Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The definition of gross income is an important definition in the determination of a person's taxable income. In the following situations, the inclusion of

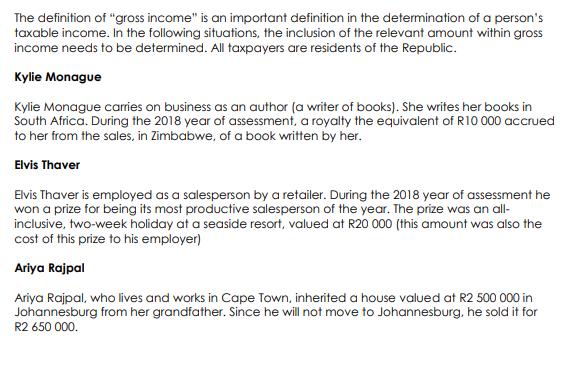

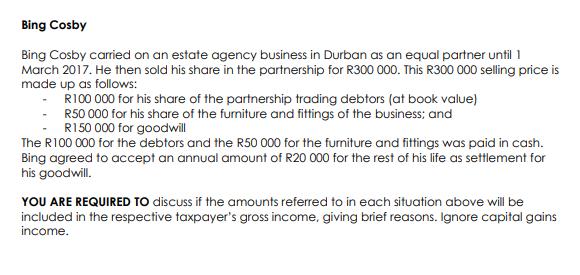

The definition of "gross income" is an important definition in the determination of a person's taxable income. In the following situations, the inclusion of the relevant amount within gross income needs to be determined. All taxpayers are residents of the Republic. Kylie Monague Kylie Monague carries on business as an author (a writer of books). She writes her books in South Africa. During the 2018 year of assessment, a royalty the equivalent of R10 000 accrued to her from the sales, in Zimbabwe, of a book written by her. Elvis Thaver Elvis Thaver is employed as a salesperson by a retailer. During the 2018 year of assessment he won a prize for being its most productive salesperson of the year. The prize was an all- inclusive, two-week holiday at a seaside resort, valued at R20 000 (this amount was also the cost of this prize to his employer) Ariya Rajpal Ariya Rajpal, who lives and works in Cape Town, inherited a house valued at R2 500 000 in Johannesburg from her grandfather. Since he will not move to Johannesburg, he sold it for R2 650 000. Bing Cosby Bing Cosby carried on an estate agency business in Durban as an equal partner until 1 March 2017. He then sold his share in the partnership for R300 000. This R300 000 selling price is made up as follows: R100 000 for his share of the partnership trading debtors (at book value) R50 000 for his share of the furniture and fittings of the business; and R150 000 for goodwill The R100 000 for the debtors and the R50 000 for the furniture and fittings was paid in cash. Bing agreed to accept an annual amount of R20 000 for the rest of his life as settlement for his goodwill. YOU ARE REQUIRED TO discuss if the amounts referred to in each situation above will be included in the respective taxpayer's gross income, giving brief reasons. Ignore capital gains income.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Kylie Monague The amount of R10 000 will be included in Kylie M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started