Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The current bear market in stocks is driving people to invest in bonds. A few months ago, after reading a reddit post, your friend

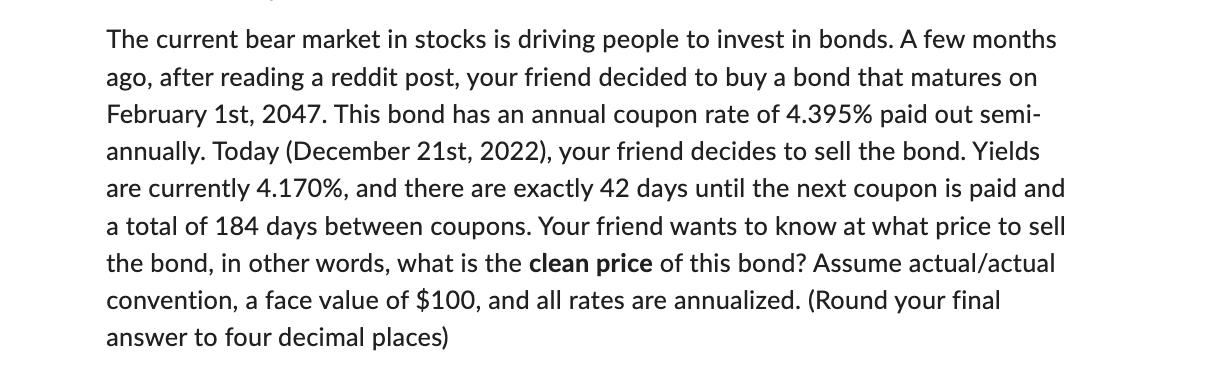

The current bear market in stocks is driving people to invest in bonds. A few months ago, after reading a reddit post, your friend decided to buy a bond that matures on February 1st, 2047. This bond has an annual coupon rate of 4.395% paid out semi- annually. Today (December 21st, 2022), your friend decides to sell the bond. Yields are currently 4.170%, and there are exactly 42 days until the next coupon is paid and a total of 184 days between coupons. Your friend wants to know at what price to sell the bond, in other words, what is the clean price of this bond? Assume actual/actual convention, a face value of $100, and all rates are annualized. (Round your final answer to four decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the clean price of the bond we need to first calculate the dirty price which is the cur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started