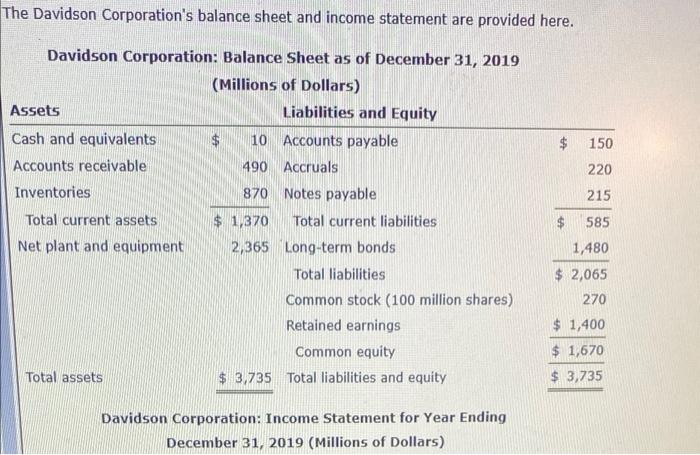

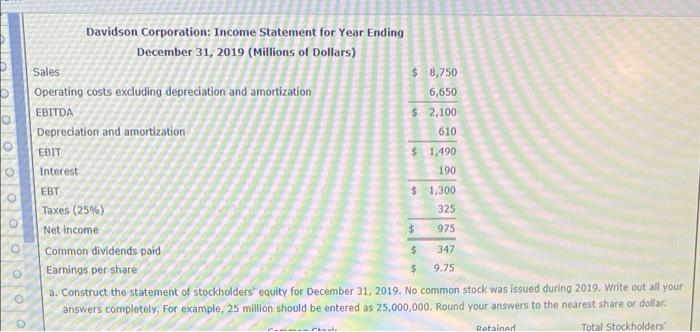

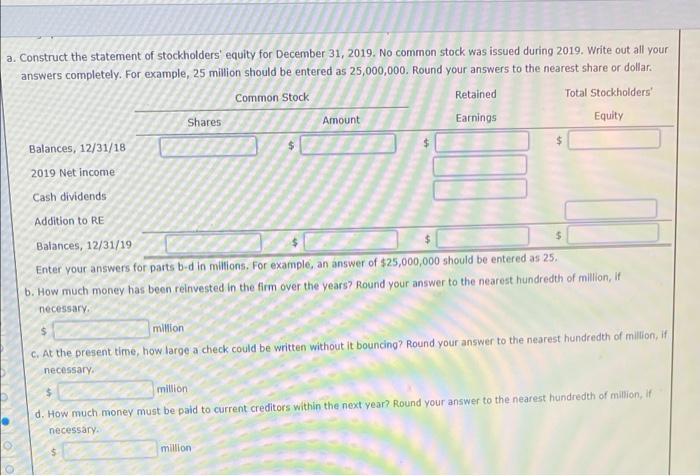

The Davidson Corporation's balance sheet and income statement are provided here. Davidson Corporation: Balance Sheet as of December 31, 2019 (Millions of Dollars) Assets Cash and equivalents Accounts receivable Inventories Total current assets. Net plant and equipment Total assets 10 490 870 $1,370 Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities 2,365 Long-term bonds Total liabilities Common stock (100 million shares) Retained earnings Common equity $3,735 Total liabilities and equity Davidson Corporation: Income Statement for Year Ending December 31, 2019 (Millions of Dollars) $ 150 220 215 585 1,480 $ 2,065 270 $ $1,400 $1,670 $3,735 00 Davidson Corporation: Income Statement for Year Ending December 31, 2019 (Millions of Dollars) Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and amortization EBIT Interest EBT Taxes (25%) Net income Common dividends paid Earnings per share $8,750 6,650 $ 2,100 610 Chade $ 1,490 190 $1,300 325 975 $ $ $ 347 9.75 a. Construct the statement of stockholders' equity for December 31, 2019. No common stock was issued during 2019. Write out all your answers completely. For example, 25 million should be entered as 25,000,000. Round your answers to the nearest share or dollar. Total Stockholders Retained a. Construct the statement of stockholders' equity for December 31, 2019. No common stock was issued during 2019. Write out all your answers completely. For example, 25 million should be entered as 25,000,000. Round your answers to the nearest share or dollar. Common Stock Retained Total Stockholders' Earnings Equity Balances, 12/31/18 2019 Net income Cash dividends Addition to RE Shares $ Amount $ Balances, 12/31/19 $ Enter your answers for parts b-d in millions. For example, an answer of $25,000,000 should be entered as 25. b. How much money has been reinvested in the firm over the years? Round your answer to the nearest hundredth of million, if necessary. million $ million c. At the present time, how large a check could be written without it bouncing? Round your answer to the nearest hundredth of million, if necessary. million d. How much money must be paid to current creditors within the next year? Round your answer to the nearest hundredth of million, if necessary