Answered step by step

Verified Expert Solution

Question

1 Approved Answer

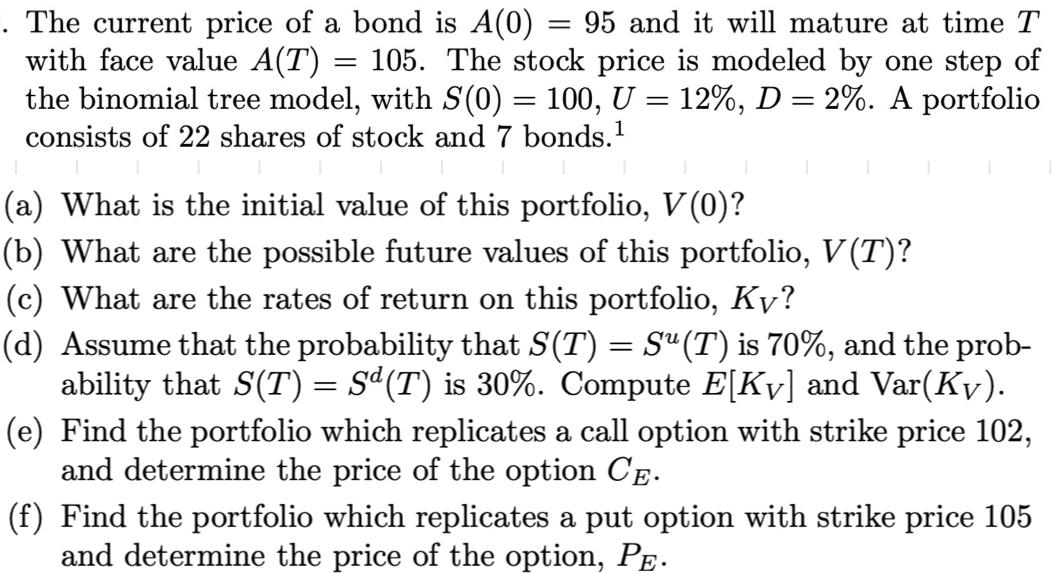

. The current price of a bond is A(0) = 95 and it will mature at time T with face value A(T) = 105.

. The current price of a bond is A(0) = 95 and it will mature at time T with face value A(T) = 105. The stock price is modeled by one step of the binomial tree model, with S(0) = 100, U = 12%, D = 2%. A portfolio consists of 22 shares of stock and 7 bonds. (a) What is the initial value of this portfolio, V(0)? (b) What are the possible future values of this portfolio, V(T)? (c) What are the rates of return on this portfolio, Ky? (d) Assume that the probability that S(T) = S(T) is 70%, and the prob- ability that S(T) = Sd(T) is 30%. Compute E[Ky] and Var(Ky). (e) Find the portfolio which replicates a call option with strike price 102, and determine the price of the option CE. (f) Find the portfolio which replicates a put option with strike price 105 and determine the price of the option, PE.

Step by Step Solution

★★★★★

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we can use the principles of noarbitrage and replication to construct portfolios that have the same payoffs as the call and put options and use the prices of these portfolios to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started