Answered step by step

Verified Expert Solution

Question

1 Approved Answer

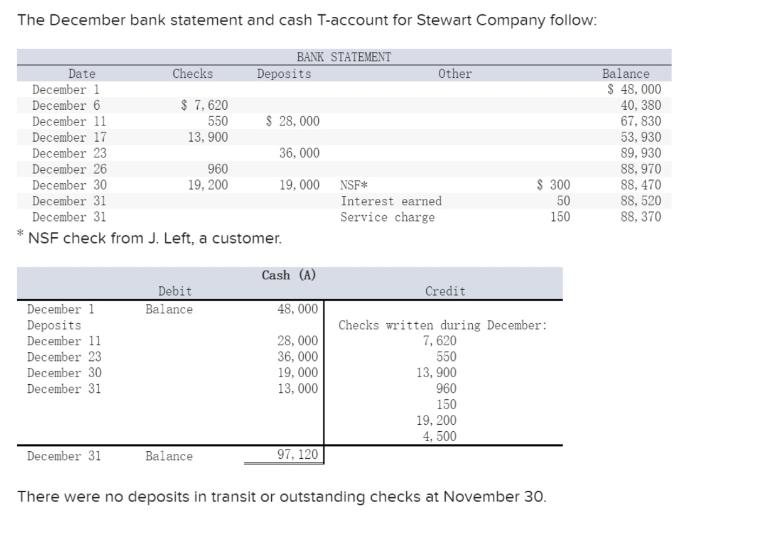

The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Date Checks Deposits Other December 1 Balance $ 48,000 December 6

The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Date Checks Deposits Other December 1 Balance $ 48,000 December 6 $ 7,620 40, 380 December 11 December 17 550 13,900 $ 28,000 67,830 53,930 December 23 36,000 89,930 December 26 960 88,970 December 30 19, 200 19,000 NSF* $ 300 88,470 December 31 December 31 Interest earned Service charge 50 88,520 150 88,370 NSF check from J. Left, a customer. Debit December 1 Balance Deposits December 11 December 23 December 30 December 31 December 31 Balance Cash (A) Credit 48,000 Checks written during December: 28,000 7,620 36,000 550 19,000 13, 900 13,000 960 150 19, 200 4,500 97, 120 There were no deposits in transit or outstanding checks at November 30. PA5-3 (Static) Part 5 and 6 5. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger? 6. If the company also has $300 of petty cash on hand, which is recorded in a different account called Petty Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the December 31 balance sheet? 5. Balance in Cash Account 6. Total Amount of Cash and Cash Equivalents

Step by Step Solution

There are 3 Steps involved in it

Step: 1

5 After the reconciliation journal entries are posted the balance reflected in the Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started