Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The current - year reserve as a percentage of gross receivables is consistent with prior years although there was an increase in revenues, gross receivables,

The currentyear reserve as a percentage of gross receivables is consistent with prior years although there was an increase in revenues, gross receivables, and the related reserve.

Retrospective review of receivable collections indicates that management's reserves have historically been accurate.

Economic conditions have been unstable, and the predictability of future conditions is limited

Revenues increased substantially year over year as a result of the introduction of a new product line.

The new product line is marketed toward customers in the restaurant industry, in which the entity does not currently have an established customer base.

The restaurant industry generally has a higher rate of business failure than other customer segments.

The entity's collections experience has primarily been with customers in the retail and professional services industries; the entity has minimal collections experience with the new product line, given the recent launch.

Approved sales terms have not changed year to year eg sales personnel may offer an extension of credit of up to percent of the purchase price consistent with prior year, criteria applied to evaluate customer creditworthiness is consistent with prior year, payment terms are consistent with prior year

Sales of the new product line are more frequently percent financed in contrast to sales of the existing product lines, resulting in an increase in gross receivables.

Competitors who manufacture similar restaurant furniture products have higher reserves as a percentage of their trade receivables.

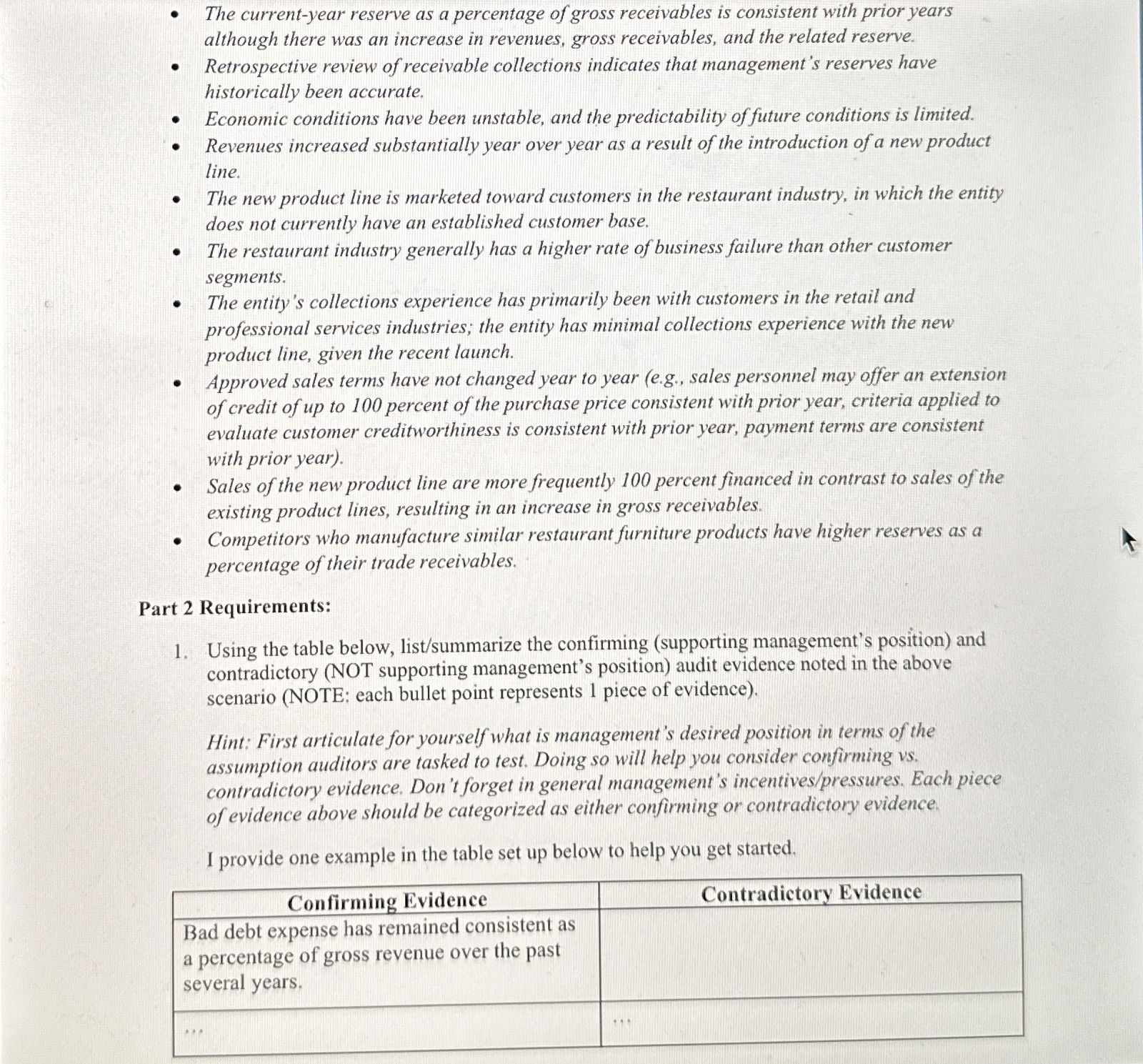

Part Requirements:

Using the table below, listsummarize the confirming supporting management's position and contradictory NOT supporting management's position audit evidence noted in the above scenario NOTE: each bullet point represents piece of evidence

Hint: First articulate for yourself what is management's desired position in terms of the assumption auditors are tasked to test. Doing so will help you consider confirming vs contradictory evidence. Don't forget in general management's incentivespressures Each piece of evidence above should be categorized as either confirming or contradictory evidence.

I provide one example in the table set up below to help you get started.

tableConfirming Evidence,Contradictory EvidencetableBad debt expense has remained consistent asa percentage of gross revenue over the pastseveral years.dots

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started