Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The December 3 1 , 2 0 2 3 , consolidated balance sheet reported a cumulative translation adjustment with a $ 3 9 , 9

The December consolidated balance sheet reported a cumulative translation adjustment with a

$ credit positive balance.

The subsidiary's common stock was issued in when the exchange rate was $$

The subsidiary's December retained earnings balance was C$ an amount that has been

translated into US$

The applicable currency exchange rates for $ for translation purposes are as follows:

Required:

a Remeasure the Mexican operation's account balances into Canadian dollars. Note: Back into the beginning net

monetary asset or liability position.

b Prepare financial statements income statement, statement of retained earnings, and balance sheet for the

Canadian subsidiary in its functional currency, Canadian dollars.

c Translate the Canadian dollar functional currency financial statements into US dollars so that Sendelbach can

prepare consolidated financial statements.

Complete this question by entering your answers in the tabs below.

Remeasure the Mexican operation's account balances into Canadian dollars. Note: Back into the beginning net monetary

asset or liability position.

Note: Input all amounts as positive values. b Prepare financial statements income statement, statement of retained earnings, and balance sheet for the Canadian

subsidiary in its functional currency, Canadian dollars.

c Translate the Canadian dollar functional currency financial statements into US dollars so that Sendelbach can prepare

consolidated financial statements.

Note: Round US Dollar values to decimal places. Amounts to be deducted and losses should be indicated with a minus

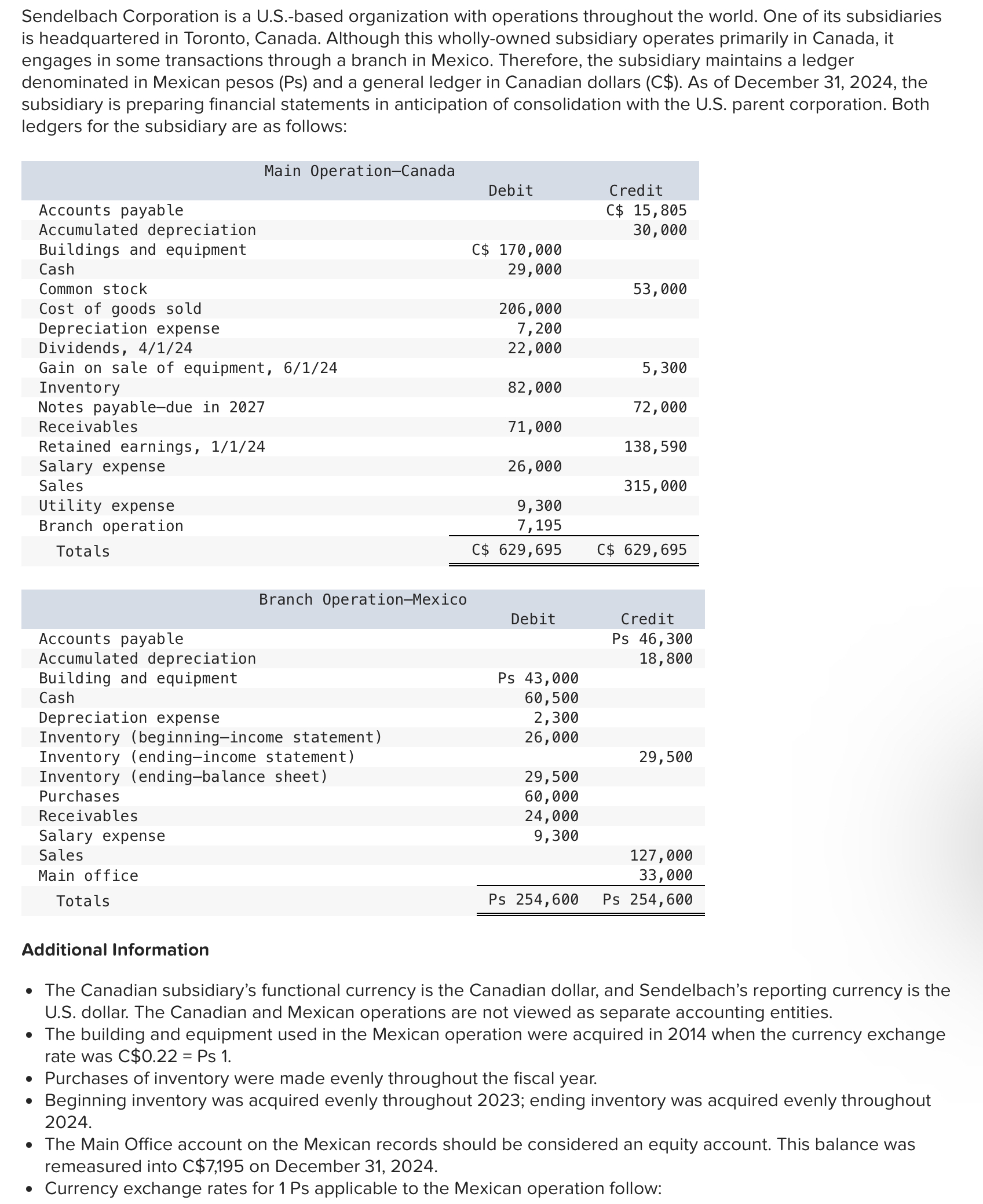

sign.Sendelbach Corporation is a USbased organization with operations throughout the world. One of its subsidiaries

is headquartered in Toronto, Canada. Although this whollyowned subsidiary operates primarily in Canada, it

engages in some transactions through a branch in Mexico. Therefore, the subsidiary maintains a ledger

denominated in Mexican pesos Ps and a general ledger in Canadian dollars C$ As of December the

subsidiary is preparing financial statements in anticipation of consolidation with the US parent corporation. Both

ledgers for the subsidiary are as follows:

Additional Information

The Canadian subsidiary's functional currency is the Canadian dollar, and Sendelbach's reporting currency is the

US dollar. The Canadian and Mexican operations are not viewed as separate accounting entities.

The building and equipment used in the Mexican operation were acquired in when the currency exchange

rate was $ Ps

Purchases of inventory were made evenly throughout the fiscal year.

Beginning inventory was acquired evenly throughout ; ending inventory was acquired evenly throughout

The Main Office account on the Mexican records should be considered an equity account. This balance was

remeasured into C$ on December

Currency exchange rates for Ps applicable to the Mexican operation follow:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started