Question

The data for this task is preloaded into your Excel workbook. Methuselah clothes is planning to expand its clothing business by opening a factory overseas.

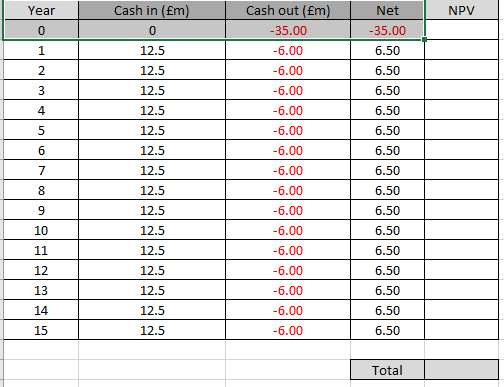

The data for this task is preloaded into your Excel workbook. Methuselah clothes is planning to expand its clothing business by opening a factory overseas. The initial year 0 investment will be 35,000,000. It is expected to generate net revenues of 12,500,000 each year if the project goes ahead. Additional costs for the project will be 6,000,000 per year. [Cashflows occur at the end of each year] The companys weighted average cost of capital is 9% and the project will have a lifetime of 15 years. (a) Calculate the net present value (NPV) of the above proposal showing your workings in an excel spreadsheet including formulas. You should complete your answer on the Task 8 Data tab of the MBF Summative data.xlsx excel file.

The data for this task is preloaded into your Excel workbook. Methuselah clothes is planning to expand its clothing business by opening a factory overseas. The initial year 0 investment will be 35,000,000. It is expected to generate net revenues of 12,500,000 each year if the project goes ahead. Additional costs for the project will be 6,000,000 per year. [Cashflows occur at the end of each year] The companys weighted average cost of capital is 9% and the project will have a lifetime of 15 years. (a) Calculate the net present value (NPV) of the above proposal showing your workings in an excel spreadsheet including formulas. You should complete your answer on the Task 8 Data tab of the MBF Summative data.xlsx excel file.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started