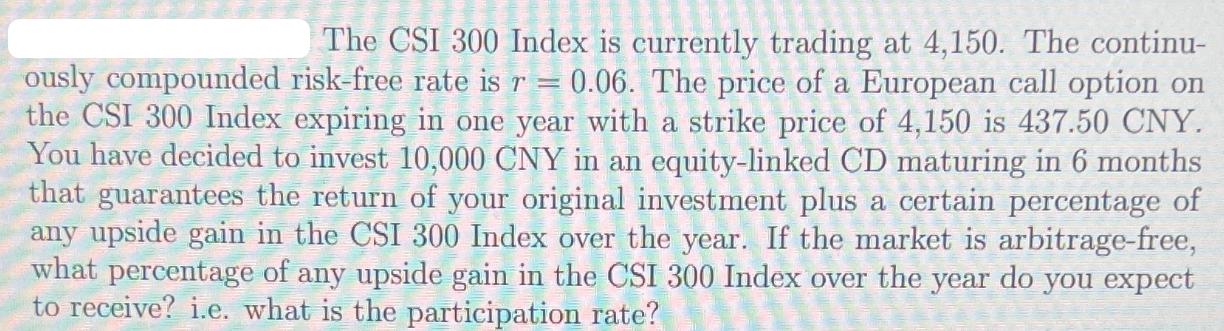

The CSI 300 Index is currently trading at 4,150. The continu- ously compounded risk-free rate is r = 0.06. The price of a European call option on the CSI 300 Index expiring in one year with a strike price of 4,150 is 437.50 CNY. You have decided to invest 10,000 CNY in an equity-linked CD maturing in 6 months that guarantees the return of your original investment plus a certain percentage of any upside gain in the CSI 300 Index over the year. If the market is arbitrage-free, what percentage of any upside gain in the CSI 300 Index over the year do you expect to receive? i.e. what is the participation rate?

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

9th Edition

73530700, 978-0073530703

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App