Question

The current financial statements for J. Rodgers Bottling Company show: The company usually pays out 60% of its net profits to shareholders and intends to

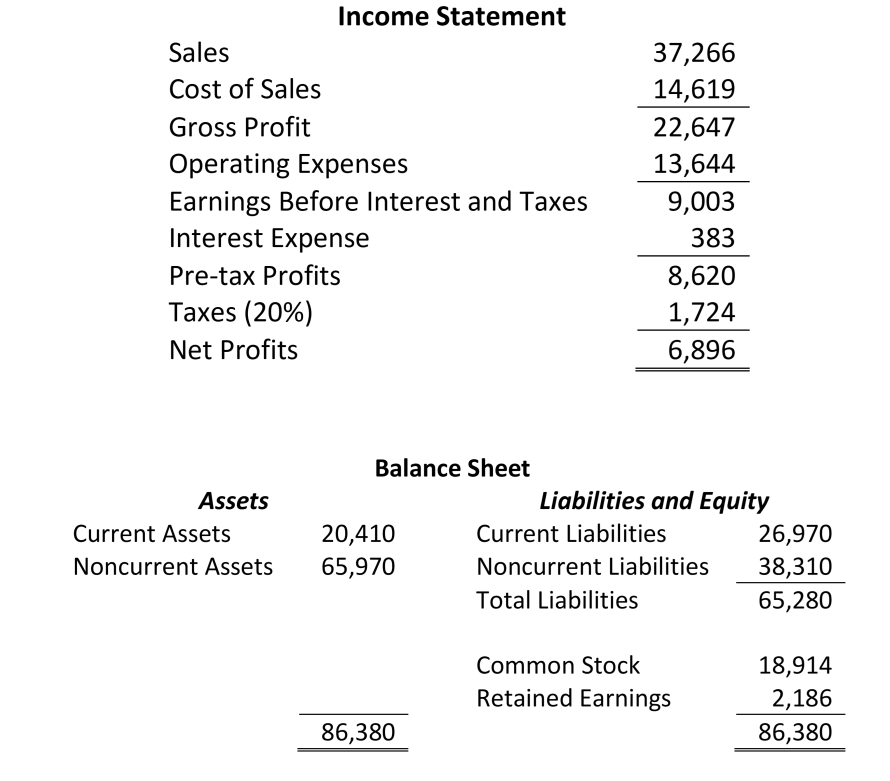

The current financial statements for J. Rodgers Bottling Company show:

The company usually pays out 60% of its net profits to shareholders and intends to continue to do so in the foreseeable future as means of satisfying its shareholder return objective. In fact, the company projects that it can grow sales by 20% in the next operating cycle. Any growth in the companys sales however will affect its current assets and current liabilities which will change proportionately.

A. Based on the companys growth forecast, will it likely need additional external financing or have excess financing in the next operating cycle? State the amount that would be needed or held in excess.

B. At what growth rate in Sales would the company neither need additional external financing nor have excess financing?

C. What are the maximum sales that the company should target in the next operating cycle if its financial policy does not permit the issue of new shares to facilitate its expansion but requires it to maintain its current level of financial leverage?

Income Statement \begin{tabular}{lr} Sales & 37,266 \\ Cost of Sales & 14,619 \\ \cline { 2 } Gross Profit & 22,647 \\ Operating Expenses & 13,644 \\ \cline { 2 } Earnings Before Interest and Taxes & 9,003 \\ Interest Expense & 383 \\ Pre-tax Profits & 8,620 \\ Taxes (20\%) & 1,724 \\ \cline { 2 } Net Profits & 6,896 \\ \hline \hline \end{tabular} Income Statement \begin{tabular}{lr} Sales & 37,266 \\ Cost of Sales & 14,619 \\ \cline { 2 } Gross Profit & 22,647 \\ Operating Expenses & 13,644 \\ \cline { 2 } Earnings Before Interest and Taxes & 9,003 \\ Interest Expense & 383 \\ Pre-tax Profits & 8,620 \\ Taxes (20\%) & 1,724 \\ \cline { 2 } Net Profits & 6,896 \\ \hline \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started