Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The customer has advised that any quotation over GHS 100,000 is unlikely to be successful. Having given the matter some thought, a small contractor may

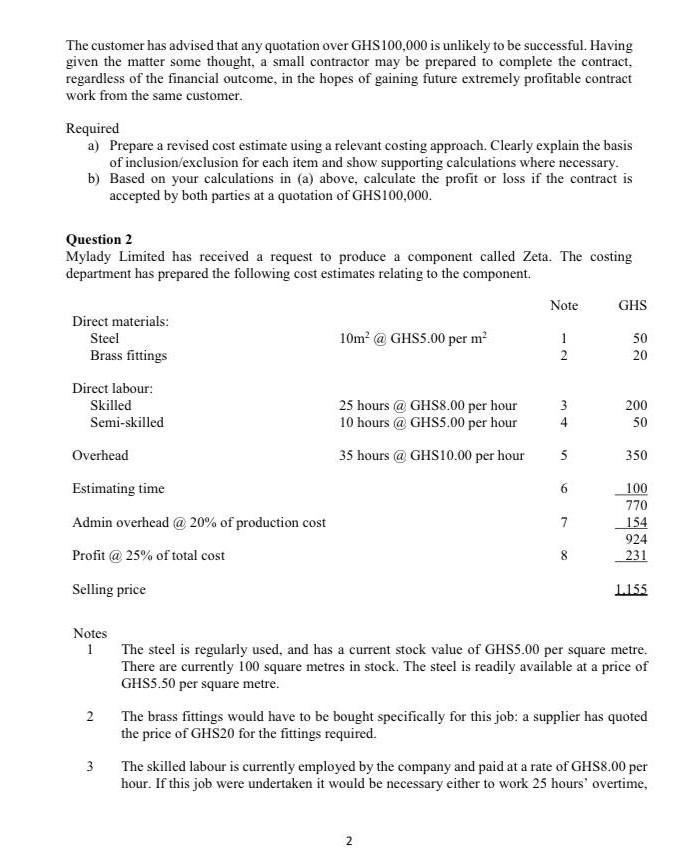

The customer has advised that any quotation over GHS 100,000 is unlikely to be successful. Having given the matter some thought, a small contractor may be prepared to complete the contract, regardless of the financial outcome in the hopes of gaining future extremely profitable contract work from the same customer. Required a) Prepare a revised cost estimate using a relevant costing approach. Clearly explain the basis of inclusion/exclusion for each item and show supporting calculations where necessary. b) Based on your calculations in (a) above, calculate the profit or loss if the contract is accepted by both parties at a quotation of GHS100,000. Question 2 Mylady Limited has received a request to produce a component called Zeta. The costing department has prepared the following cost estimates relating to the component. Note GHS Direct materials: Steel 10m? @ GHS5.00 per m 1 50 Brass fittings 2 20 Direct labour: Skilled Semi-skilled 3 4 200 50 25 hours @ GHS8.00 per hour 10 hours @ GHS5.00 per hour 35 hours @ GHS10.00 per hour 5 350 6 100 Overhead Estimating time Admin overhead @ 20% of production cost Profit @ 25% of total cost 7 770 154 924 231 8 Selling price 1.155 Notes 1 2 The steel is regularly used, and has a current stock value of GHS5.00 per square metre. There are currently 100 square metres in stock. The steel is readily available at a price of GHS5.50 per square metre. The brass fittings would have to be bought specifically for this job: a supplier has quoted the price of GHS20 for the fittings required. The skilled labour is currently employed by the company and paid at a rate of GHS8.00 per hour. If this job were undertaken it would be necessary either to work 25 hours' overtime, 3 2 The customer has advised that any quotation over GHS 100,000 is unlikely to be successful. Having given the matter some thought, a small contractor may be prepared to complete the contract, regardless of the financial outcome in the hopes of gaining future extremely profitable contract work from the same customer. Required a) Prepare a revised cost estimate using a relevant costing approach. Clearly explain the basis of inclusion/exclusion for each item and show supporting calculations where necessary. b) Based on your calculations in (a) above, calculate the profit or loss if the contract is accepted by both parties at a quotation of GHS100,000. Question 2 Mylady Limited has received a request to produce a component called Zeta. The costing department has prepared the following cost estimates relating to the component. Note GHS Direct materials: Steel 10m? @ GHS5.00 per m 1 50 Brass fittings 2 20 Direct labour: Skilled Semi-skilled 3 4 200 50 25 hours @ GHS8.00 per hour 10 hours @ GHS5.00 per hour 35 hours @ GHS10.00 per hour 5 350 6 100 Overhead Estimating time Admin overhead @ 20% of production cost Profit @ 25% of total cost 7 770 154 924 231 8 Selling price 1.155 Notes 1 2 The steel is regularly used, and has a current stock value of GHS5.00 per square metre. There are currently 100 square metres in stock. The steel is readily available at a price of GHS5.50 per square metre. The brass fittings would have to be bought specifically for this job: a supplier has quoted the price of GHS20 for the fittings required. The skilled labour is currently employed by the company and paid at a rate of GHS8.00 per hour. If this job were undertaken it would be necessary either to work 25 hours' overtime, 3 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started