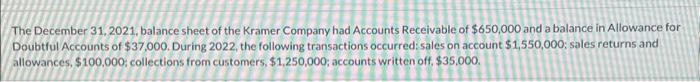

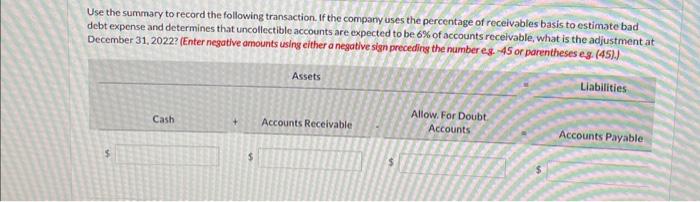

The December 31,2021, balance sheet of the Kramer Company had Accounts Receivable of $650,000 and a balance in Allowance for Doubtful Accounts of $37,000. During 2022, the following transactions occurred: sales on account $1,550,000; sales returns and allowances, $100,000; collections from customers, $1,250,000; accounts written off, $35,000. Use the summary to record the following transaction. If the company uses the percentage of receivables basis to estimate bad debt expense and determines that uncollectible accounts are expected to be 6% of accounts receivable, what is the adjustment at December 31, 2022? (Enter negative amounts using either a negative sign preceding the number eg, -45 or parentheses eg. (45).) Use the summary to record the following transaction. If the company uses the percentage of receivables basis to estimate bad dcbt expense and determines that uncollectible accounts are expected to be 6% of accounts recelvable, what is the adjustment at December 31,2022 ? (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45)). The December 31,2021, balance sheet of the Kramer Company had Accounts Receivable of $650,000 and a balance in Allowance for Doubtful Accounts of $37,000. During 2022, the following transactions occurred: sales on account $1,550,000; sales returns and allowances, $100,000; collections from customers, $1,250,000; accounts written off, $35,000. Use the summary to record the following transaction. If the company uses the percentage of receivables basis to estimate bad debt expense and determines that uncollectible accounts are expected to be 6% of accounts receivable, what is the adjustment at December 31, 2022? (Enter negative amounts using either a negative sign preceding the number eg, -45 or parentheses eg. (45).) Use the summary to record the following transaction. If the company uses the percentage of receivables basis to estimate bad dcbt expense and determines that uncollectible accounts are expected to be 6% of accounts recelvable, what is the adjustment at December 31,2022 ? (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45))