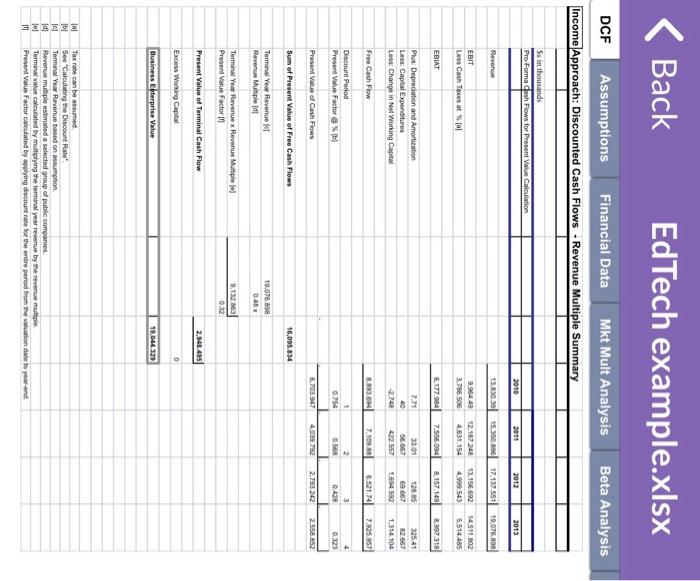

The DCF (discounted cash flow method) is an Income Approach to valuation. It estimates the present value of future cash flows that an asset will generate over its life. These cash flows are discounted at a rate appropriate for the risk of the asset, the WACC of the target company. The 5 Public Company Comps you will find found are used to determine the Revenue and EBITDA multiples. There are singular templates on canvas for review of any of the components of this DCF model. For this assignment, you will be working individually, on your Target Company (or BMC) financials. You will be required to construct comprehensive financials for a Discounted Cash Flows analysis, with all accompanying data. This assignment is 100% excel based, and a former student example (not a template) is provided. You are required to create your own file for submission. student example (not a template) is provided. You are required to create your own file for submission. You will be graded on the following: 1. Historical financial data (Baseline year, 3 years). 2. Projected financial data (Future years, 3 years. Include capital spending, depreciation and amortization, and change in working capital). 3. Cash and debt as of the valuation date (current year), if applicable. 4. Comparable public companies (5), Revenue and EBITDA multiples, with statistical summary and chosen indication. 5. Capital structure data; How is the company financed (Debt \% / Equity \%). 6. Beta and WACC analysis. 7. Determination of Enterprise Value (DCF). EdTech example.xlsx The DCF (discounted cash flow method) is an Income Approach to valuation. It estimates the present value of future cash flows that an asset will generate over its life. These cash flows are discounted at a rate appropriate for the risk of the asset, the WACC of the target company. The 5 Public Company Comps you will find found are used to determine the Revenue and EBITDA multiples. There are singular templates on canvas for review of any of the components of this DCF model. For this assignment, you will be working individually, on your Target Company (or BMC) financials. You will be required to construct comprehensive financials for a Discounted Cash Flows analysis, with all accompanying data. This assignment is 100% excel based, and a former student example (not a template) is provided. You are required to create your own file for submission. student example (not a template) is provided. You are required to create your own file for submission. You will be graded on the following: 1. Historical financial data (Baseline year, 3 years). 2. Projected financial data (Future years, 3 years. Include capital spending, depreciation and amortization, and change in working capital). 3. Cash and debt as of the valuation date (current year), if applicable. 4. Comparable public companies (5), Revenue and EBITDA multiples, with statistical summary and chosen indication. 5. Capital structure data; How is the company financed (Debt \% / Equity \%). 6. Beta and WACC analysis. 7. Determination of Enterprise Value (DCF). EdTech example.xlsx