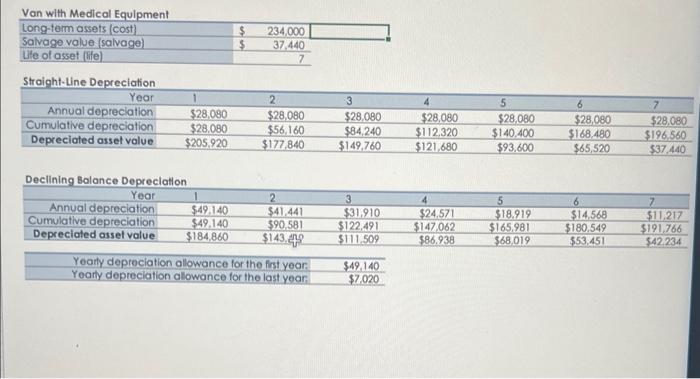

the DB formula I used got the right answers but as you can see in the first picture i got it wrong just need help to follow fhe guidelines of the assignment!

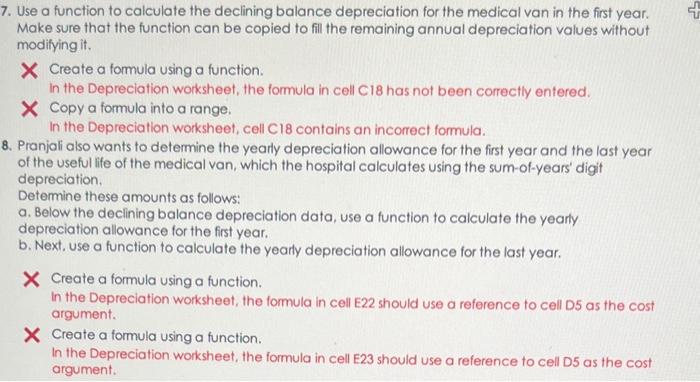

7. Use a function to calculate the declining balance depreciation for the medical van in the first year. Make sure that the function can be copied to fill the remaining annual depreciation values without modifying it. X Create a formula using a function. In the Depreciation worksheet, the formula in cell C18 has not been correctly entered. Copy a formula into a range. In the Depreciation worksheet, cell Cl8 contains an incorrect formula. 8. Pranjali also wants to determine the yearly depreciation allowance for the first year and the last year of the useful life of the medical van, which the hospital calculates using the sum-of-years digit depreciation. Determine these amounts as follows: a. Below the declining balance depreciation data, use a function to calculate the yearly depreciation allowance for the first year. b. Next, use a function to calculate the yearly depreciation allowance for the last year. X Create a formula using a function. In the Depreciation worksheet, the formula in cell E22 should use a reference to cell D5 as the cost argument. Declining Balance Deoreclation 7. Use a function to calculate the declining balance depreciation for the medical van in the first year. Make sure that the function can be copied to fill the remaining annual depreciation values without modifying it. X Create a formula using a function. In the Depreciation worksheet, the formula in cell C18 has not been correctly entered. Copy a formula into a range. In the Depreciation worksheet, cell Cl8 contains an incorrect formula. 8. Pranjali also wants to determine the yearly depreciation allowance for the first year and the last year of the useful life of the medical van, which the hospital calculates using the sum-of-years digit depreciation. Determine these amounts as follows: a. Below the declining balance depreciation data, use a function to calculate the yearly depreciation allowance for the first year. b. Next, use a function to calculate the yearly depreciation allowance for the last year. X Create a formula using a function. In the Depreciation worksheet, the formula in cell E22 should use a reference to cell D5 as the cost argument. Declining Balance Deoreclation