Answered step by step

Verified Expert Solution

Question

1 Approved Answer

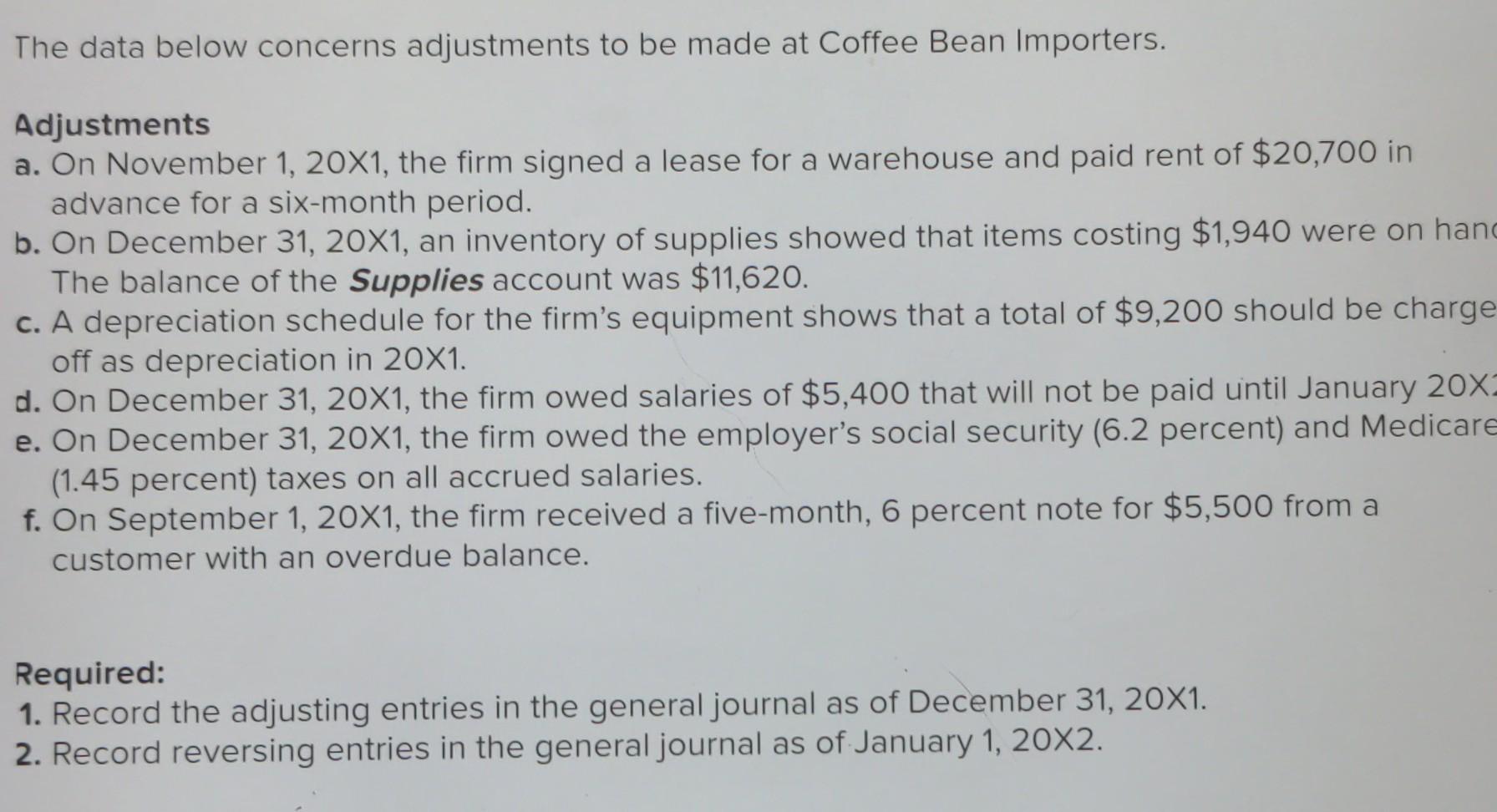

The data below concerns adjustments to be made at Coffee Bean Importers. a Adjustments a. On November 1, 20x1, the firm signed a lease for

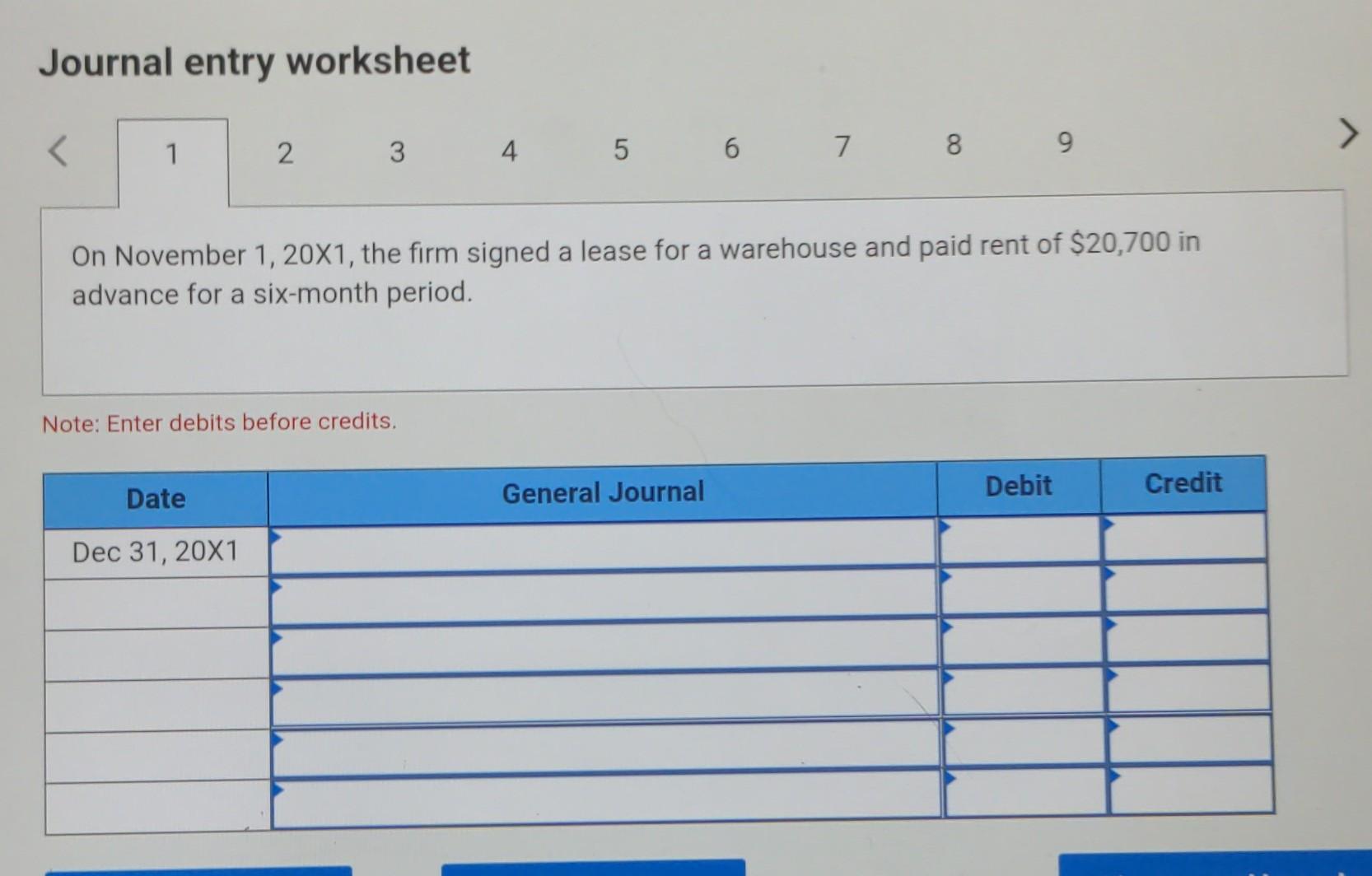

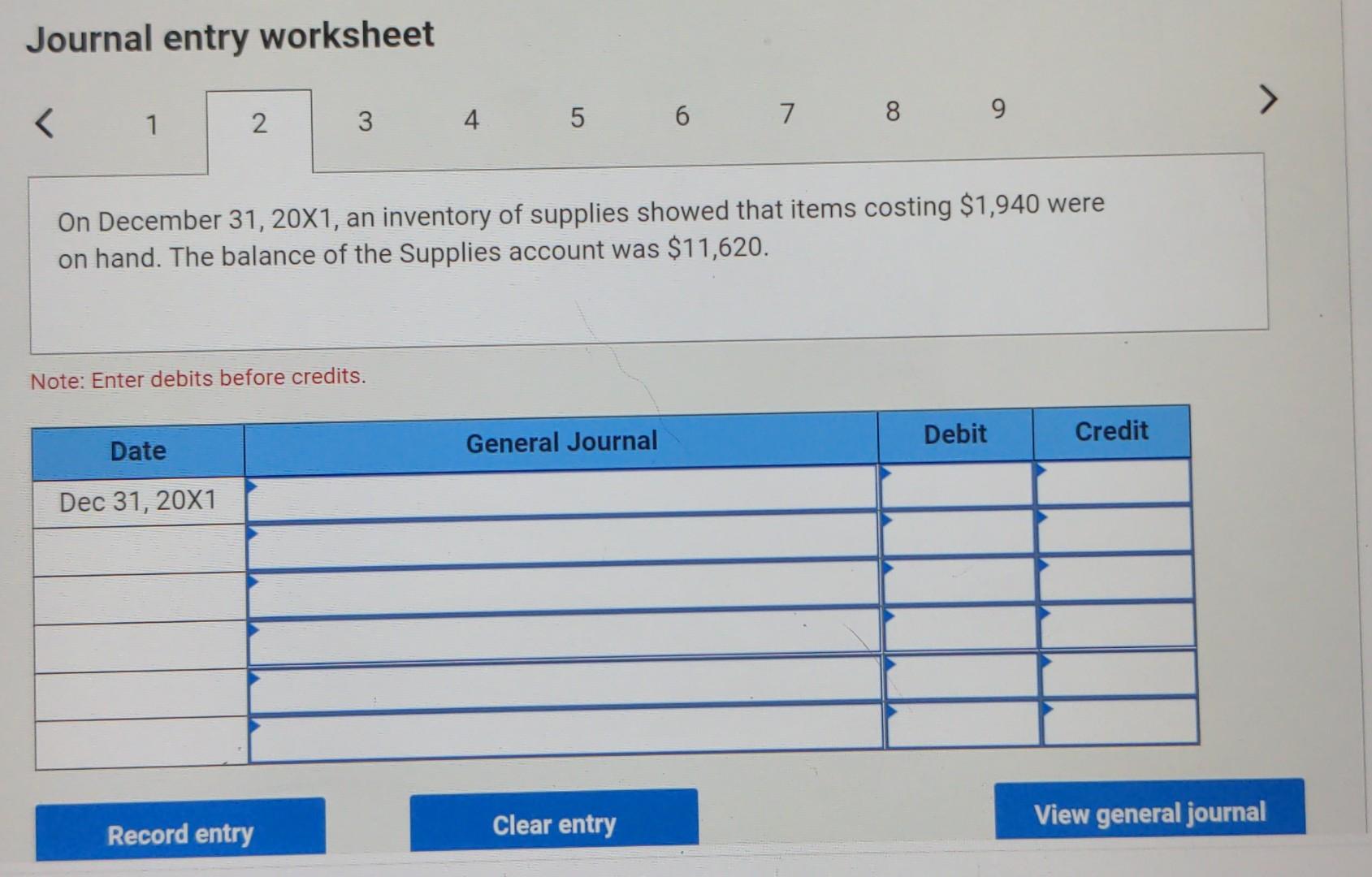

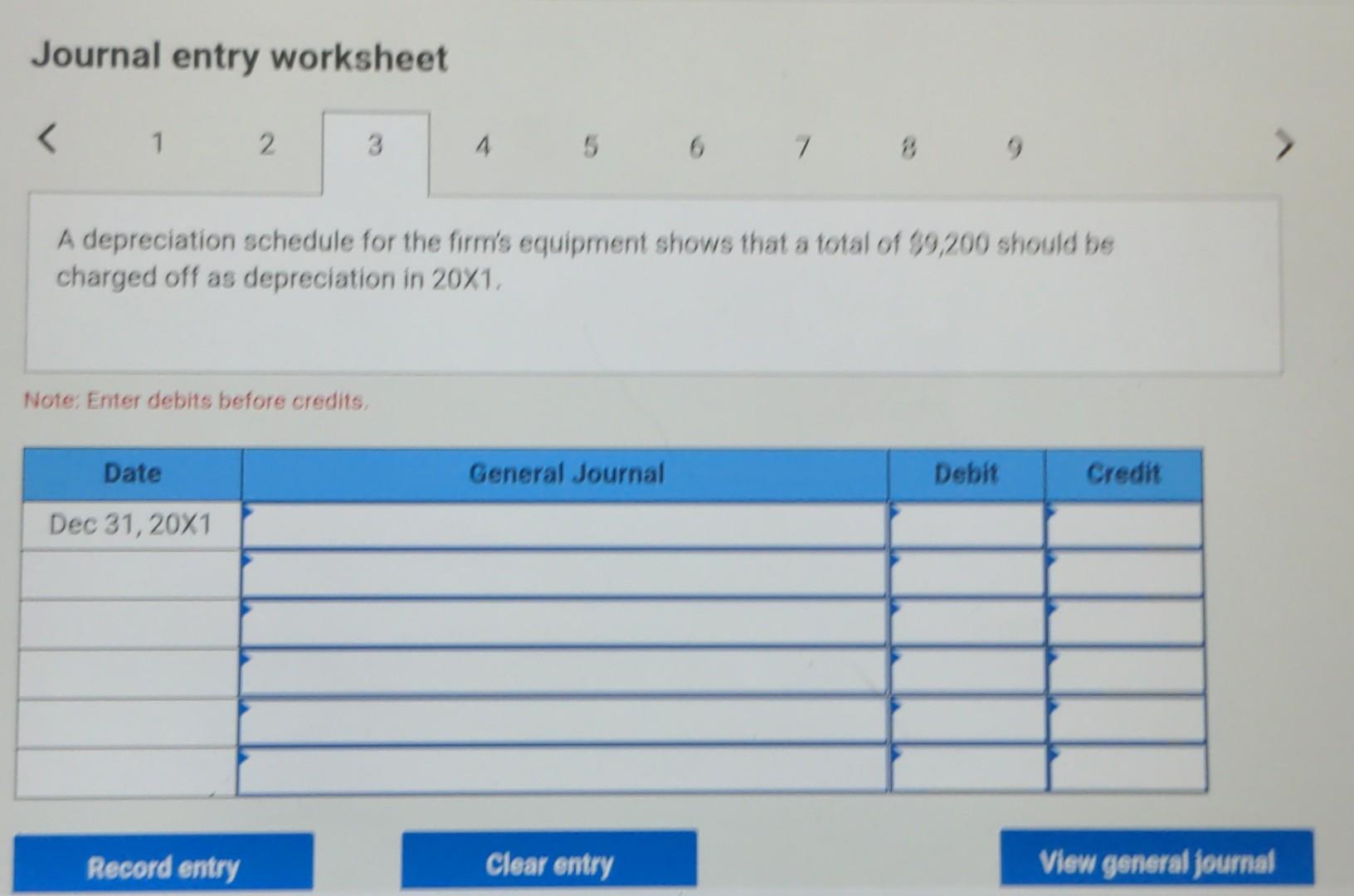

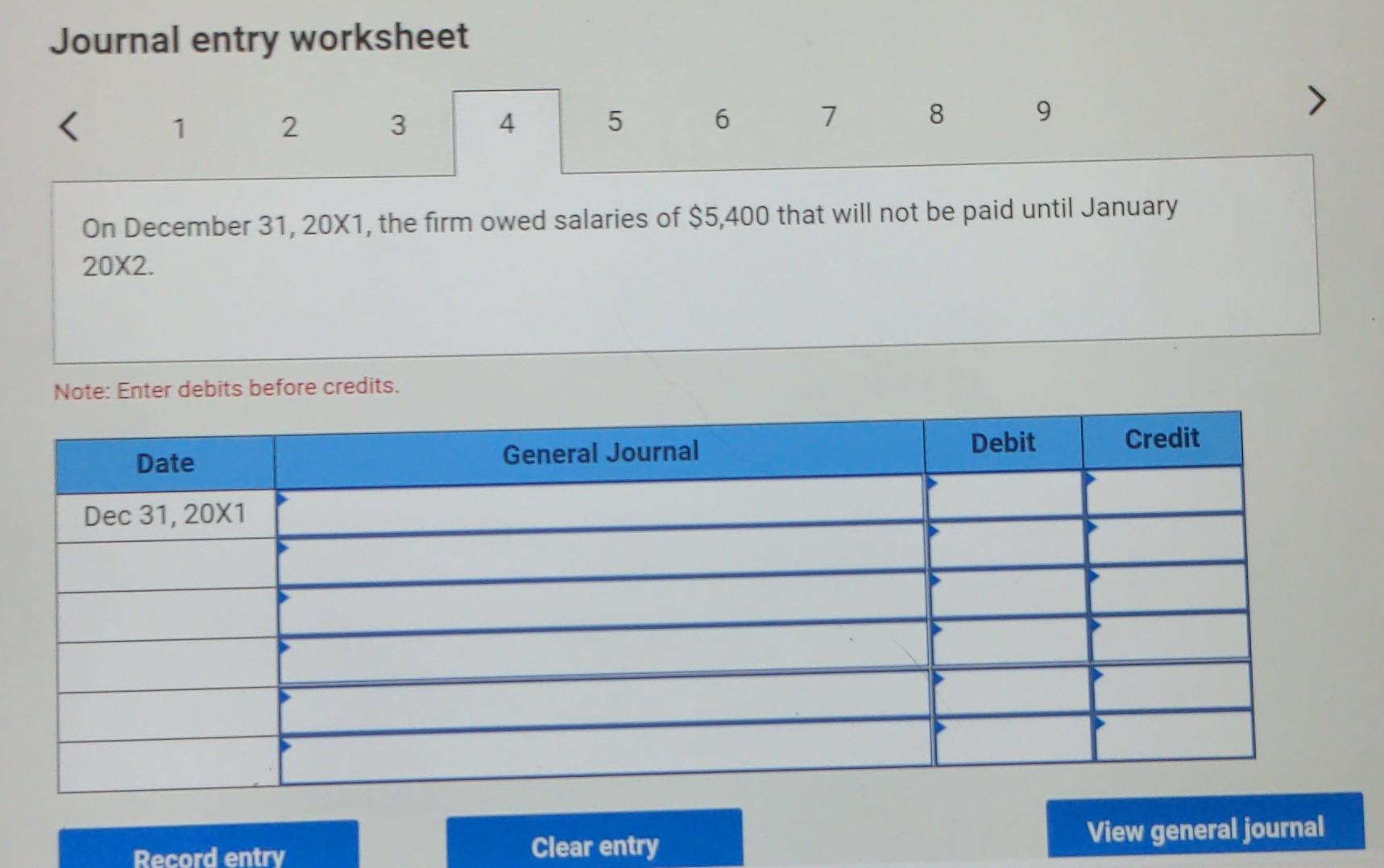

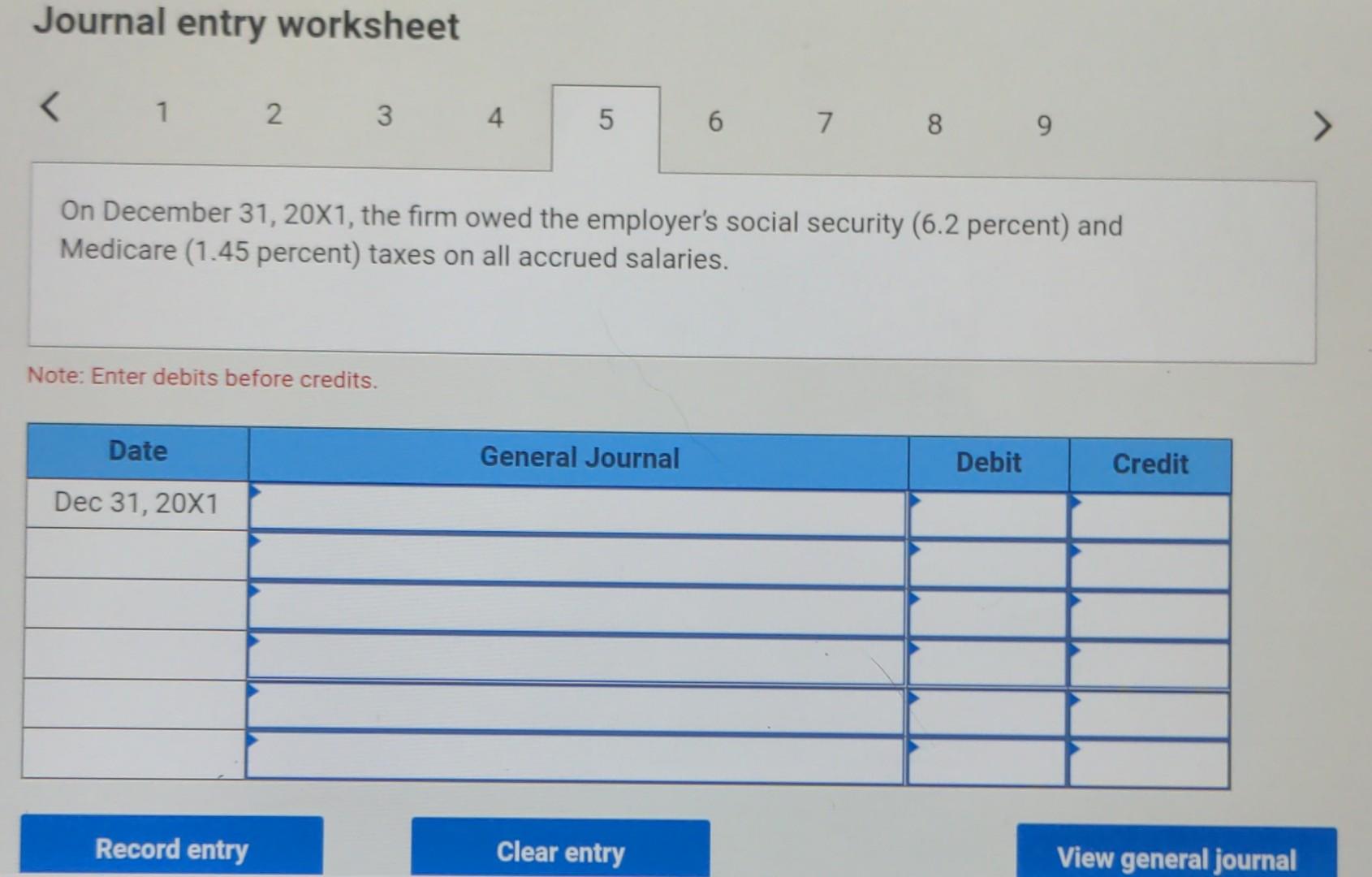

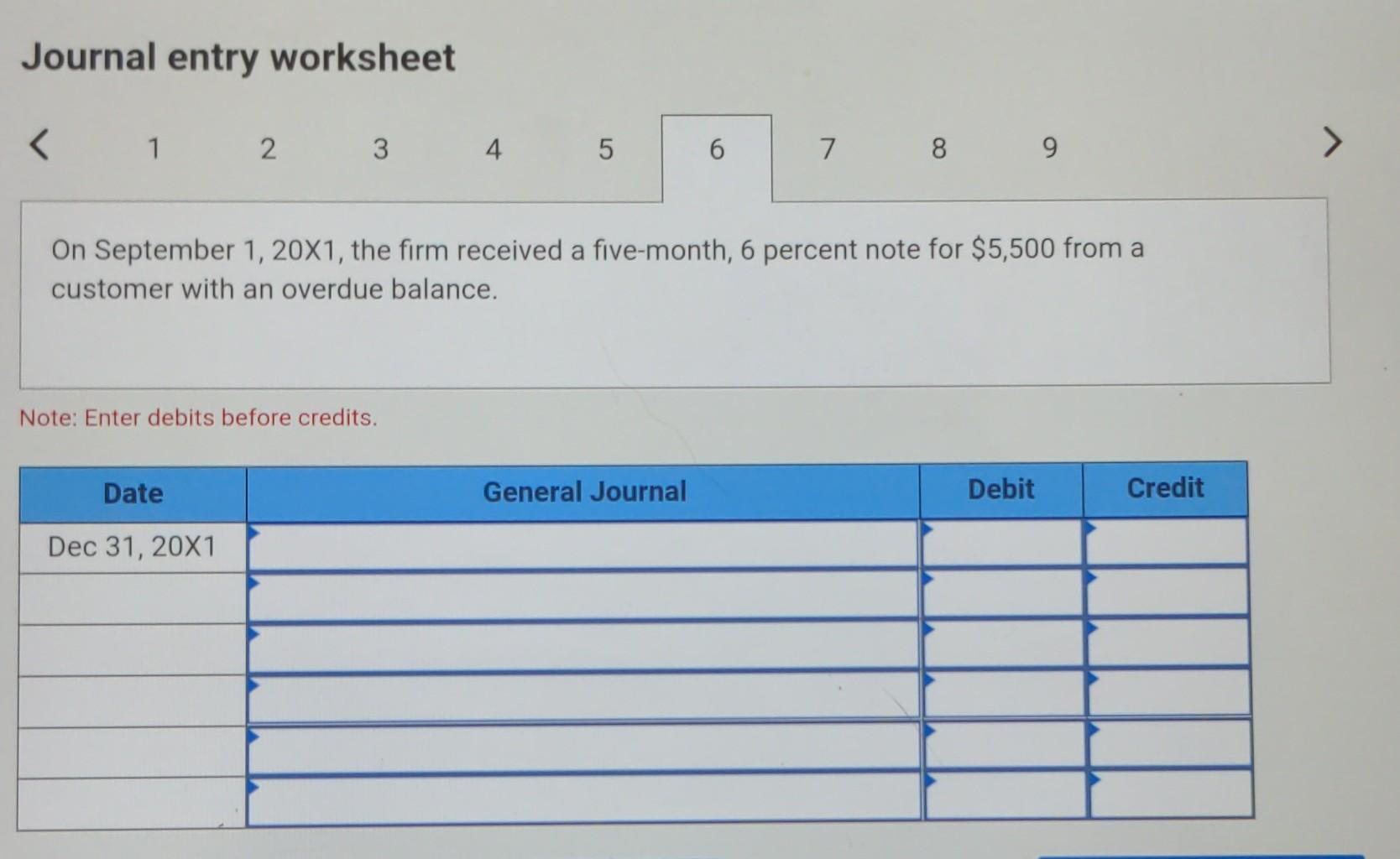

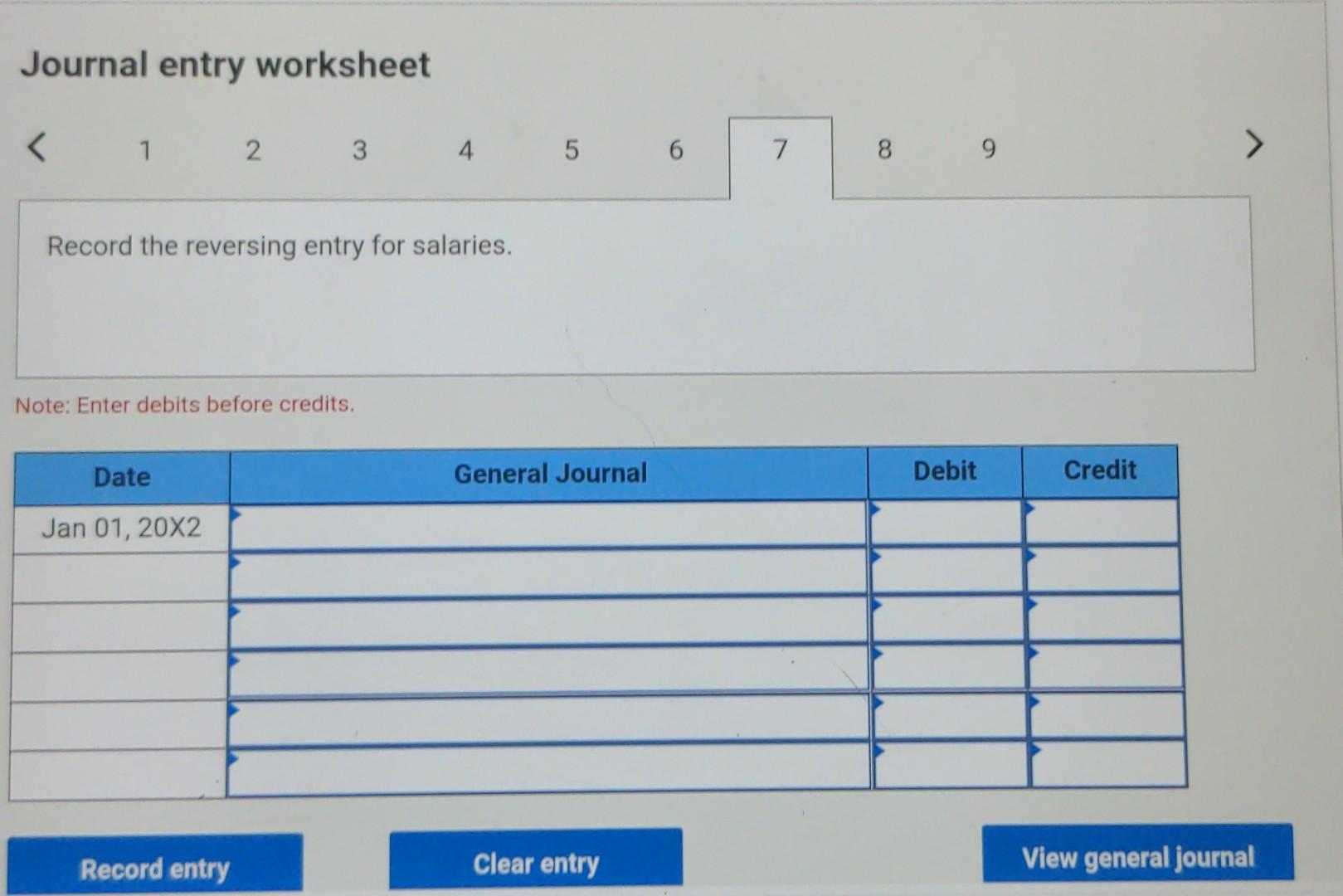

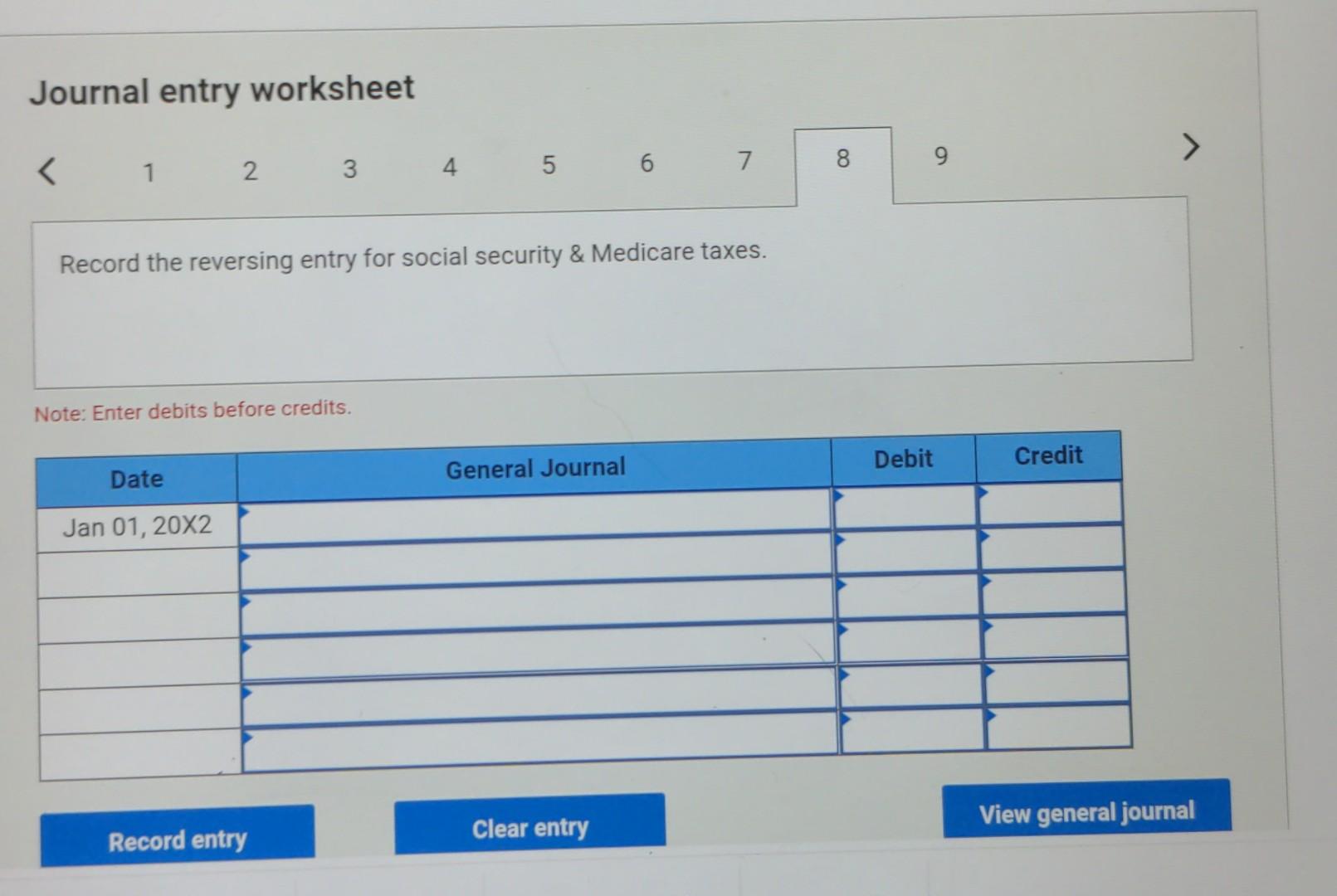

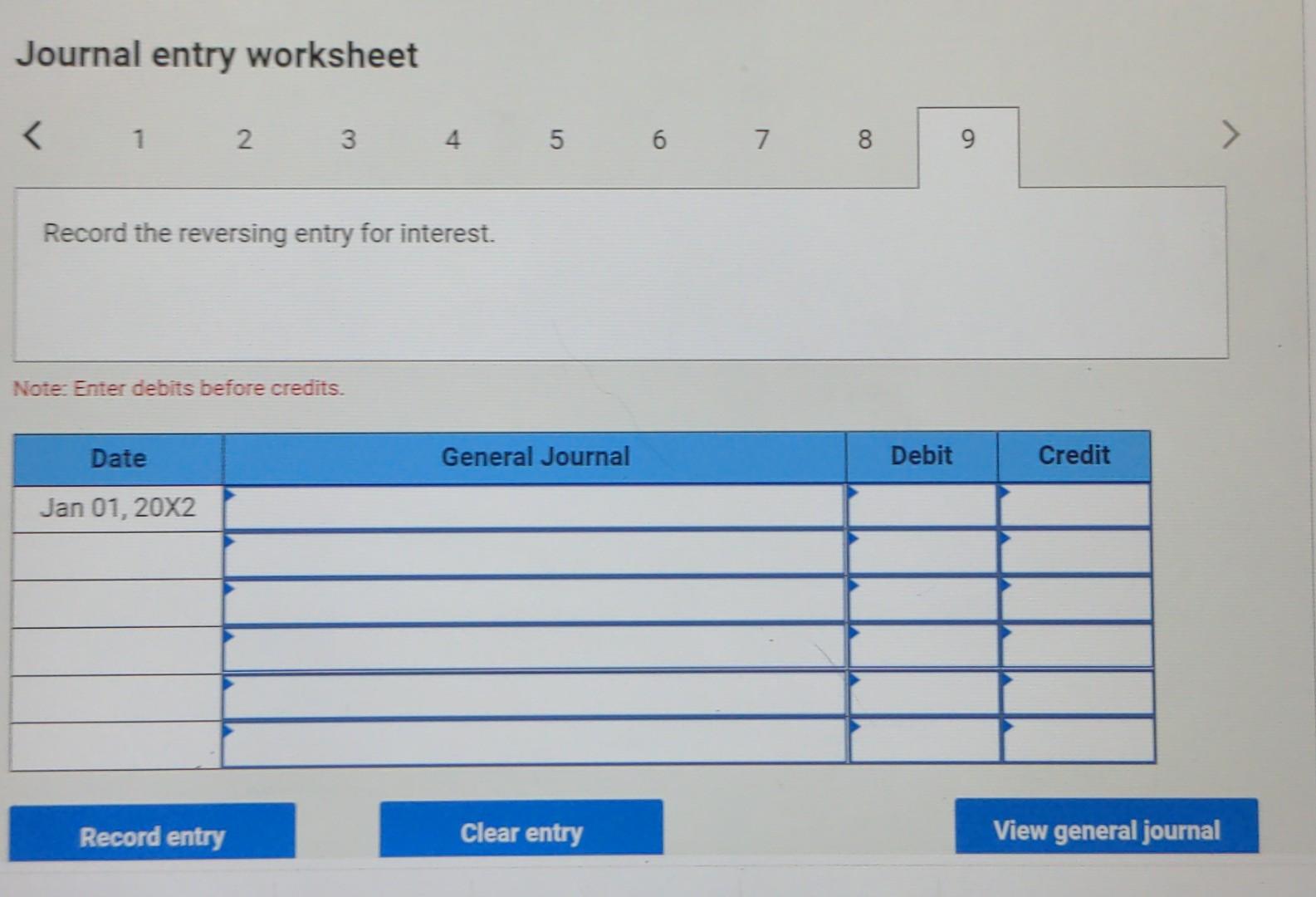

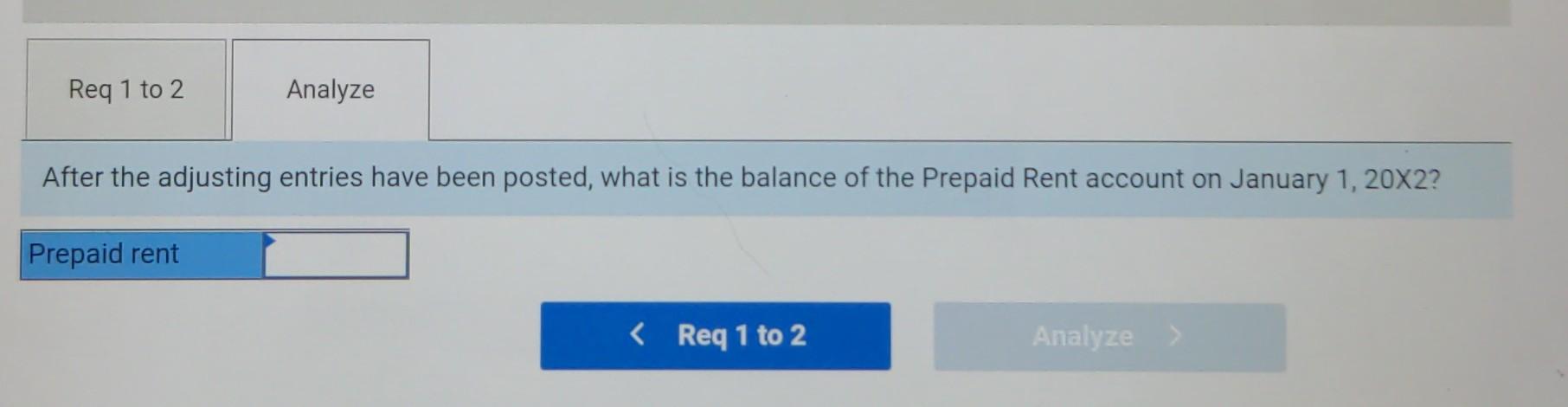

The data below concerns adjustments to be made at Coffee Bean Importers. a Adjustments a. On November 1, 20x1, the firm signed a lease for a warehouse and paid rent of $20,700 in advance for a six-month period. b. On December 31, 20X1, an inventory of supplies showed that items costing $1,940 were on hand The balance of the Supplies account was $11,620. C. A depreciation schedule for the firm's equipment shows that a total of $9,200 should be charge off as depreciation in 20X1. d. On December 31, 20x1, the firm owed salaries of $5,400 that will not be paid until January 20% e. On December 31, 20X1, the firm owed the employer's social security (6.2 percent) and Medicare (1.45 percent) taxes on all accrued salaries. f. On September 1, 20X1, the firm received a five-month, 6 percent note for $5,500 from a customer with an overdue balance. Required: 1. Record the adjusting entries in the general journal as of December 31, 20X1. 2. Record reversing entries in the general journal as of January 1, 20X2. Analyze: After the adjusting entries have been posted, what is the balance of the Prepaid Rent account on January 1, 20X2? Journal entry worksheet On December 31, 20X1, the firm owed the employer's social security (6.2 percent) and Medicare (1.45 percent) taxes on all accrued salaries. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 20X1 Record entry Clear entry View general journal Journal entry worksheet On September 1, 20x1, the firm received a five-month, 6 percent note for $5,500 from a customer with an overdue balance. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 20X1 Journal entry worksheet Record the reversing entry for salaries. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01, 20X2 Record entry Clear entry View general journal Journal entry worksheet > 8 00 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started