Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The current gap between the Consumer Price Index and the PCE deflator: matches what is historically typical. is unusually large. is unusually small. is unusual,

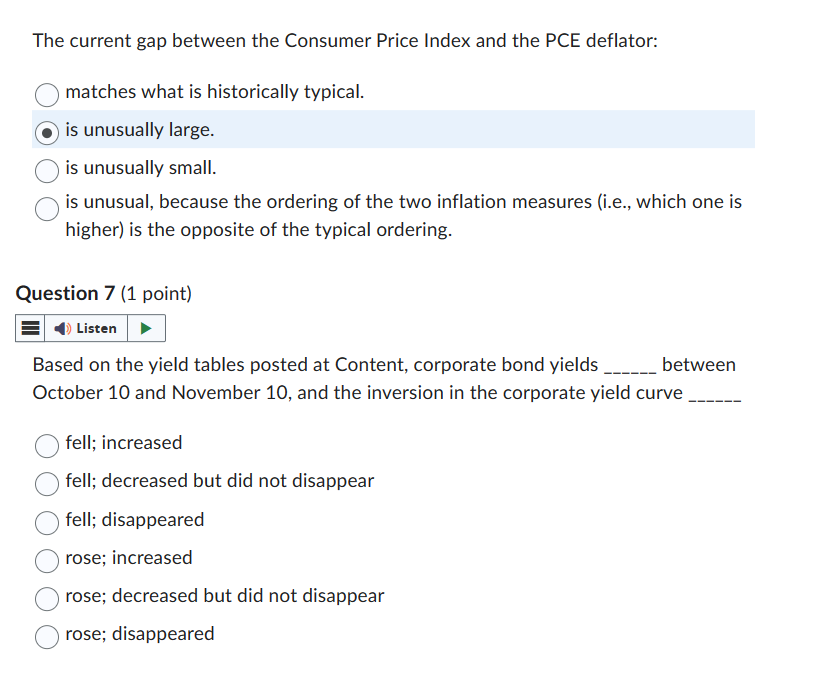

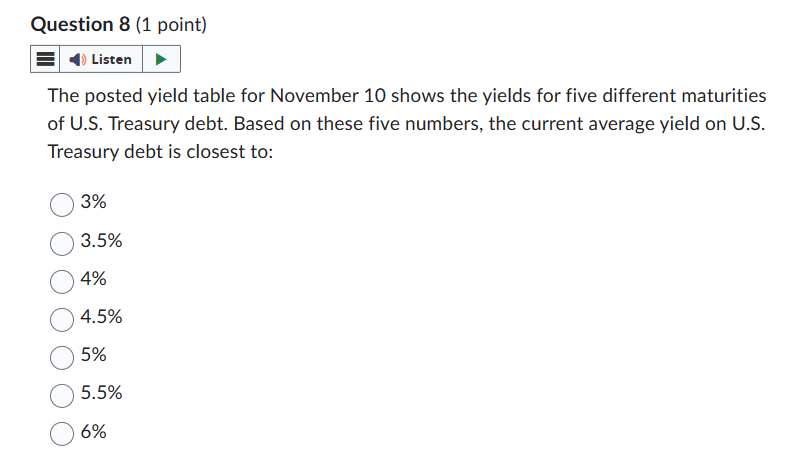

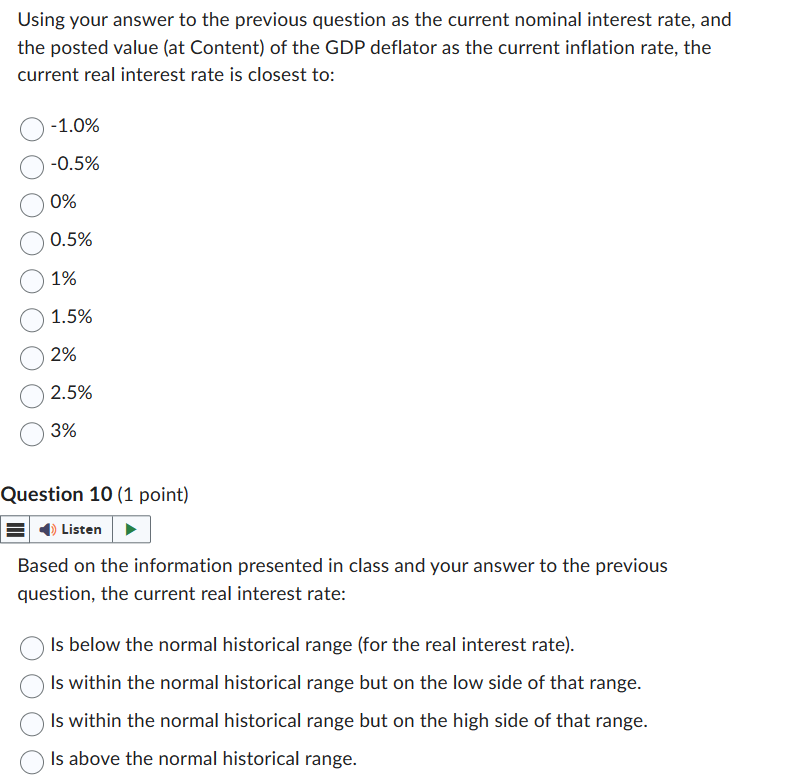

The current gap between the Consumer Price Index and the PCE deflator: matches what is historically typical. is unusually large. is unusually small. is unusual, because the ordering of the two inflation measures (i.e., which one is higher) is the opposite of the typical ordering. Question 7 (1 point) Based on the yield tables posted at Content, corporate bond yields between October 10 and November 10, and the inversion in the corporate yield curve fell; increased fell; decreased but did not disappear fell; disappeared rose; increased rose; decreased but did not disappear rose; disappeared The posted yield table for November 10 shows the yields for five different maturities of U.S. Treasury debt. Based on these five numbers, the current average yield on U.S. Treasury debt is closest to: 3%3.5%4%4.5%5%5.5%6% Using your answer to the previous question as the current nominal interest rate, and the posted value (at Content) of the GDP deflator as the current inflation rate, the current real interest rate is closest to: 1.0%0.5%0%0.5%1%1.5%2%2.5%3% Question 10 (1 point) Based on the information presented in class and your answer to the previous question, the current real interest rate: Is below the normal historical range (for the real interest rate). Is within the normal historical range but on the low side of that range. Is within the normal historical range but on the high side of that range. Is above the normal historical range

The current gap between the Consumer Price Index and the PCE deflator: matches what is historically typical. is unusually large. is unusually small. is unusual, because the ordering of the two inflation measures (i.e., which one is higher) is the opposite of the typical ordering. Question 7 (1 point) Based on the yield tables posted at Content, corporate bond yields between October 10 and November 10, and the inversion in the corporate yield curve fell; increased fell; decreased but did not disappear fell; disappeared rose; increased rose; decreased but did not disappear rose; disappeared The posted yield table for November 10 shows the yields for five different maturities of U.S. Treasury debt. Based on these five numbers, the current average yield on U.S. Treasury debt is closest to: 3%3.5%4%4.5%5%5.5%6% Using your answer to the previous question as the current nominal interest rate, and the posted value (at Content) of the GDP deflator as the current inflation rate, the current real interest rate is closest to: 1.0%0.5%0%0.5%1%1.5%2%2.5%3% Question 10 (1 point) Based on the information presented in class and your answer to the previous question, the current real interest rate: Is below the normal historical range (for the real interest rate). Is within the normal historical range but on the low side of that range. Is within the normal historical range but on the high side of that range. Is above the normal historical range Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started