Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The debt of INKA consists of two bonds. The first bond was issued in 2011, with a 15-year maturity and a 6% coupon rate. The

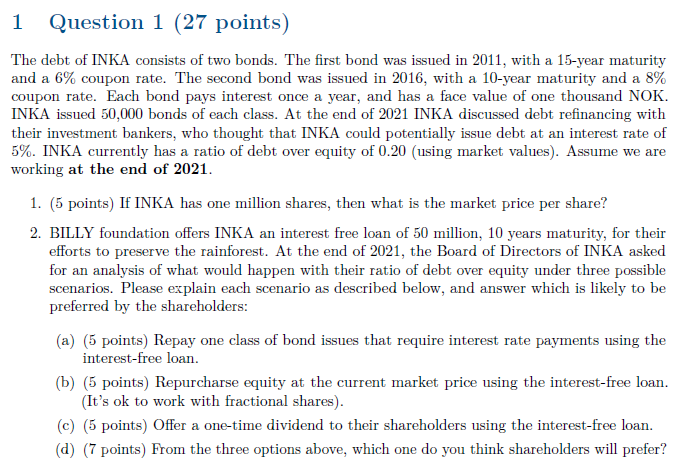

The debt of INKA consists of two bonds. The first bond was issued in 2011, with a 15-year maturity and a 6% coupon rate. The second bond was issued in 2016, with a 10 -year maturity and a 8% coupon rate. Each bond pays interest once a year, and has a face value of one thousand NOK. INKA issued 50,000 bonds of each class. At the end of 2021 INKA discussed debt refinancing with their investment bankers, who thought that INKA could potentially issue debt at an interest rate of 5%. INKA currently has a ratio of debt over equity of 0.20 (using market values). Assume we are working at the end of 2021. 1. (5 points) If INKA has one million shares, then what is the market price per share? 2. BILLY foundation offers INKA an interest free loan of 50 million, 10 years maturity, for their efforts to preserve the rainforest. At the end of 2021, the Board of Directors of INKA asked for an analysis of what would happen with their ratio of debt over equity under three possible scenarios. Please explain each scenario as described below, and answer which is likely to be preferred by the shareholders: (a) (5 points) Repay one class of bond issues that require interest rate payments using the interest-free loan. (b) (5 points) Repurcharse equity at the current market price using the interest-free loan. (It's ok to work with fractional shares). (c) (5 points) Offer a one-time dividend to their shareholders using the interest-free loan. (d) (7 points) From the three options above, which one do you think shareholders will prefer

The debt of INKA consists of two bonds. The first bond was issued in 2011, with a 15-year maturity and a 6% coupon rate. The second bond was issued in 2016, with a 10 -year maturity and a 8% coupon rate. Each bond pays interest once a year, and has a face value of one thousand NOK. INKA issued 50,000 bonds of each class. At the end of 2021 INKA discussed debt refinancing with their investment bankers, who thought that INKA could potentially issue debt at an interest rate of 5%. INKA currently has a ratio of debt over equity of 0.20 (using market values). Assume we are working at the end of 2021. 1. (5 points) If INKA has one million shares, then what is the market price per share? 2. BILLY foundation offers INKA an interest free loan of 50 million, 10 years maturity, for their efforts to preserve the rainforest. At the end of 2021, the Board of Directors of INKA asked for an analysis of what would happen with their ratio of debt over equity under three possible scenarios. Please explain each scenario as described below, and answer which is likely to be preferred by the shareholders: (a) (5 points) Repay one class of bond issues that require interest rate payments using the interest-free loan. (b) (5 points) Repurcharse equity at the current market price using the interest-free loan. (It's ok to work with fractional shares). (c) (5 points) Offer a one-time dividend to their shareholders using the interest-free loan. (d) (7 points) From the three options above, which one do you think shareholders will prefer Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started