Question

The current risk-free rate is 2 percent and the market risk premium is 3 percent. You are trying to value ABC company and it

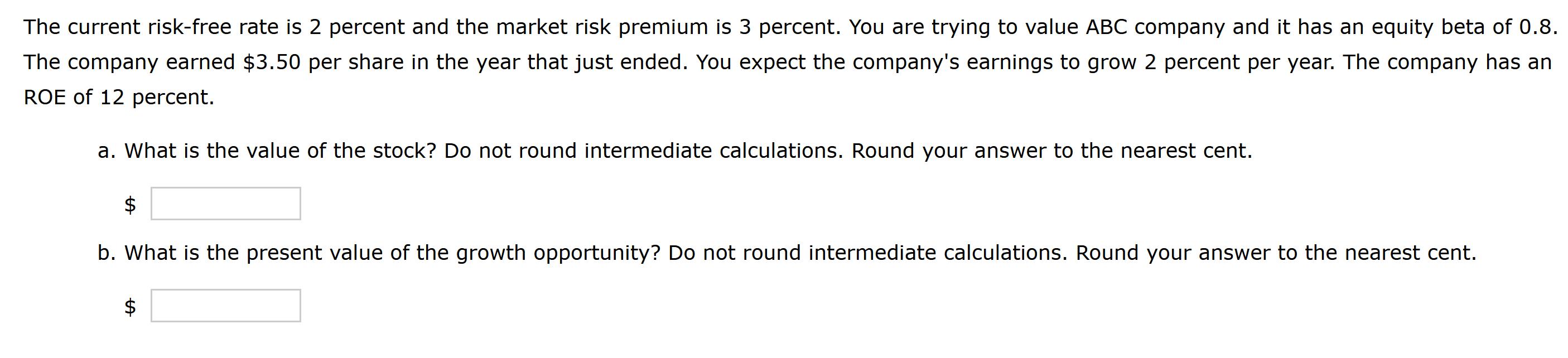

The current risk-free rate is 2 percent and the market risk premium is 3 percent. You are trying to value ABC company and it has an equity beta of 0.8. The company earned $3.50 per share in the year that just ended. You expect the company's earnings to grow 2 percent per year. The company has an ROE of 12 percent. a. What is the value of the stock? Do not round intermediate calculations. Round your answer to the nearest cent. b. What is the present value of the growth opportunity? Do not round intermediate calculations. Round your answer to the nearest cent. +A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Value of the Stock ABC We can use the Capital Asset Pricing Model CAPM to estimate the cost of equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds

11th Edition

1305262999, 1305262997, 035726164X, 978-1305262997

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App