Question

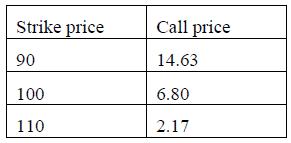

Consider stock XYZ with a current price of $100. XYZ does not pay dividends. The following table provides you the call and put options information

Consider stock XYZ with a current price of $100. XYZ does not pay dividends. The following table provides you the call and put options information written on this stock. Long the call options with strike prices $90 and $110 and short two call options with strike price $100. Show the payoff and profit diagram. (The continuously compounded risk-free interest rate is 5%.)

This question has to be solved on paper then share (not solve in excel) only the diagram has to be created in excel and then share, diagram is mandatory.

Strike price 90 100 110 Call price 14.63 6.80 2.17

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Forecasting With Forecast X

Authors: Holton Wilson, Barry Keating, John Solutions Inc

6th Edition

73373648, 978-9339220426, 9339220420, 978-0073373645

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App