Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Cutting Edge Corporation manufactures drill bits for dentists' drills. Given modern eating habits, it is a healthy business. The Cutting Edge manufactures two

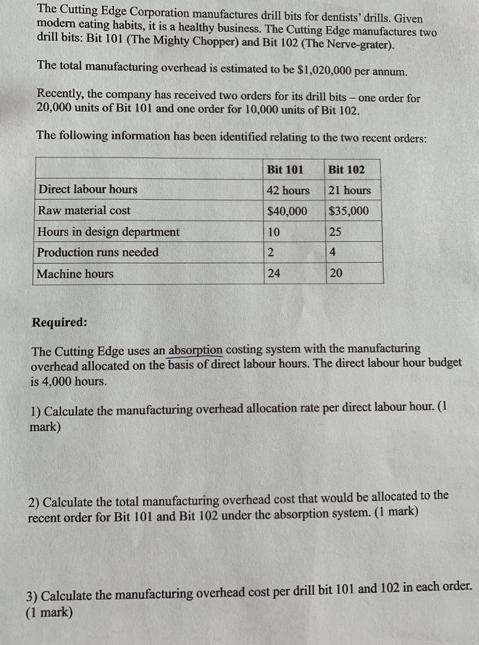

The Cutting Edge Corporation manufactures drill bits for dentists' drills. Given modern eating habits, it is a healthy business. The Cutting Edge manufactures two drill bits: Bit 101 (The Mighty Chopper) and Bit 102 (The Nerve-grater). The total manufacturing overhead is estimated to be $1,020,000 per annum. Recently, the company has received two orders for its drill bits - one order for 20,000 units of Bit 101 and one order for 10,000 units of Bit 102. The following information has been identified relating to the two recent orders: Direct labour hours Raw material cost Hours in design department Production runs needed. Machine hours Bit 101 42 hours $40,000 10 2 24 Bit 102 21 hours $35,000 25 4 20 Required: The Cutting Edge uses an absorption costing system with the manufacturing overhead allocated on the basis of direct labour hours. The direct labour hour budget is 4,000 hours. 1) Calculate the manufacturing overhead allocation rate per direct labour hour. (1 mark) 2) Calculate the total manufacturing overhead cost that would be allocated to the recent order for Bit 101 and Bit 102 under the absorption system. (1 mark) 3) Calculate the manufacturing overhead cost per drill bit 101 and 102 in each order. (1 mark)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of manufacturing overhead allocation rate per direct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started