Answered step by step

Verified Expert Solution

Question

1 Approved Answer

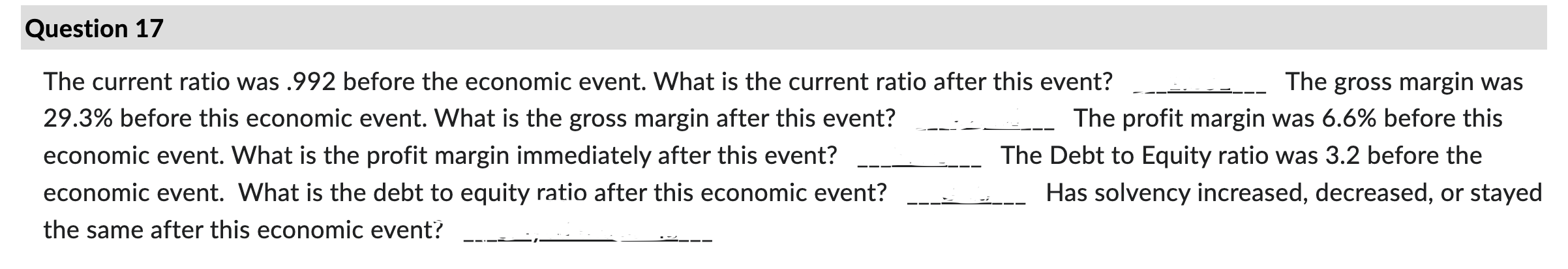

The current ratio was .992 before the economic event. What is the current ratio after this event? The gross margin was 29.3% before this economic

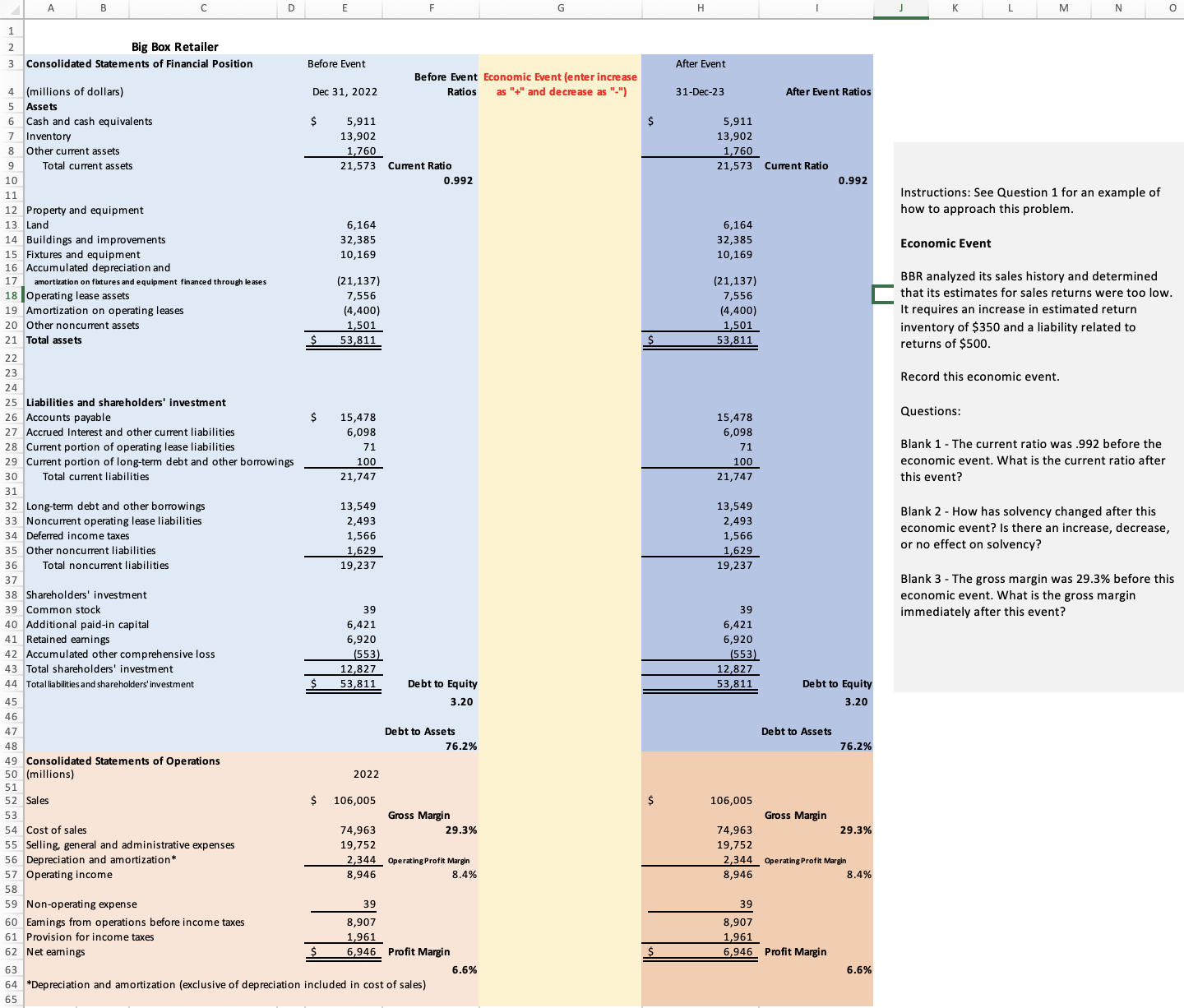

The current ratio was .992 before the economic event. What is the current ratio after this event? The gross margin was 29.3% before this economic event. What is the gross margin after this event? The profit margin was 6.6% before this economic event. What is the profit margin immediately after this event? The Debt to Equity ratio was 3.2 before the economic event. What is the debt to equity ratio after this economic event? Has solvency increased, decreased, or stayed the same after this economic event? Instructions: See Question 1 for an example of how to approach this problem. Economic Event BBR analyzed its sales history and determined that its estimates for sales returns were too low. It requires an increase in estimated return inventory of $350 and a liability related to returns of $500. Record this economic event. Questions: Blank 1 - The current ratio was .992 before the economic event. What is the current ratio after this event? Blank 2 - How has solvency changed after this economic event? Is there an increase, decrease, or no effect on solvency? Blank 3 - The gross margin was 29.3% before this economic event. What is the gross margin immediately after this event

The current ratio was .992 before the economic event. What is the current ratio after this event? The gross margin was 29.3% before this economic event. What is the gross margin after this event? The profit margin was 6.6% before this economic event. What is the profit margin immediately after this event? The Debt to Equity ratio was 3.2 before the economic event. What is the debt to equity ratio after this economic event? Has solvency increased, decreased, or stayed the same after this economic event? Instructions: See Question 1 for an example of how to approach this problem. Economic Event BBR analyzed its sales history and determined that its estimates for sales returns were too low. It requires an increase in estimated return inventory of $350 and a liability related to returns of $500. Record this economic event. Questions: Blank 1 - The current ratio was .992 before the economic event. What is the current ratio after this event? Blank 2 - How has solvency changed after this economic event? Is there an increase, decrease, or no effect on solvency? Blank 3 - The gross margin was 29.3% before this economic event. What is the gross margin immediately after this event Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started