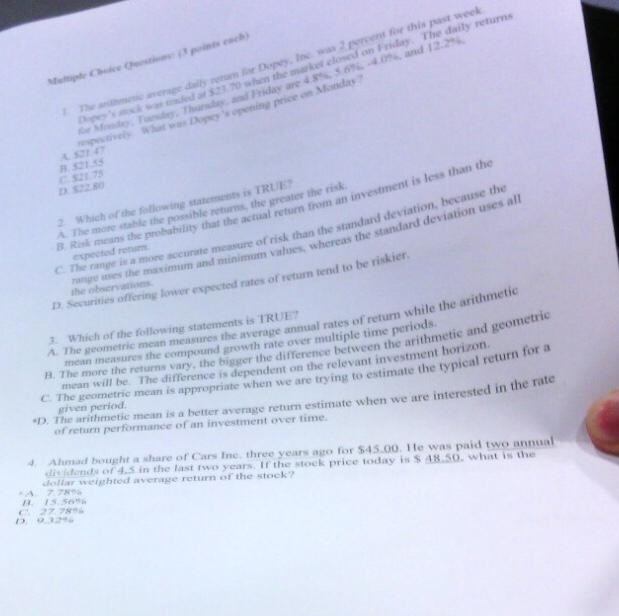

The daily returns ee erne dls n e Dopywees te this past week S31 321 7 S328 2 Which of the tolowing is TRUE A. The more stable the possible returns, the greater the risk the accual returm fiom an investiment is less than the B. Risl mesns the probsbility that espected rem The range is a more sceunste messure of risk than the standard deviation heca de te msximum and minimum valoes, whereas the standard deviao D Securities off ering lower espected rates of return tend to be riskier 3. Which of the following statements is TRUE A. The geometric mean mensures the mean measures the compound growth rate over multiple time average annual rates of return while the arithmetic B The more the retuns vary, the bigsger the difference mean will be. The difference is dependent on the relevant investment horizon. C. The geometric mean is appropriate when we are trying to estimate the typical return between the arithmetic and geometric given period D. The arithmetic mean is a better average return estimate when we are in of returm performance of an investment over time. erested in the rate 4 Ahmad bought share of Cars Inc. three years ago for $45.00. Ile was paid two annual ditydernds or4.5 in the last two years Ir the stock price ioday ollar weightod average returm of the stock? 1.5 50% s 4s.so. whit s he 13, 9,32% The daily returns ee erne dls n e Dopywees te this past week S31 321 7 S328 2 Which of the tolowing is TRUE A. The more stable the possible returns, the greater the risk the accual returm fiom an investiment is less than the B. Risl mesns the probsbility that espected rem The range is a more sceunste messure of risk than the standard deviation heca de te msximum and minimum valoes, whereas the standard deviao D Securities off ering lower espected rates of return tend to be riskier 3. Which of the following statements is TRUE A. The geometric mean mensures the mean measures the compound growth rate over multiple time average annual rates of return while the arithmetic B The more the retuns vary, the bigsger the difference mean will be. The difference is dependent on the relevant investment horizon. C. The geometric mean is appropriate when we are trying to estimate the typical return between the arithmetic and geometric given period D. The arithmetic mean is a better average return estimate when we are in of returm performance of an investment over time. erested in the rate 4 Ahmad bought share of Cars Inc. three years ago for $45.00. Ile was paid two annual ditydernds or4.5 in the last two years Ir the stock price ioday ollar weightod average returm of the stock? 1.5 50% s 4s.so. whit s he 13, 9,32%