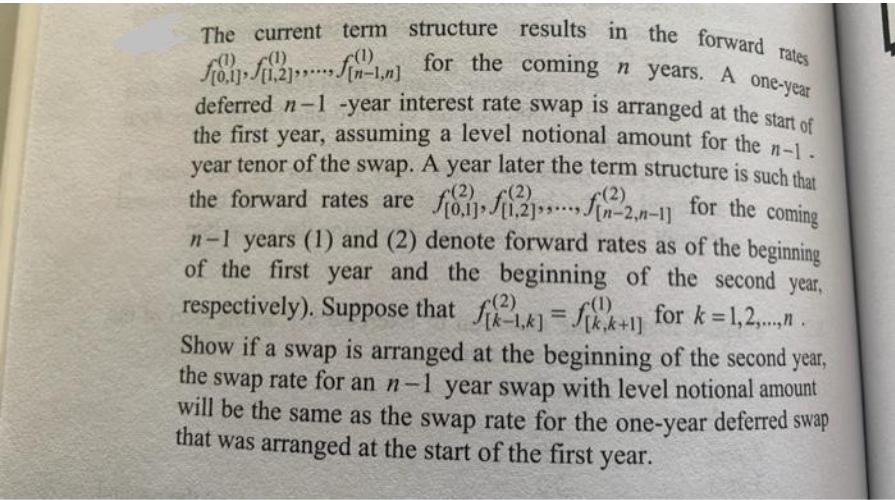

The current term structure results in the forward rates fon-1.n] for the coming n years. A one-year *****[n-1,n] J[n-2,n-1] deferred n-1 -year interest rate

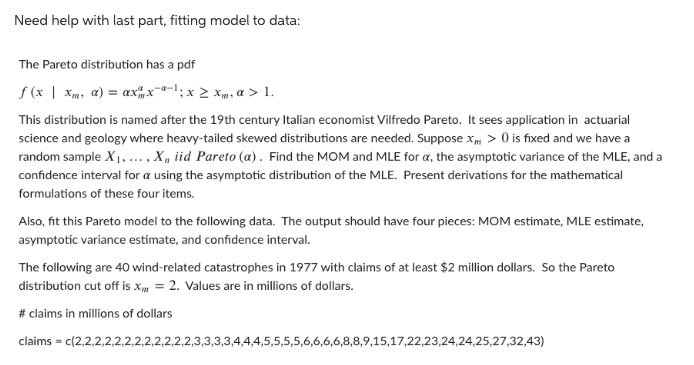

The current term structure results in the forward rates fon-1.n] for the coming n years. A one-year *****[n-1,n] J[n-2,n-1] deferred n-1 -year interest rate swap is arranged at the start of the first year, assuming a level notional amount for the n-1. year tenor of the swap. A year later the term structure is such that the forward rates are f...22.n-1) for the coming n-1 years (1) and (2) denote forward rates as of the beginning of the first year and the beginning of the second year, respectively). Suppose that fk] = fk+1] for k=1,2,... Show if a swap is arranged at the beginning of the second year, the swap rate for an n-1 year swap with level notional amount will be the same as the swap rate for the one-year deferred swap that was arranged at the start of the first year. (2) f(1) (1) Need help with last part, fitting model to data: The Pareto distribution has a pdf f (x | xm, a) = xx-; x xm, > 1. This distribution is named after the 19th century Italian economist Vilfredo Pareto. It sees application in actuarial science and geology where heavy-tailed skewed distributions are needed. Suppose xm > 0 is fixed and we have a random sample X, ..., X, iid Pareto (a). Find the MOM and MLE for a, the asymptotic variance of the MLE, and a confidence interval for a using the asymptotic distribution of the MLE. Present derivations for the mathematical formulations of these four items. Also, fit this Pareto model to the following data. The output should have four pieces: MOM estimate, MLE estimate, asymptotic variance estimate, and confidence interval. The following are 40 wind-related catastrophes in 1977 with claims of at least $2 million dollars. So the Pareto distribution cut off is X = 2. Values are in millions of dollars. # claims in millions of dollars claims = c(2,2,2,2,2,2,2,2, ,3,4,4,4,5,5,5,5,6,6,6,6,8,8,9,15,17,22,23,24,24,25,27,32,43)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started