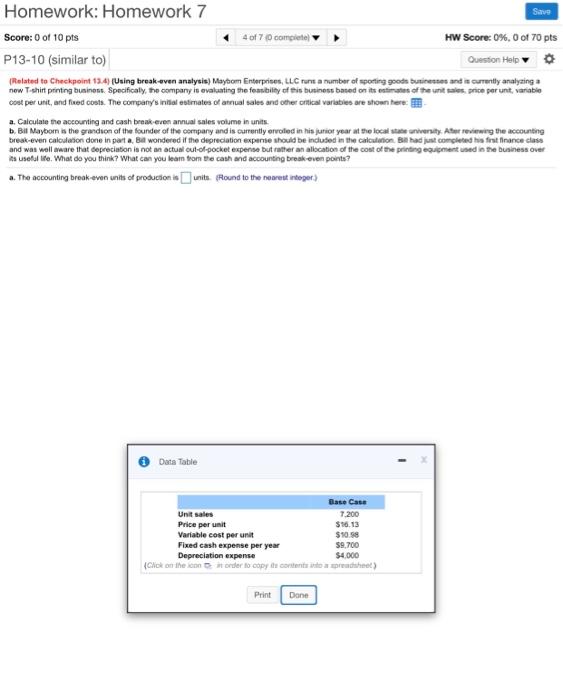

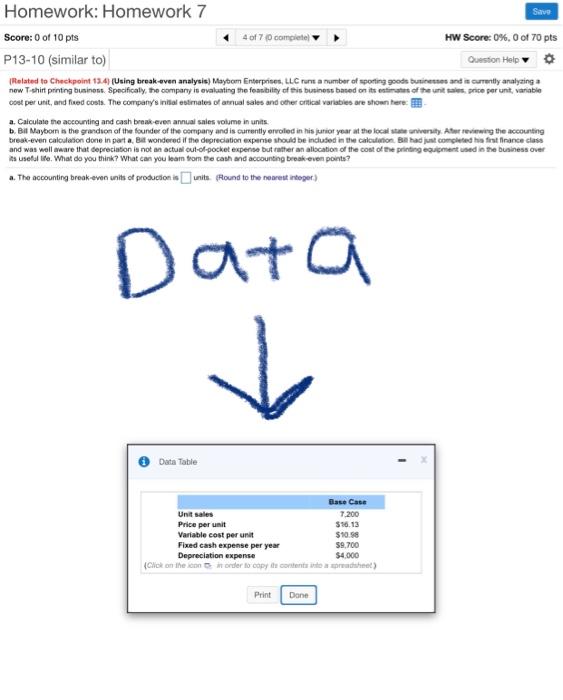

the data for the first question ir right under the question

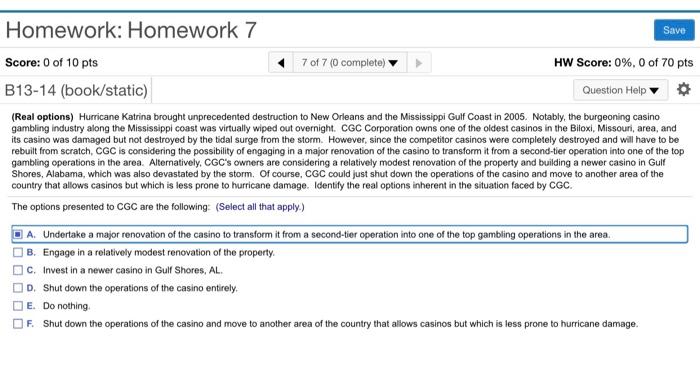

Homework: Homework 7 Save Score: 0 of 10 pts 4 of 7 complete HW Score: 0%, 0 of 70 pts P13-10 (similar to) Question Help (Related to Checkpoint 13.4) (Using break-even analysis) Maytom Enterprises, LLC runt a number of spotting goods businesses and is currently analyzing a now T-shirt printing business. Specifically, the company in evaluating the feasibility of this business based on its times of the unit les price per unt, variable cost per unit, and fixed costs. The company's inhalestimates of annual sales and other critical variables are shown here: a. Calculate the accounting and cash break even annual sales volume in units. b. Bil Mayor is the grandson of the founder of the company and is currently orvoted in his junior year at the local state university Ater reviewing the accounting break-even calculation done in part a Be wondered if the depreciation experie should be indused in the calculation had just completed his first finance class and was well aware that depreciation is not an actual out-of-pocket expense but rather an allocation of the cost of the printing equipment used in the business over its useful. What do you think? What can you learn from the cash and accounting break even points? a. The accounting break-even units of production is uits (Round to the nearest Integer Data Table Base Case Unit sales 7.200 Price per unit $96.13 Variable cost per unit $10.58 Fixed cash expense per year 39.700 Depreciation expense $4,000 Click on the order to copy the content predshet) Print Done Homework: Homework 7 Save Score: 0 of 10 pts 7 of 7 (0 complete) HW Score: 0%, 0 of 70 pts B13-14 (book/static) Question Help (Real options) Hurricane Katrina brought unprecedented destruction to New Orleans and the Mississippi Gulf Coast in 2005. Notably, the burgeoning casino gambling industry along the Mississippi coast was virtually wiped out overnight. CGC Corporation owns one of the oldest casinos in the Biloxi, Missouri area, and its casino was damaged but not destroyed by the tidal surge from the storm. However, since the competitor casinos were completely destroyed and will have to be rebuilt from scratch, CGC is considering the possibility of engaging in a major renovation of the casino to transform it from a second-tier operation into one of the top gambling operations in the area. Alternatively, CGC's owners are considering a relatively modest renovation of the property and building a newer casino in Gulf Shores, Alabama, which was also devastated by the storm. Of course, CGC could just shut down the operations of the casino and move to another area of the country that allows casinos but which is less prone to hurricane damage. Identify the real options inherent in the situation faced by CGC. The options presented to CGC are the following(Select all that apply.) O A Undertake a major renovation of the casino to transform it from a second-tier operation into one of the top gambling operations in the area. B. Engage in a relatively modest renovation of the property. C. Invest in a newer casino in Gulf Shores, AL. OD Shut down the operations of the casino entirely, DE. Do nothing OF Shut down the operations of the casino and move to another area of the country that allows casinos but which is less prone to hurricane damage. Save Homework: Homework 7 Score: 0 of 10 pts 6 of 7 (0 complete) HW Score: 0%, 0 of 70 pts P13-13 (similar to) Question Help (Degree of Operating Leverage) Brackets, Inc. currently anticipates that if they had a 11 percent increase in sales, net operating profits would increase by 57 percent. If Brackets' NOI is $14.2 million, what level of fixed costs do they have? The company's level of fixed costs is 8 million (Round to one decimal place.) Homework: Homework 7 Save Score: 0 of 10 pts 4 of 70 completely HW Score: 0%, 0 of 70 pts P13-10 (similar to) Question Help Related to Checkpoint 13.4) (Using break-even analysis) Maytom Enterprises, LLC run a number of sporting goods Businesses and is currently analyzing a now T-shirt printing business. Specifically, the company is evaluating the feasibility of this business based on its estimates of the units price per unit, variable cost per unit, and fixed costs. The company's intal estimates of annual sales and other critical variables are shown here a. Calculate the accounting and cash broak even annual sales volume in units. b. Bil Mayborn is the grandion of the founder of the company and is currently orvoed in his junior year at the local state university Ater reviewing the accounting break-even calculation done in part a. Bit wondered if the depreciation expense should be included in the calculation. Bu had just completed his first finance class and was well ware that depreciation is not an actual out-of-pocket expense but rather an allocation of the cost of the printing equipment used in the business over is useful life. What do you think? What can you learn from the cash and accounting break even points? The accounting break-even units of production is uits (Round to the nearest integer) Data Data Table Base Case Unit Sales 7.200 Price per unit $56.13 Variable cost per unit $10.95 Fixed cash expense per year 59.700 Depreciation expense $4,000 Click on the order to copy the contenere Print Done