Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The current stock price of ABC is So = 17. Your boss is convinced that the stock price in 3 months (T= 0.25) will

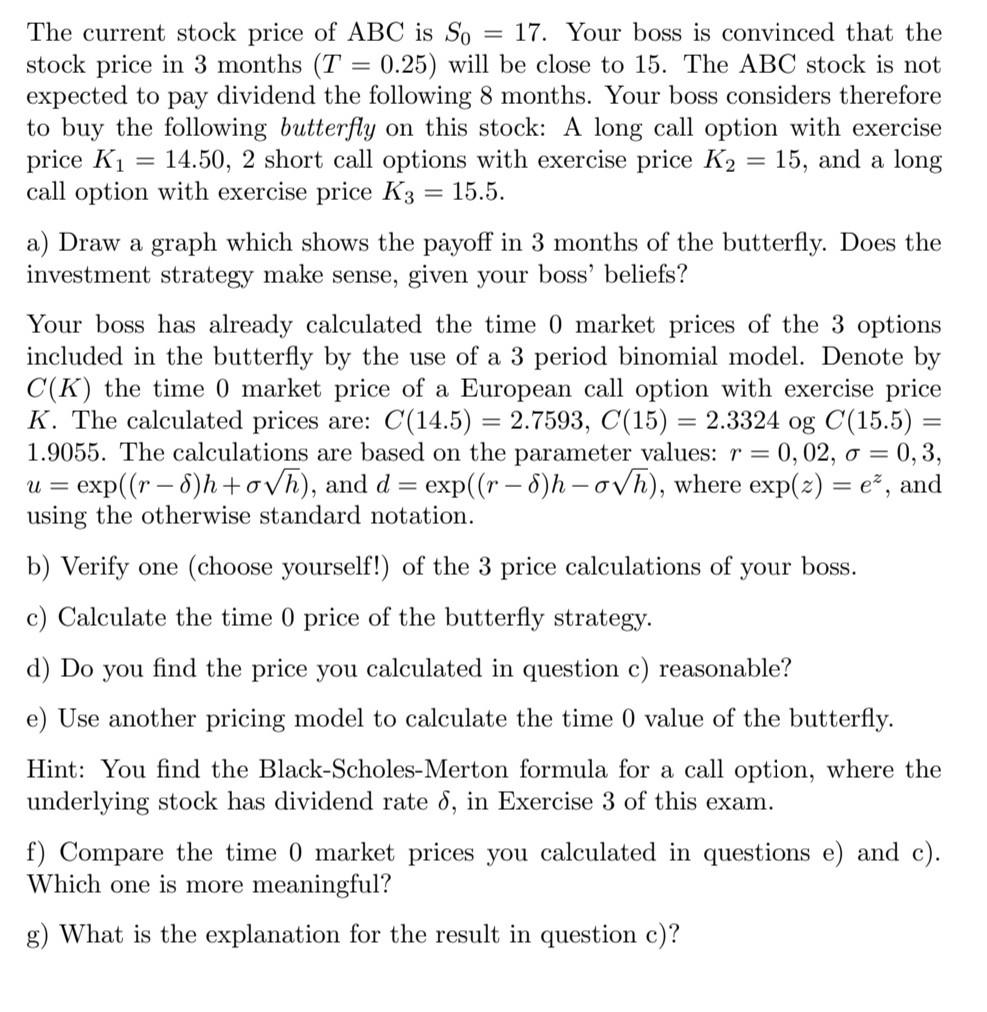

The current stock price of ABC is So = 17. Your boss is convinced that the stock price in 3 months (T= 0.25) will be close to 15. The ABC stock is not expected to pay dividend the following 8 months. Your boss considers therefore to buy the following butterfly on this stock: A long call option with exercise price K 14.50, 2 short call options with exercise price K2 15, and a long = 15.5. = call option with exercise price K3 = a) Draw a graph which shows the payoff in 3 months of the butterfly. Does the investment strategy make sense, given your boss' beliefs? Your boss has already calculated the time 0 market prices of the 3 options included in the butterfly by the use of a 3 period binomial model. Denote by C(K) the time 0 market price of a European call option with exercise price K. The calculated prices are: C(14.5)= 2.7593, C(15) = 2.3324 og C(15.5) = 1.9055. The calculations are based on the parameter values: r = 0, 02, o = 0,3, U = = exp((r8)h +oh), and d = exp((r-8)h-oh), where exp(z) = e, and using the otherwise standard notation. b) Verify one (choose yourself!) of the 3 price calculations of your boss. c) Calculate the time 0 price of the butterfly strategy. d) Do you find the price you calculated in question c) reasonable? e) Use another pricing model to calculate the time 0 value of the butterfly. Hint: You find the Black-Scholes-Merton formula for a call option, where the underlying stock has dividend rate 6, in Exercise 3 of this exam. f) Compare the time 0 market prices you calculated in questions e) and c). Which one is more meaningful? g) What is the explanation for the result in question c)?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution a The payoff graph of the butterfly spread would look like a butterfly shape It would be lo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started