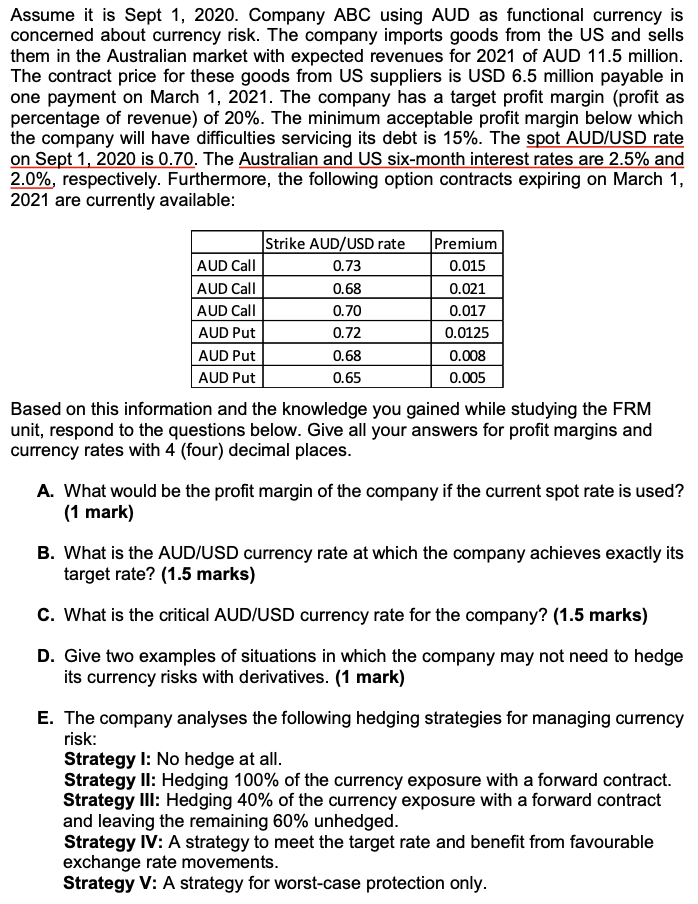

The data and question is presented in the snapshot below:

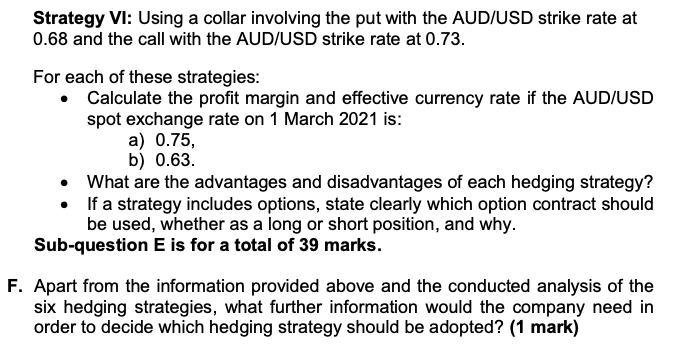

Assume it is Sept 1. 2020. Company ABC using AUD as functional currency is concemed about currency risk. The company imports goods from the US and sells them in the Australian market with expected revenues for 2021 of AUD 11.5 million. The contract price for these goods from US suppliers is USD 5.5 million payable in one payment on March 1, 2021. The company has a target prot margin (prot as percentage of revenue} of 20%. The minimum acceptable profit margin below which the company will have difculties servicing its debt is 15%. The amt AUDIUSD rate on Sept 1. 2020 is 0.?0. The Australian and US six-month interest rates are 2.5% and 2.0%. respectively. Furthermore. the following option contracts expiring on March 1, 2021 are currently available: StI'ikEAUD USDrate m AUDCaII D015 11?} 53 3'2 53 suntan m II \"- m \"E Based on this information and the knowledge you gained while studying the FEM unit. respond to the questions below. Give all your answers for prot margins and currency rates with 4 {four} decimal places. A. What would be the prot margin of the company if the current spot rate is used? (1 mark] B. What is the AUDIUSD currency rate at which the company achieves exactly its target rate? [1.5 mats} C. What is the critical AUDIUSD currency rate for the company? (1.5 marks) D. Give two examples of situations in which the company may not need to hedge its currency risks with derivatives. [1 mark) E. The company analyses the following hedging strategies for managing currency risk: Strategy I: No hedge at all. Strategy II: Hedging 100% of the currency exposure with a forward contract. Strategy III: Hedging 40% of the currency exposure with a forward contract and leaving the remaining 50% unhedged. Strategy W: A strategy to meet the target rate and benet from favourable exchange rate movements. Strategy V: A strategy for worstcase protection only. Strategy VI: Using a collar involving the put with the AUD/USD strike rate at 0.68 and the call with the AUD/USD strike rate at 0.73. For each of these strategies: . Calculate the profit margin and effective currency rate if the AUD/USD spot exchange rate on 1 March 2021 is: a) 0.75, b) 0.63. . What are the advantages and disadvantages of each hedging strategy? . If a strategy includes options, state clearly which option contract should be used, whether as a long or short position, and why. Sub-question E is for a total of 39 marks. F. Apart from the information provided above and the conducted analysis of the six hedging strategies, what further information would the company need in order to decide which hedging strategy should be adopted? (1 mark)