Answered step by step

Verified Expert Solution

Question

1 Approved Answer

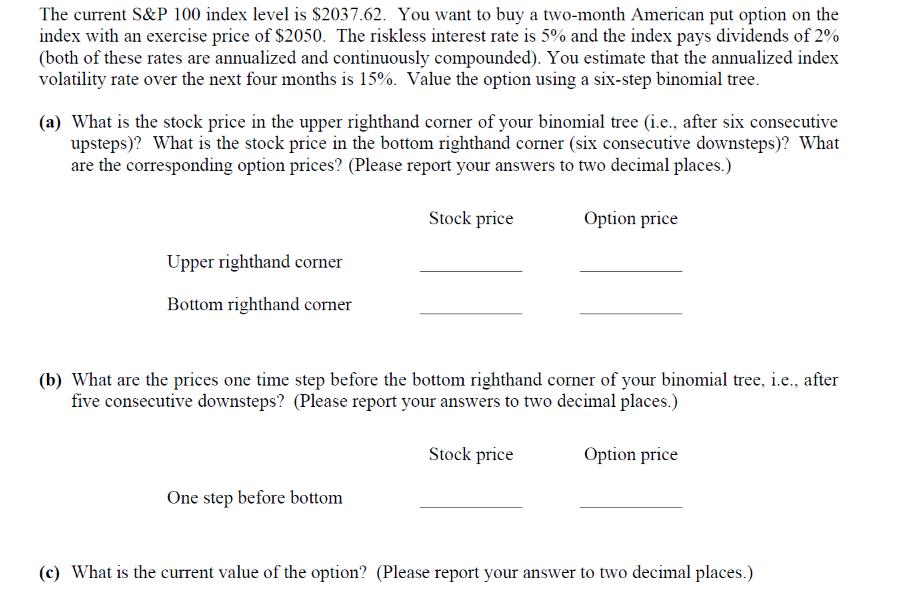

The current S&P 100 index level is $2037.62. You want to buy a two-month American put option on the index with an exercise price

The current S&P 100 index level is $2037.62. You want to buy a two-month American put option on the index with an exercise price of $2050. The riskless interest rate is 5% and the index pays dividends of 2% (both of these rates are annualized and continuously compounded). You estimate that the annualized index volatility rate over the next four months is 15%. Value the option using a six-step binomial tree. (a) What is the stock price in the upper righthand corner of your binomial tree (i.e., after six consecutive upsteps)? What is the stock price in the bottom righthand corner (six consecutive downsteps)? What are the corresponding option prices? (Please report your answers to two decimal places.) Upper righthand corner Bottom righthand corner Stock price One step before bottom (b) What are the prices one time step before the bottom righthand corner of your binomial tree, i.e., after five consecutive downsteps? (Please report your answers to two decimal places.) Option price Stock price Option price (c) What is the current value of the option? (Please report your answer to two decimal places.) (d) Suppose you're a market maker who sells this put option to a customer. How would you synthetically create the option to offset your risk? Be sure to identify the securities traded, whether you buy or sell these securities, and the quantities you should trade. Would you hold this portfolio to expiration?

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Solutions To value the option using a binomial tree we need to calculate the stock prices at each node and the corresponding option prices Well start by defining the parameters given Current SP 100 in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started