The day-to-day lives of people all over the world have changed in ways considered unthinkable a few weeks ago thanks to the Coronavirus Disease 2019

The day-to-day lives of people all over the world have changed in ways considered unthinkable a few weeks ago thanks to the Coronavirus Disease 2019 (Covid-19).

In the midst of the pandemic in Malaysia, consumers have many worries to bear - fearing for the health of their families, whether they can buy for their basic needs, and the loss of freedom to move about. These common concerns are manifesting themselves in different ways as consumers adapt their old behaviors - and adopt new ones.

"It's clear that the movement control order (MCO) has had an impact on what people buy and how they buy it, but also how much they buy when they go shopping," revealed Ipsos Malaysia's managing director Arun Menon in an interview with BizHive.

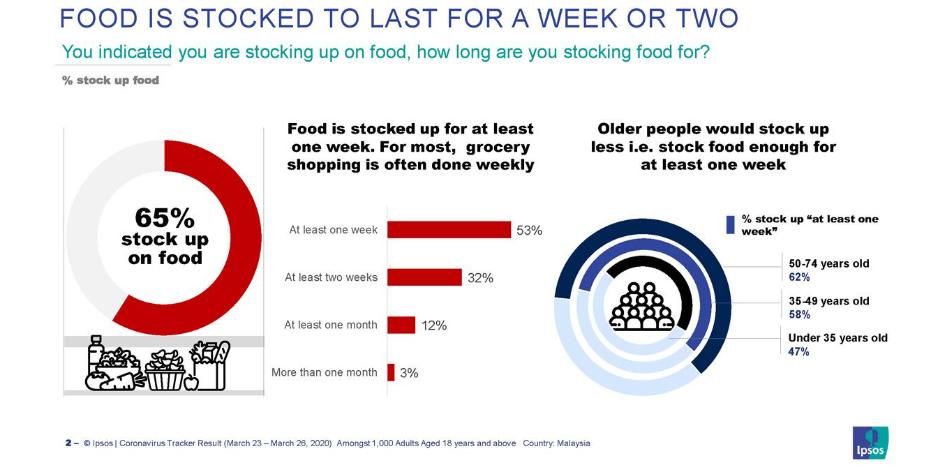

"Stocking up on food and essential items more than before is a common response to the crisis. Almost half of them are stocking up for two weeks or more.

"With their movement restricted, it's natural that consumers are more cautious about going out, and their shopping behavior reflects that."

With Malaysia nearing the end of Phase 3 of the nationwide MCO - and to May 12 seeing a further extension - shoppers are prioritizing their spending since the order was first imposed on March 18, 2020.

According to a special survey pertaining to the effects of Covid-19 on the Economy and individuals (Round 1) by the Department of Statistics Malaysia from March 23 to 31, 2020, there was a significant change in daily needs spending before and during Covid- 19 outbreak.

"Spending pattern of raw materials for cooking at the market or supermarket or grocery shows that the current purchase has shifted towards sometimes and seldom as compared to before Covid-19 outbreak," the report revealed.

"There is a change in dining in restaurants, dining in the fast-food restaurant, and watching movies at cinema activities with consumers having stopped those activities during the outbreak."

Ipsos Malaysia's Menon concurred with this research.

"With regards to what people are buying, Malaysians report that they spend more on items with longer shelf life than they would usually do, such as pasta and rice (33 percent) and canned food (18 percent)," he detailed.

"People are also buying more of household cleaners (13 percent) and toilet paper (two percent), which have much to do with the simple fact that people spend all their time at home now.

"The opposite is the case for personal care items and beauty products (minus 12 percent), as these are things people are using when they go out," he added.

"Also, our data suggest that with the uncertain times we are in, people prefer to spend their money on essentials items rather than more 'luxury' items such as chocolate and sweets (minus 17 percent) as well as alcohol (minus eight percent)," Menon indicated.

This comes as the pandemic has put health and hygiene as a priority. Hence the spending allocation to these products from the monthly budget has significantly increased.

"We do expect this to stay for a while even after MCO is lifted. Our studies across markets indicate consumers are more likely to stick to brands that are familiar with than looking for experimentation within these product categories, familiarity gives them comfort and assurance."

Speedier shift towards technology

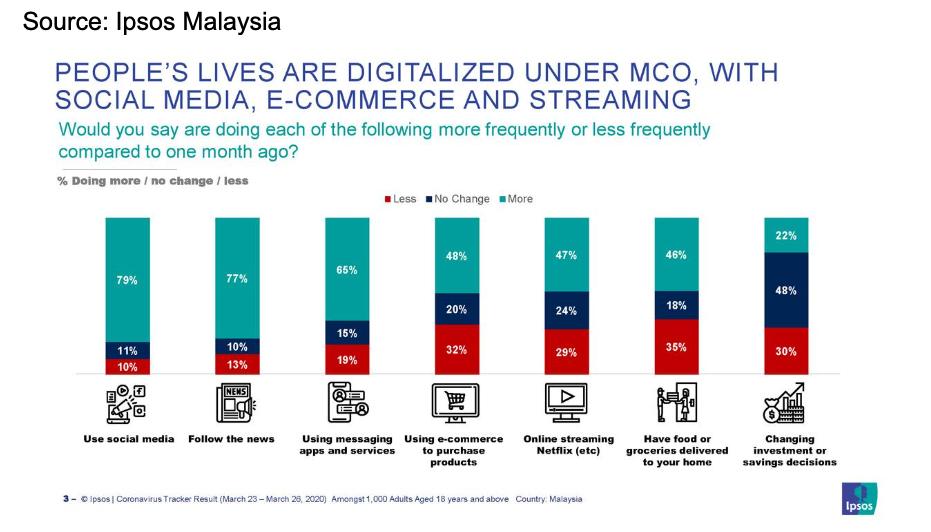

With technology taking on greater prominence during this pandemic and MCO, a sharp increase in e-commerce activities is likely to happen.

"That is likely, and we are already seeing it," Menon added. "In our study, we see that almost half (48 percent) of Malaysians say they buy things online more now compared to one month ago, while only about one third (32 percent) saying that they buy less.

"Another thing we see increasing is having food or groceries delivered to home. When our Covid-19 survey was conducted in late March, during the second week of the MCO, 17 percent of Malaysians say that they have ordered food via an app for the first time in the past week.

"Online purchases and delivery services has increased the most among the younger population below 35 years old. When it comes to categories, people are particularly prone to buy more personal care items, groceries, and clothes online."

In a statement, Commerce. Asia founder and executive chairman Ganesh Kumar Bangah said e-commerce continues to be one of few industries that thrive in such challenging circumstances as the ecosystem is seeing a very encouraging spike in the first quarter of 2020 (1Q20).

Commerce. Asia also foresees a permanent change in consumer behavior, as many are expected to make their purchases via digital marketplaces even after the MCO is lifted.

"Online shopping is now the 'new norm' as the Covid-19 pandemic has resulted in eCommerce businesses booming globally as people shift towards online platforms," he said in the statement.

"We are seeing significant growth in our merchants' sales across various product categories. This change in buying behavior shows that Malaysians are adapting to new living situations."

On this note, Menon said Malaysia's transition to online or digital is less likely to reverse.

"The MCO has been a catalyst to what has been already transitioning. Once consumers are used to benefiting and convenience they are less likely to opt-out." When asked about big-ticket purchases such as cars and properties, Menon said a change is "very likely."

"More than two out of three Malaysians (70 percent) say they are thinking about delaying a major purchase because of the situation, a sentiment that is more prevalent among the older population than the young ones.

"Furthermore, 72 percent say they less likely to make a major purchase such as a home or a car now than they were six months ago. Even as the situation gets better, the inclination to make big-ticket purchases may take some time to recover."

Pandemic drags on consumer spending habits

The retail sector is most likely to be hit the hardest given that most outlets throughout Malaysia have remained closed for the entire duration of the MCO.

This is with the exception of certain segments such as hypermarkets, grocery stores, and petrol stations which were only allowed to operate from 8 am to 8 pm, while in Sarawak, operating times were from 7 am to 7 pm.

Meanwhile, hardware shops, electrical and electronics shops (excluding telecommunications equipment as well as ICT equipment shops), and full-service laundry shops were recently added to the list of those allowed to operate during the MCO.

The research arm of Kenanga Investment Bank Bhd (Kenanga Research) expected consumer sentiment to remain soft for the upcoming quarters on the back of Covid-19 and MCO.

"The Malaysian Institute of Economic Research's (MIER) posted 82.3 points, down 1.7ppt quarter on quarter (q-o-q) and down 14.5ppt year on year (y-o-y), for its fourth quarter of the current year 2019 (4QCY19) Consumer Sentiment Index (CSI)," Kenanga Research said.

"We believe the q-o-q weakness is largely owed to the increasingly cautious spending patterns observed from the consumers, which leans more towards value-for-money purchases instead of high-value discretionary spending such as vehicles, imported goods, and overseas travels.

"That said, we are expecting consumer sentiment to remain soft for the upcoming quarters, as heightening Covid-19 cases recorded within Malaysia and the imposed movement restriction is likely to dent consumers confidence, which would consequently disrupt the retail industry."

Impact of MCO on household expenditure

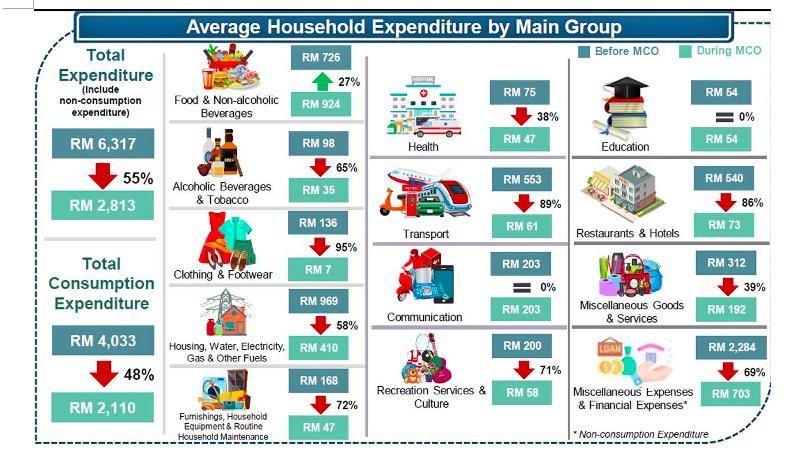

In a study by DOSM on the impact of MCO on household expenditure, it was revealed that the MCO indirectly affected the economic activities including household income and expenditure pattern.

"Households do not purchase durable and semi-durable goods during the MCO except on an online basis," DOSM said in its study.

"The minimum usage of public transport, the limited movement and the drop of oil prices caused the average of household expenditure in Transport decreased up to 80 percent.

"No expenditure on recreational and cultural services and hotels except for the services that can be accessed from homes such as the payor paid TV services.

"The expenditure for food and beverages at home increased by 27 percent, taking into consideration the purchase of raw materials for food that was consumed away from home before MCO."

The study also highlighted that households still purchase personal care items where it contributes 43.9 percent of the total expenditure on Miscellaneous Goods and Services.

"The consumption of utilities is expected to increase 50 percent since households stay at home all the time as compared to only at nights before the implementation of MCO."

According to the study, the household expenditure pattern during the MCO is expected to differ from the expenditure pre-MCO.

This is because the expenditure of the household is more focused on goods and services that are really required by the household such as food, utilities, health, and communication, it added.

"The average of household consumption expenditure during the MCO is estimated to reduce by RM1,923 or 48 percent while the average of household expenditure inclusive of financial expenses to record a decrease of RM3,504 or 55 percent from the expenditure before the MCO.

"Expenditure on food and non-alcoholic beverages group increased by 27 percent resulted from the requirement to purchase additional raw materials for the eat-at-home purpose."

Source: https://www.theborneopost.com/2020/04/26/covid-19-changes-consumer-buying-behaviours/

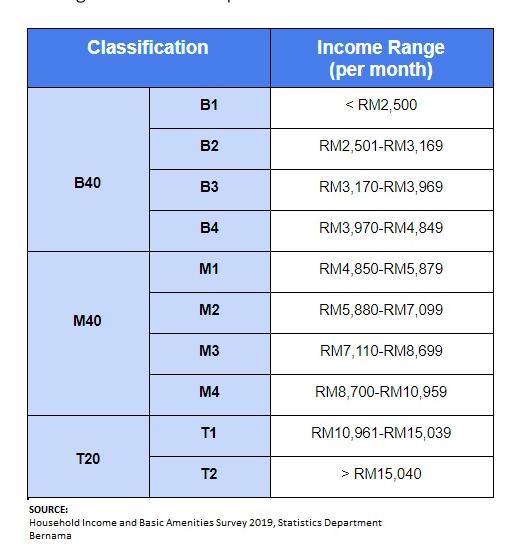

- 1). Consider segmentation as a way to view the household expenditure in relation to digitation in the new norm (due to Covid 19). State the needs and objectives of consumers in situations for at least three segments that you identify. (You need to discuss the needs and objectives of different segments like the lower, middle, and upper-income groups. Talk about what they will consider and take action in the different situations in the new normal with Covid19.)

2). Compare the different segmentation and position decisions a small business entrepreneur than for a large corporation during this new norm. (By asking questions about who are the customers of Small businesses (industrial segmentation) you will then be able to create a detailed description of your ideal customer, the. you are likely to find that you need more than one persona to really identify the segments you are targeting.)

FOOD IS STOCKED TO LAST FOR A WEEK OR TWO You indicated you are stocking up on food, how long are you stocking food for? % stock up food Food is stocked up for at least one week. For most, grocery shopping is often done weekly Older people would stock up less i.e. stock food enough for at least one week 65% stock up on food % stock up "at least one week" At least one week 53% 50-74 years old 62% At least two weeks 32% 35-49 years old 58% At least one month 12% Under 35 years old 47% More than one month | 3% 2- O ipsos | Coronavirus Tracker Result (March 23 - March 28, 2020) Amongst 1,000 Adults Aged 18 years and above Country: Malaysia Ipsos

Step by Step Solution

3.63 Rating (182 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 A critical situation pushes human behaviour towards different directions with some aspects of behaviour being irrevocable COVID19 pandemic is not a normal crisis and to control the spread of ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started