Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The current rate of interest on S-T Treasury Bills = 10%, intermediate term Gov. Bonds = 11%, Lt- Gov. Bonds = 12%, AA rate

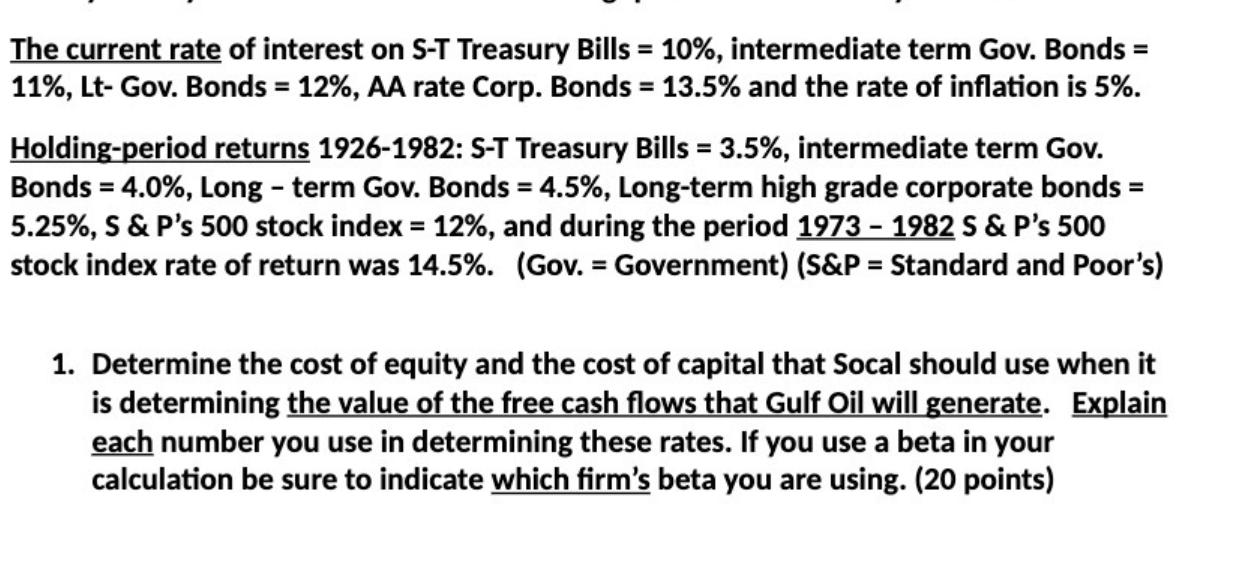

The current rate of interest on S-T Treasury Bills = 10%, intermediate term Gov. Bonds = 11%, Lt- Gov. Bonds = 12%, AA rate Corp. Bonds = 13.5% and the rate of inflation is 5%. Holding-period returns 1926-1982: S-T Treasury Bills = 3.5%, intermediate term Gov. Bonds = 4.0%, Long-term Gov. Bonds = 4.5%, Long-term high grade corporate bonds = 5.25%, S & P's 500 stock index = 12%, and during the period 1973 - 1982 S & P's 500 stock index rate of return was 14.5%. (Gov. = Government) (S&P = Standard and Poor's) 1. Determine the cost of equity and the cost of capital that Socal should use when it is determining the value of the free cash flows that Gulf Oil will generate. Explain each number you use in determining these rates. If you use a beta in your calculation be sure to indicate which firm's beta you are using. (20 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cost of equity using CAPM CAPM formula is Cost of EquityRfRmRf Where Rf is the riskfree rate is the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started