Answered step by step

Verified Expert Solution

Question

1 Approved Answer

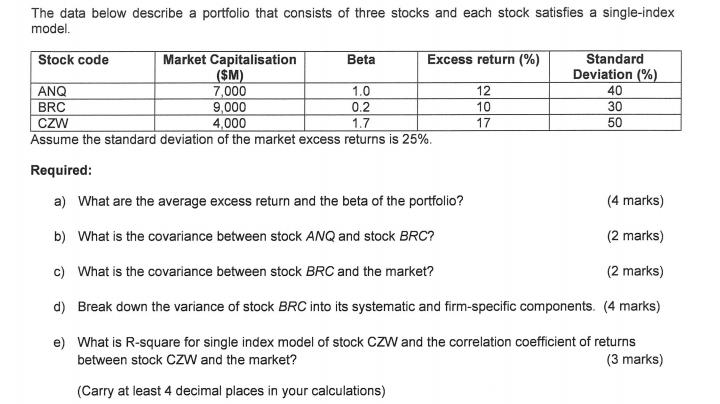

The data below describe a portfolio that consists of three stocks and each stock satisfies a single-index model. Stock code Market Capitalisation ($M) ANQ

The data below describe a portfolio that consists of three stocks and each stock satisfies a single-index model. Stock code Market Capitalisation ($M) ANQ 7,000 BRC 9,000 CZW 4,000 Beta Excess return (%) Standard Deviation (%) 1.0 0.2 127 207 40 30 50 1.7 Assume the standard deviation of the market excess returns is 25%. Required: a) What are the average excess return and the beta of the portfolio? b) What is the covariance between stock ANQ and stock BRC? c) What is the covariance between stock BRC and the market? (4 marks) (2 marks) (2 marks) d) Break down the variance of stock BRC into its systematic and firm-specific components. (4 marks) e) What is R-square for single index model of stock CZW and the correlation coefficient of returns between stock CZW and the market? (3 marks) (Carry at least 4 decimal places in your calculations)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve these questions lets use the formulas for the singleindex model a Average excess return and beta of the portfolio Average excess return of th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started