Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The daily exchange rates for the five-year period 2003 to 2008 between currency A and currency B are well modeled by a normal distribution

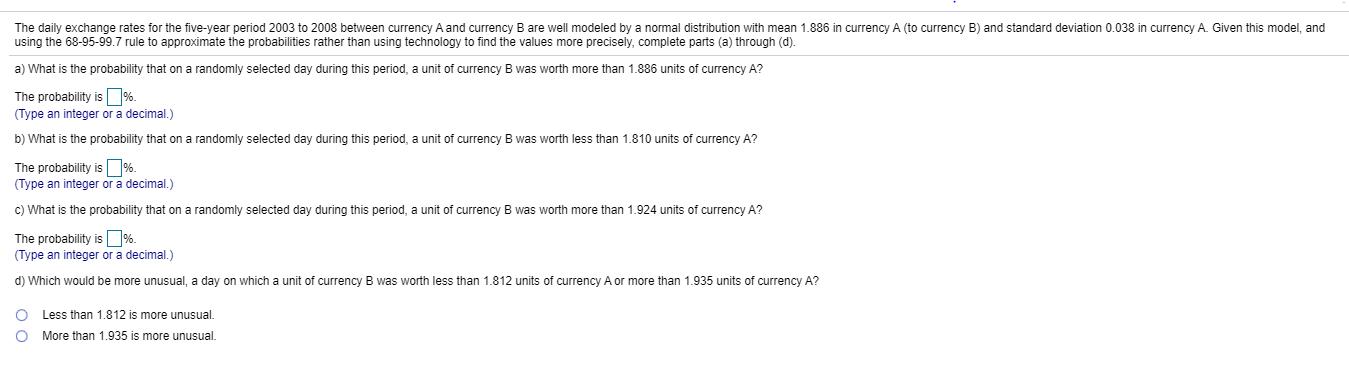

The daily exchange rates for the five-year period 2003 to 2008 between currency A and currency B are well modeled by a normal distribution with mean 1.886 in currency A (to currency B) and standard deviation 0.038 in currency A. Given this model, and using the 68-95-99.7 rule to approximate the probabilities rather than using technology to find the values more precisely, complete parts (a) through (d). a) What is the probability that on a randomly selected day during this period, a unit of currency swas worth more than 1.886 units of currency A? The probability is %. (Type an integer or a decimal.) b) What is the probability that on a randomly selected day during this period, a unit of currency was worth less than 1.810 units of currency A? The probability is %. (Type an integer or a decimal.) c) What is the probability that on a randomly selected day during this period, a unit of currency B was worth more than 1.924 units of currency A? The probability is %. (Type an integer or a decimal.) d) Which would be more unusual, a day on which a unit of currency B was worth less than 1.812 units of currency A or more than 1.935 units of currency A? O Less than 1.812 is more unusual. More than 1.935 is more unusual.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

mean u1888 and standard deviation0038 Using the rule 6895997 means 12 3 standard deviations ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started