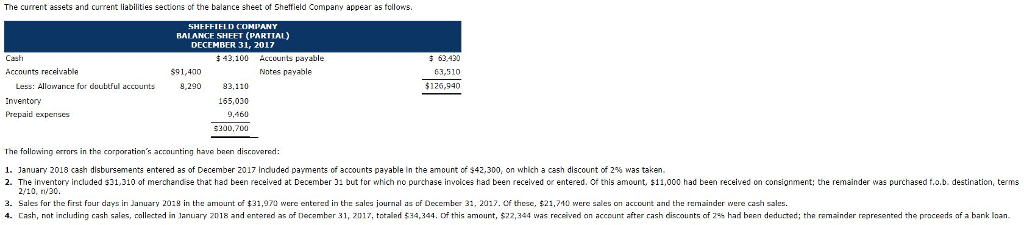

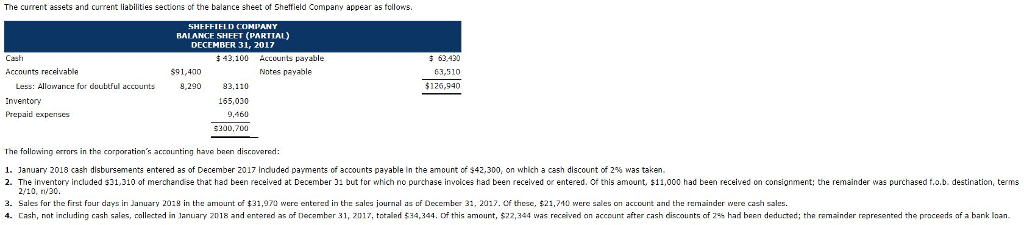

The current assets and current liabilities sections of the balance sheet of Sheffield Company appear as follows.

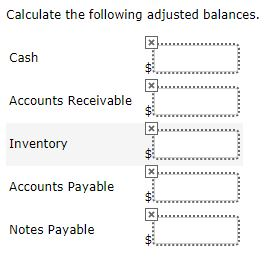

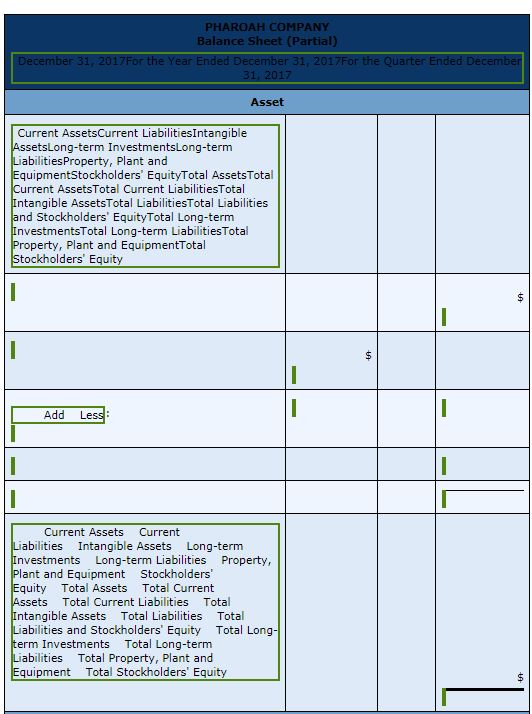

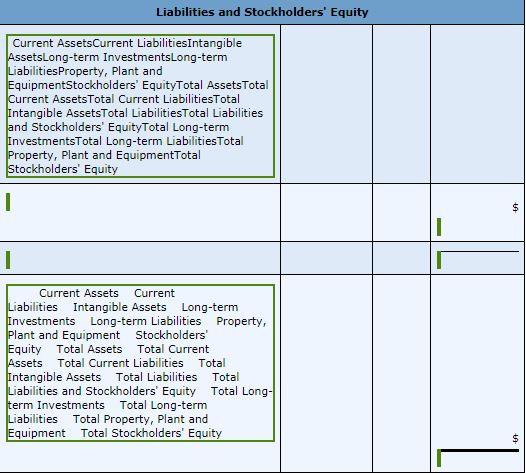

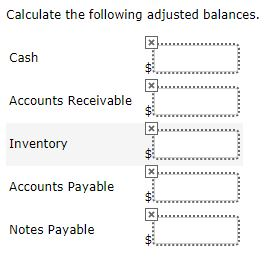

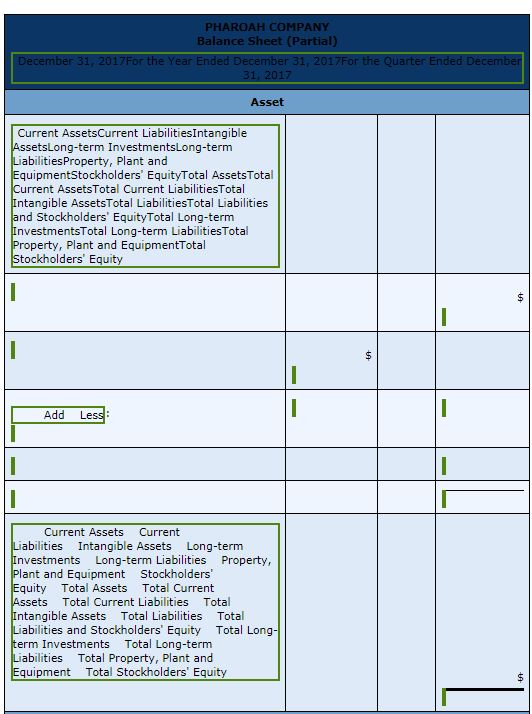

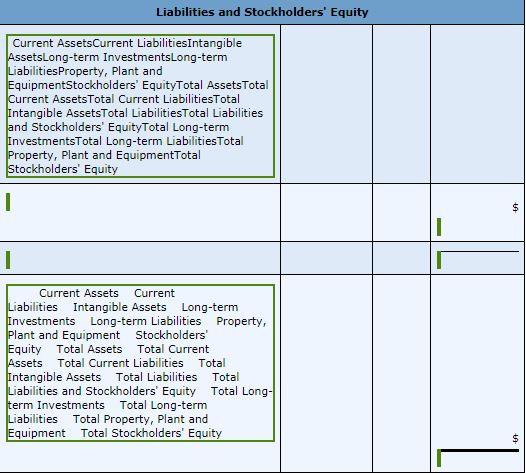

The current assets and current liabilities sections of the balance sheet of Shetfield Company appear as fcllows. LD COMPANY BALANCE SHEET (PARTIAL) DECEMBER 31, 2017 Cash 43,100 Accounts payable 63,430 Accounts receivable $91,400 Nates payable Less: Allowance for doubtful accounts 9,290 3,110 155,030 9,460 5300,700 $126,940 Prepaid expenses The following errors in tha corporation's accounting have been discovered: 1. January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the amount of $42,300, on which a cash discount of 2%, was taken. 2. The inventory included $31,310 of merchandise that had been received at December 31 but for which no purchase invcices had been received or entered. Of this amount, $11,000 had been received on consignment; the remainder was purchased f.o.b. destination, terms 210, 30 3- Sales for the first four days in January 2018 in the amount of $31,970 were entered in the sales lournal as of December 31, 2017Ofthese, $21,740 were sales on account and the remainder were cash sales. 4. Cash, nat including cash sales, collected in lanuary 2018 and entered as of Decamber 31, 2017, totalad $34,344. of this amount, $22,344 was receved an account after cash discounts of 2gs had been dedurted; the remainder represented the praceeds af a bank Inan Calculate the following adjusted balances. Cash Accounts Receivable Inventory Accounts Payable Notes Payable PHAROAH COMPANY Balance Sheet (Partial) December 31, 2017For the Year Ended December 31, 2017For the Quarter Ended December Asset Current AssetsCurrent LiabilitiesIntangible AssetsLong-term InvestmentsLong-term LiabilitiesProperty, Plant and EquipmentStockholders' EquityTotal AssetsTotal Current AssetsTotal Current LiabilitiesTotal Intangible AssetsTotal LiabilitiesTotal Liabilities and Stockholders' EquityTotal Long-term nvestmentsTotal Long-term LiabilitiesTotal Property, Plant and EquipmentTotal Add Less Current Assets Current Liabilities Intangible Assets Long-term nvestments Long-term Liabilities Property, Plant and Equipment Stockholders Equity Total Assets Total Current Assets Total Current Liabilities Total Intangible Assets Total Liabilities Total Liabilities and Stockholders' Equity Total Long term Investments Total Long-term Liabilities Total Property, Plant and Liabilities and Stockholders' Equity Current AssetsCurrent LiabilitiesIntangible AssetsLong-term InvestmentsLong-term abilitiesProperty, Plant and EquipmentStockholders EquityTotal AssetsTotal Current AssetsTotal Current LiabilitiesTotal Intangible AssetsTotal LiabilitiesTotal Liabilities and Stockholders' EquityTotal Long-term InvestmentsTotal Long-term LiabilitiesTotal Property, Plant and EquipmentTotal Stockholders Equity Current Assets Current LiabilitiesIntangible Assets Long-term Investments Long-term Liabilities Property, Plant and Equipment Stockholders' Equity Total Assets Total Current Assets Total Current Liabilities Total Intangible Assets Total Liabilities Total Liabilities and Stockholders' Equity Total Long- erm Investments Total Long-term Liabilities Total Property, Plant and Equipment Total Stockholders' Equity