Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The dark magic of structured finance conjured many low-risk securities out of many risky securities. Like all dark magic, however, the conjuring came at a

The dark magic of structured finance conjured many low-risk securities out of many risky securities. Like all dark magic, however, the conjuring came at a price because if you didn't get the spell exactly correct it was easy to create something much riskier and dangerous than you were likely to have ever imagined.

Please help me this!

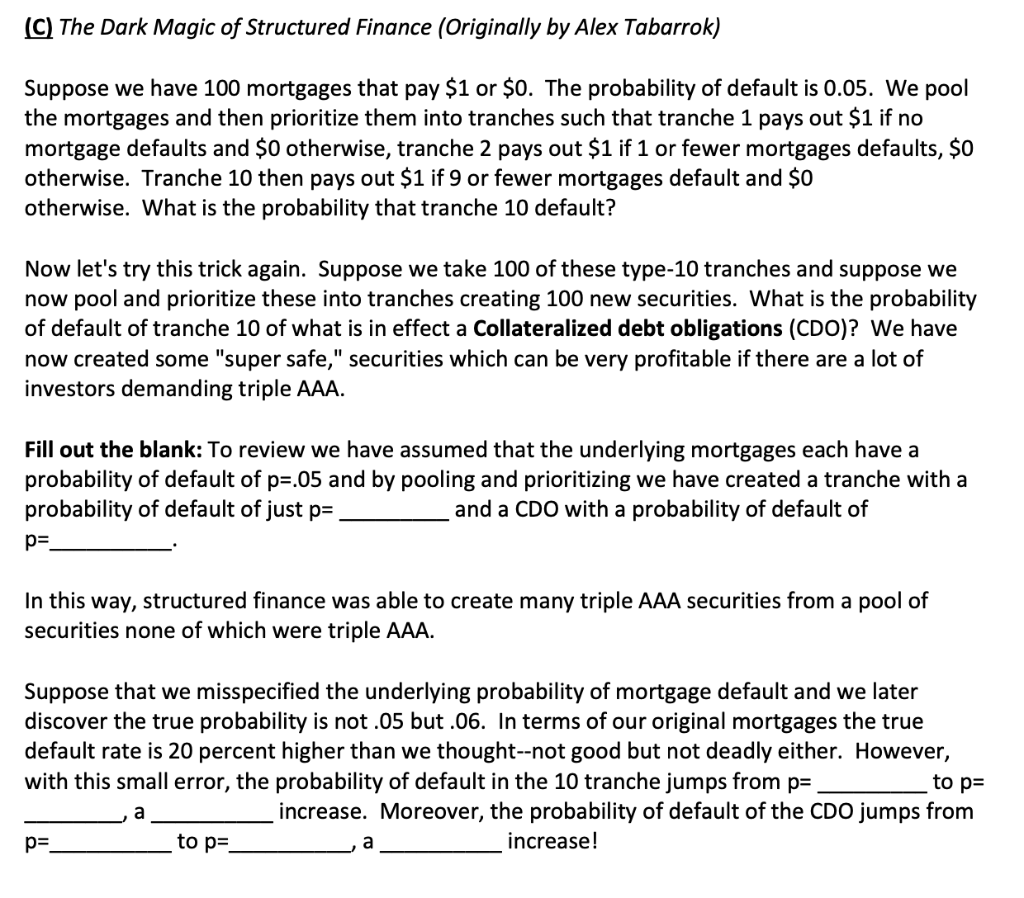

(C) The Dark Magic of Structured Finance (Originally by Alex Tabarrok) Suppose we have 100 mortgages that pay $1 or $0. The probability of default is 0.05. We pool the mortgages and then prioritize them into tranches such that tranche 1 pays out $1 if no mortgage defaults and $0 otherwise, tranche 2 pays out $1 if 1 or fewer mortgages defaults, $0 otherwise. Tranche 10 then pays out $1 if 9 or fewer mortgages default and $0 otherwise. What is the probability that tranche 10 default? Now let's try this trick again. Suppose we take 100 of these type-10 tranches and suppose we now pool and prioritize these into tranches creating 100 new securities. What is the probability of default of tranche 10 of what is in effect a Collateralized debt obligations (CDO)? We have now created some "super safe," securities which can be very profitable if there are a lot of investors demanding triple AAA. Fill out the blank: To review we have assumed that the underlying mortgages each have a probability of default of p=.05 and by pooling and prioritizing we have created a tranche with a probability of default of just p= and a CDO with a probability of default of p= In this way, structured finance was able to create many triple AAA securities from a pool of securities none of which were triple AAA. Suppose that we misspecified the underlying probability of mortgage default and we later discover the true probability is not .05 but .06. In terms of our original mortgages the true default rate is 20 percent higher than we thought--not good but not deadly either. However, with this small error, the probability of default in the 10 tranche jumps from p=. a increase. Moreover, the probability of default of the CDO jumps from p= increase! to p= to p= a (C) The Dark Magic of Structured Finance (Originally by Alex Tabarrok) Suppose we have 100 mortgages that pay $1 or $0. The probability of default is 0.05. We pool the mortgages and then prioritize them into tranches such that tranche 1 pays out $1 if no mortgage defaults and $0 otherwise, tranche 2 pays out $1 if 1 or fewer mortgages defaults, $0 otherwise. Tranche 10 then pays out $1 if 9 or fewer mortgages default and $0 otherwise. What is the probability that tranche 10 default? Now let's try this trick again. Suppose we take 100 of these type-10 tranches and suppose we now pool and prioritize these into tranches creating 100 new securities. What is the probability of default of tranche 10 of what is in effect a Collateralized debt obligations (CDO)? We have now created some "super safe," securities which can be very profitable if there are a lot of investors demanding triple AAA. Fill out the blank: To review we have assumed that the underlying mortgages each have a probability of default of p=.05 and by pooling and prioritizing we have created a tranche with a probability of default of just p= and a CDO with a probability of default of p= In this way, structured finance was able to create many triple AAA securities from a pool of securities none of which were triple AAA. Suppose that we misspecified the underlying probability of mortgage default and we later discover the true probability is not .05 but .06. In terms of our original mortgages the true default rate is 20 percent higher than we thought--not good but not deadly either. However, with this small error, the probability of default in the 10 tranche jumps from p=. a increase. Moreover, the probability of default of the CDO jumps from p= increase! to p= to p= aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started